Partnerships can be a lucrative revenue stream — when your business has the right tools for the job.

Indeed, many SaaS companies miss out on potential partner-driven revenue because they lack precise partnership tracking.

It's no secret that, in 2026, the traditional spreadsheet tracking is dead.

Manual updates, delayed insights, and fragmented data no longer cut it.

Instead, today's partner programs demand real-time visibility from overlap to close, ensuring every deal is tracked, attributed, and optimized for growth.

Modern solutions replace outdated spreadsheets with automated, CRM-integrated partnership tracking software, ensuring that partner-sourced revenue is captured seamlessly.

A precision-driven, real-time partnership tracker gives SaaS companies the edge by aligning sales teams, automating reporting, and enabling data-driven decisions.

With clear visibility into partner-influenced deals, businesses can maximize partner ROI, improve collaboration, and scale revenue faster.

In today's competitive landscape, partnership tracking isn't optional — it's essential for unlocking sustainable, repeatable growth.

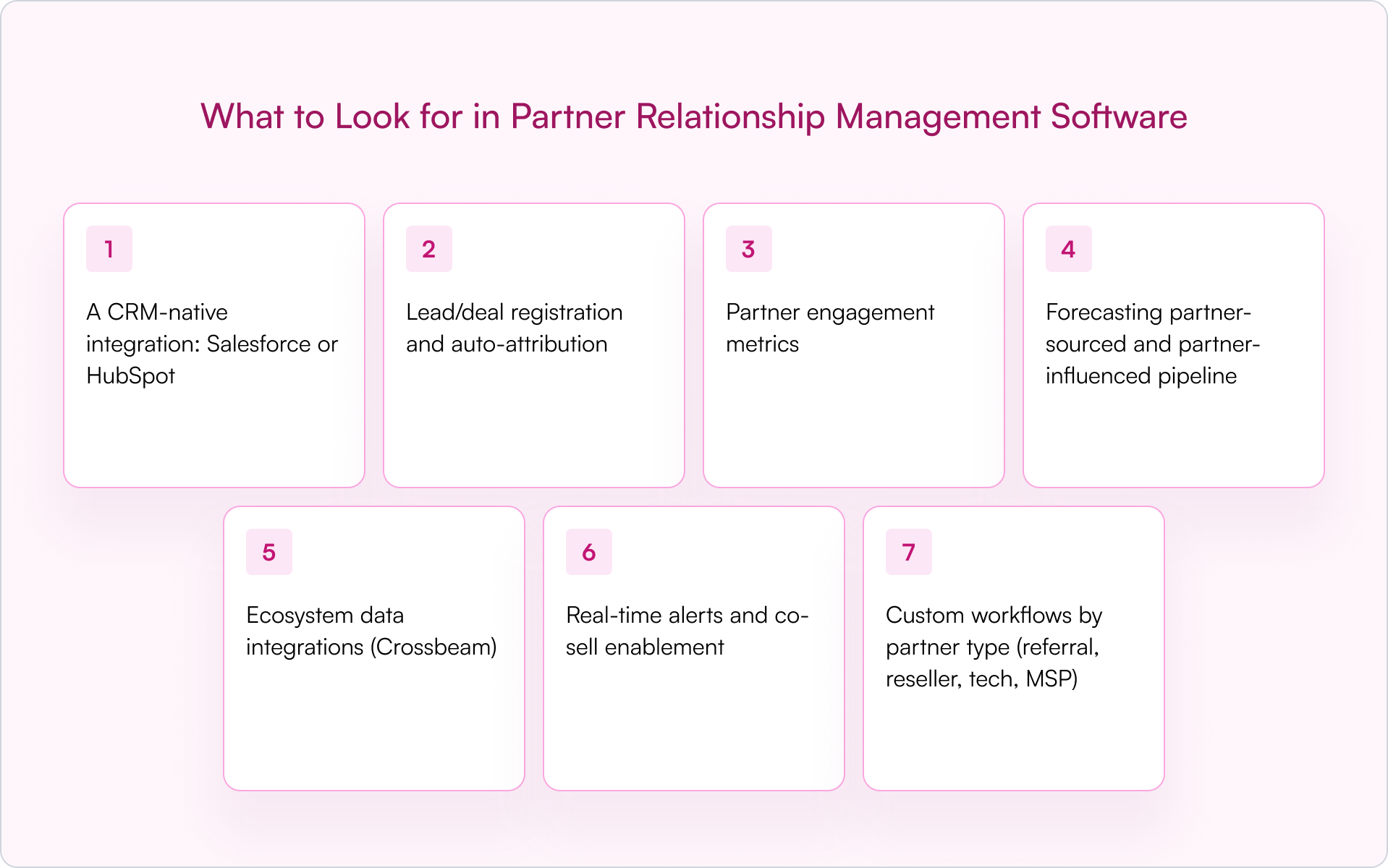

What to Look for in a Partnership Tracking Platform

So, you know you need a modern partnership tracking platform.

But which features should you be looking out for?

Here are seven features that every strong partnership tracking platform should have in 2026:

- A CRM-native integration: Salesforce or HubSpot

- Lead/deal registration and auto-attribution

- Partner engagement metrics — for example: Slack or email syncs, partner activities log

- Forecasting partner-sourced and partner-influenced pipeline

- Ecosystem data integrations (Crossbeam)

- Real-time alerts and co-sell enablement

- Custom workflows by partner type (referral, reseller, tech, MSP)

10 Best Partnership Trackers to Use in 2026

Ready to revolutionize your partnerships by investing in a new partnerships tracker?

Here are ten top tools to consider.

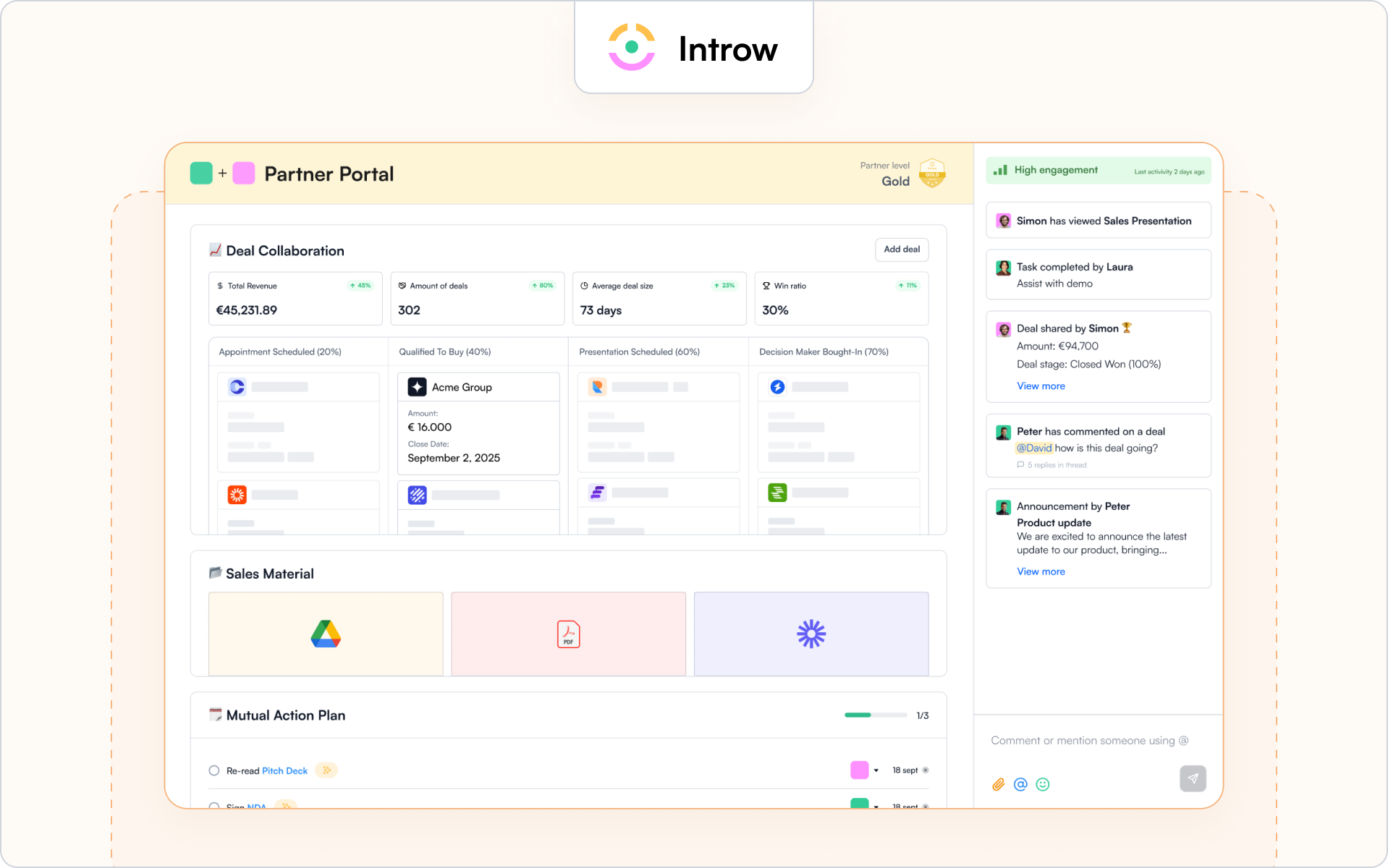

#1 Introw (with Crossbeam Integration)

Introw is the most powerful PRM for modern SaaS companies — and its native integration with Crossbeam supercharges the entire partner revenue workflow.

Here's Why It's #1:

- Starts where your team lives: Salesforce or HubSpot

- Tracks every partner deal, lead, and engagement touch in real time

- Uses Crossbeam's account mapping data to identify overlapping customers and prospects across your ecosystem

- Tracks every engagement your partners have with content/sales presentations

- Tracks commissions in real-time

- All activity is tracked and visible to Partner Managers, RevOps, and CROs

Quick Feature Rundown:

- CRM-native lead & deal registration

- Real-time alerts via Slack and email

- Deal attribution and forecasting built into your pipeline

- Partner segmentation, enablement, and engagement tracking

- Modular workflows (referral, reseller, MSP, tech)

- Set-up in minutes — not months

Find out more:

🔗 Introw + Crossbeam Integration Overview

#2 PartnerStack

Referral and affiliate program software PartnerStack comes with some handy partner performance tracking features designed to help businesses recruit, track, and optimize partnerships effectively.

Quick Feature Rundown:

- Lead Monitoring

- CRM Integration

- Automated Attribution

- Performance Reporting

- Commission Automation

- UTM Tracking Support

- Fraud Protection

Pros: Commission automation, partner marketplace

Cons: Not ideal for co-sell motions or deep CRM integration

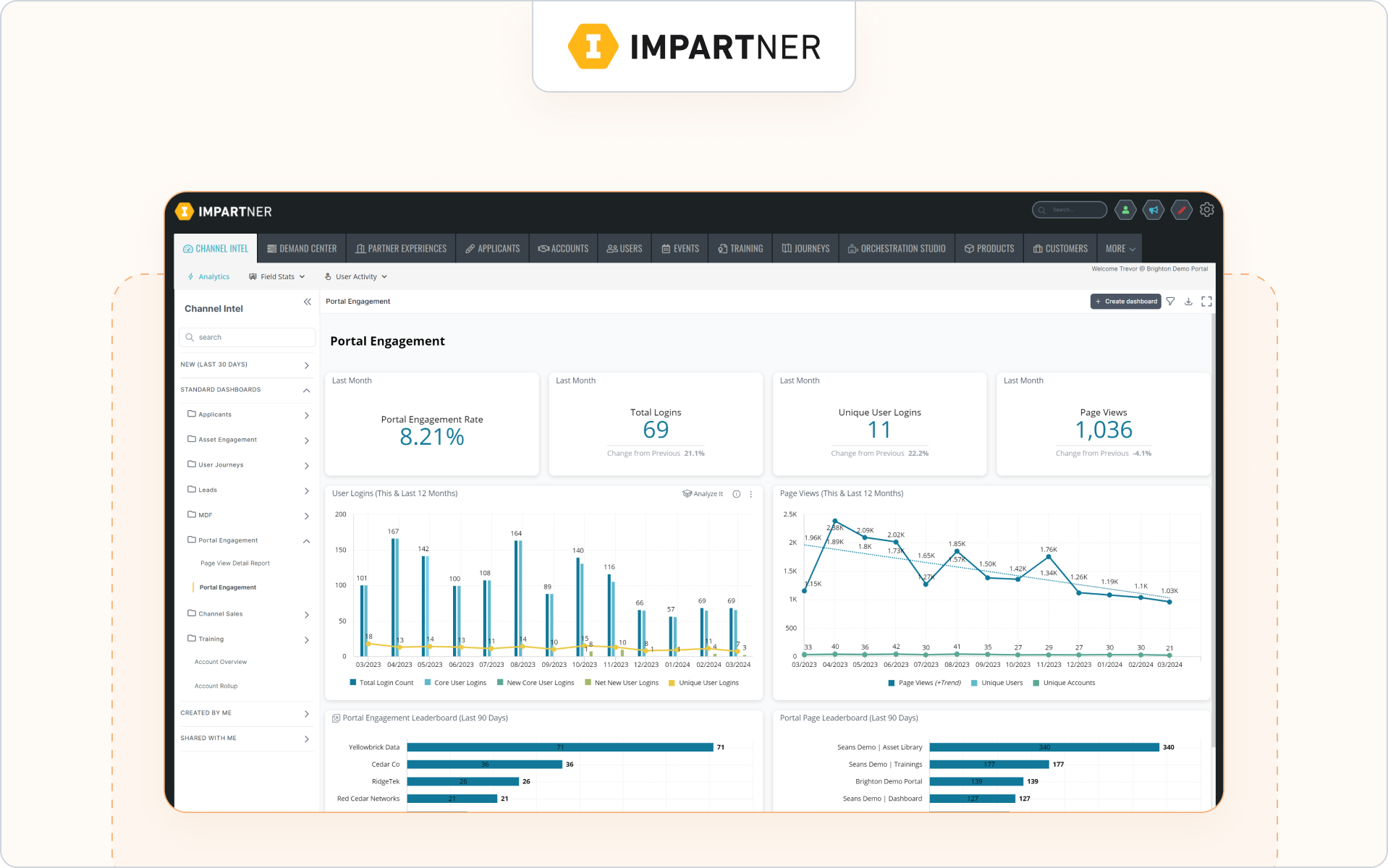

#3 Impartner

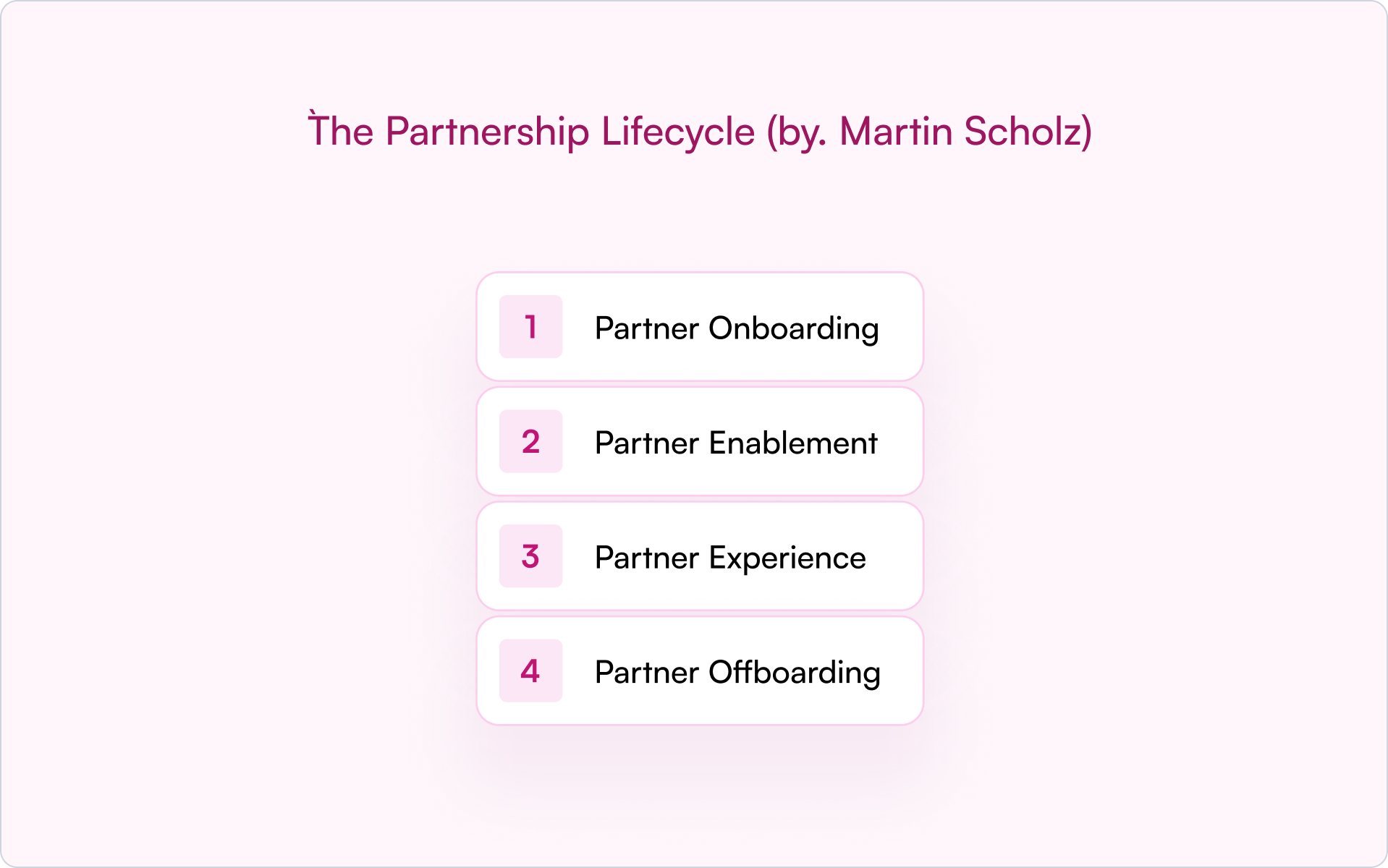

Impartner is a leading Partner Relationship Management platform designed to optimize and automate the entire partner lifecycle, enhancing collaboration and driving revenue growth.

Quick Feature Rundown:

- Partner dashboards

- Individual Partner Portals

- Portal workflows

- Role-based permissions

- Opportunity management

- Action tracking

- Lead management

- Partner performance reporting

- Partner engagement tools

- CRM integration

Pros: Comprehensive tracking, robust backend

Cons: Heavier set-up, limited CRM-native tracking

#4 Allbound (now Channelscaler)

Channelscaler (previously Allbound) helps leaders scale by winning partner mindshare, ensuring high levels of partner engagement and placing ease of doing business at the heart of your go-to-market channel strategy.

Quick Feature Rundown:

- Lead Management

- Opportunity Management

- Action Tracking

- Partner Performance Reporting

- CRM Integration

- Program Compliance Manager

- Business Planning Tools

- Journey Builder

- Analytics Studio

Pros: Great partner management, easy to use, good customer support

Cons: Limited customization

#5 ZINFI

ZINFI is a comprehensive Partner Relationship Management platform that streamlines partner engagement and performance tracking.

This platform puts a heavy focus on automation, empowering you to save time and money when managing your partnerships.

Quick Feature Rundown:

- Lead management

- Opportunity management

- Performance analytics

- Incentive management

- Partner portal

- Partner onboarding

- Partner training

- Deal registration

- Automated partner onboarding, training, marketing, selling, and performance tracking

Pros: Easy to use, strong partner management, good customer support

Cons: Some features are limited

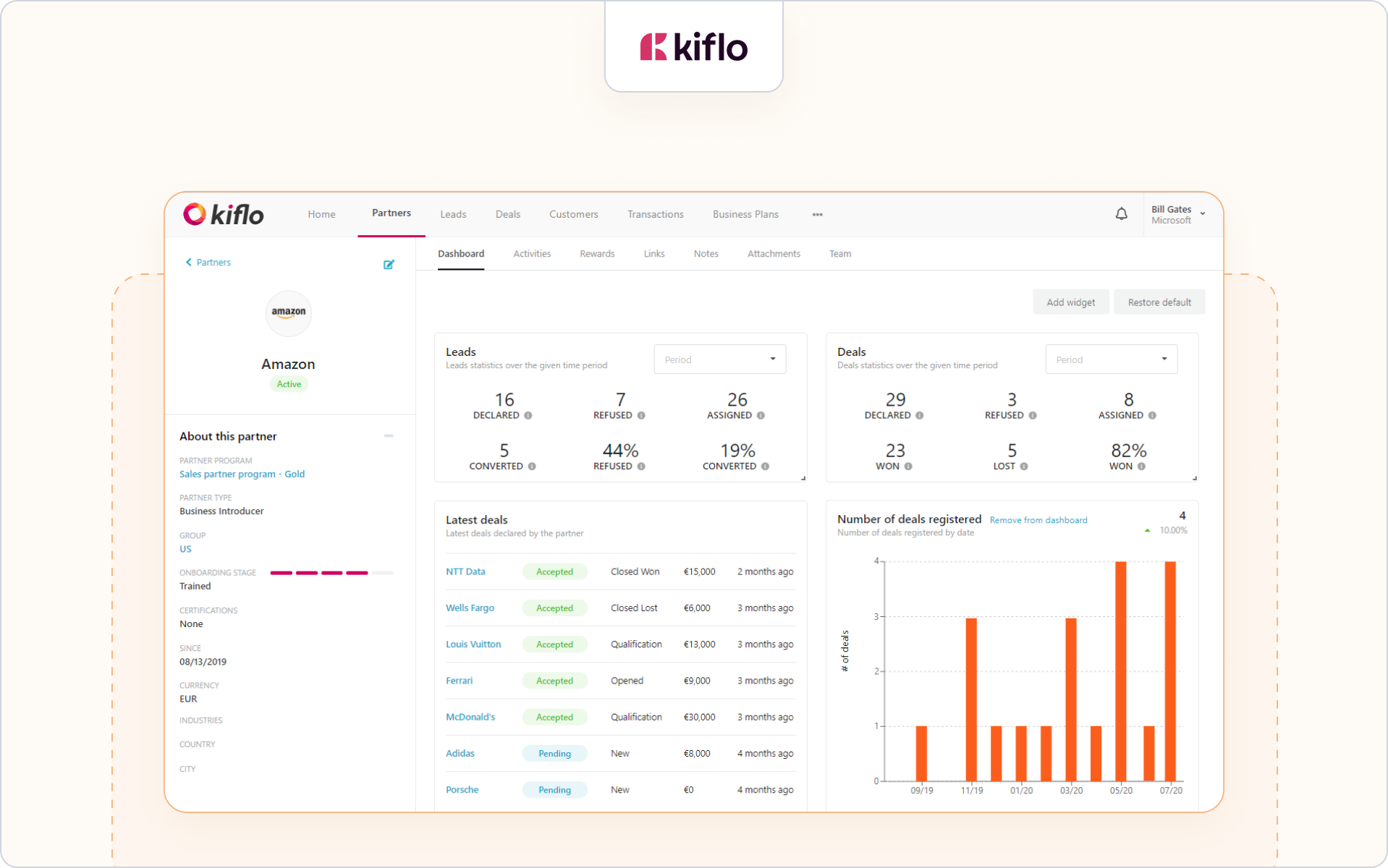

#6 Kiflo

Partner Relationship Management platform Kiflo is designed to streamline partner engagement, growth, and success.

It offers customizable and automated tools that show users a visual representation of their partnerships.

Furthermore, Kiflo caters specifically to small to medium-sized businesses, providing a personalized approach to partner management.

Quick Feature Rundown:

- Lead and Deal Registration

- Real-Time Deal Tracking

- Dynamic Performance Dashboards

- Automated Partner Onboarding

- Customizable Certifications

- Content Management and Sharing

- Automated Reward and Incentive Management

- Comprehensive Analytics

- CRM Integration

Pros: Good customer support, strong partner management features

Cons: Integrations have limitations

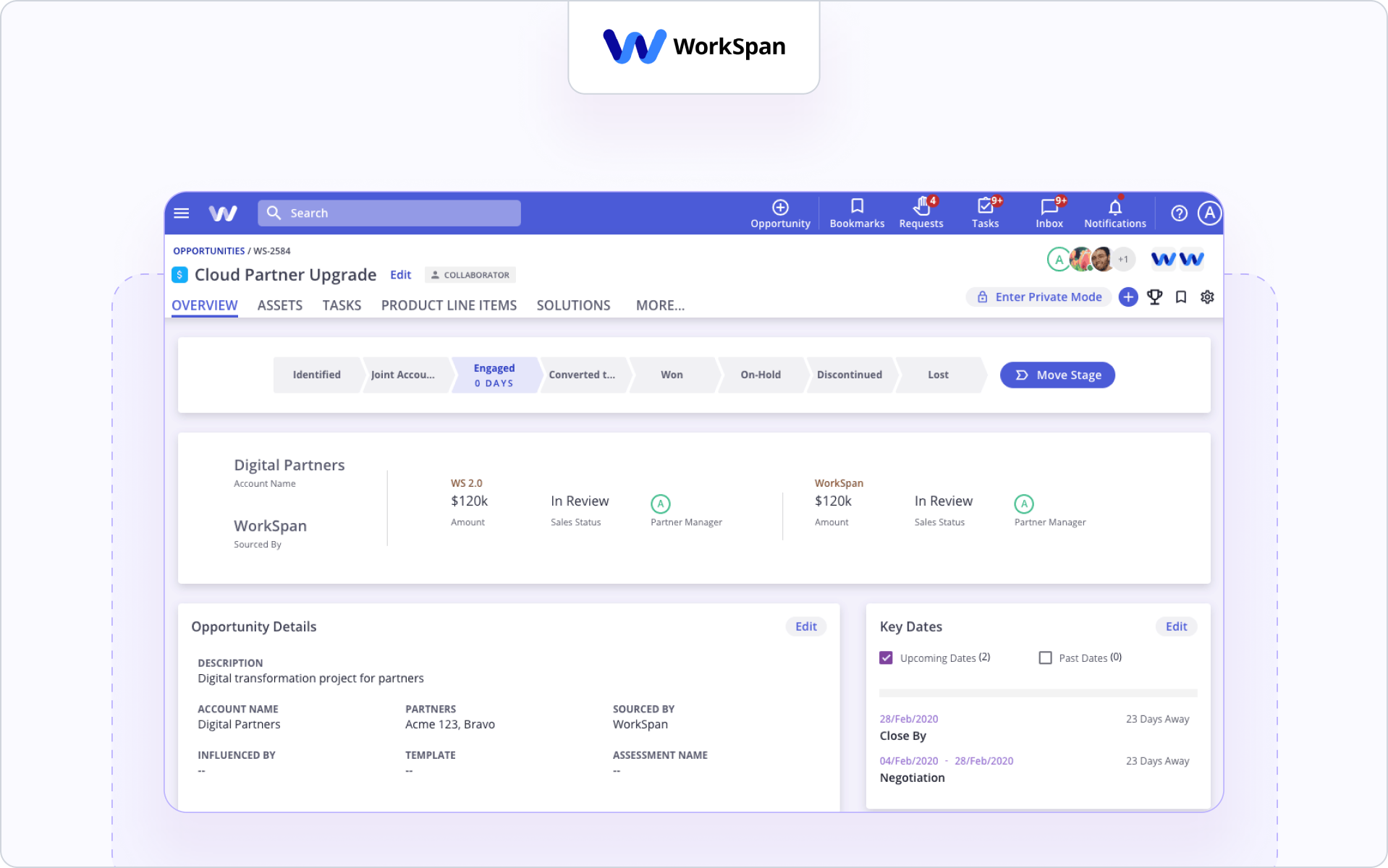

#7 WorkSpan

WorkSpan is a Partner Relationship Management platform designed to enhance collaboration and drive revenue growth through strategic partnerships.

It provides a comprehensive ecosystem for co-selling, co-innovating, co-marketing, and co-investing, enabling organizations to optimize their partnership strategies effectively.

Quick Feature Rundown:

- Co-sell opportunity management

- Performance measurement

- Best-practice partnership planning templates

- Comprehensive reporting and analytics

- Real-time data sharing and collaboration

- AI-driven insights and recommendations

- Secure ecosystem access control

- Automated referral creation and sharing

- Customizable dashboards and metrics

- Integration with existing CRM systems

Pros: Strong partner management and collaboration tools

Cons: Steep learning curve

#8 LeadsBridge

LeadsBridge is a comprehensive integration platform designed to streamline lead generation and management processes by connecting various marketing and CRM tools.

Its unique value proposition lies in offering over 380 integrations.

These integrations include custom solutions tailored to specific business needs, ensuring seamless data synchronization and enhanced marketing efficiency.

Quick Feature Rundown:

- Lead sync

- Audience targeting

- Online-to-offline tracking

- Custom integration

- Real-time data syncing

- Lookalike audiences

- Platform-to-platform integration

- Lead nurturing

- eCommerce synchronization

Pros: Helpful customer support, thorough automation, seamless integrations

Cons: Initial set-up can be complex

#9 ZiftONE

Zift Solutions is a comprehensive Partner Relationship Management platform that streamlines channel management, enhances partner engagement, and drives revenue growth.

This software integrates marketing, sales, and learning processes into a single platform, offering personalized experiences for businesses and their partners.

Quick Feature Rundown:

- Partner explorer

- Tier Programs

- User achievements

- Partner groups

- Customizable partner portals

- Real-time analytics and reporting

- Seamless CRM integration

- Automated lead distribution

- Partner onboarding tools

Pros: Easy to use and good customer support

Cons: Limited customization

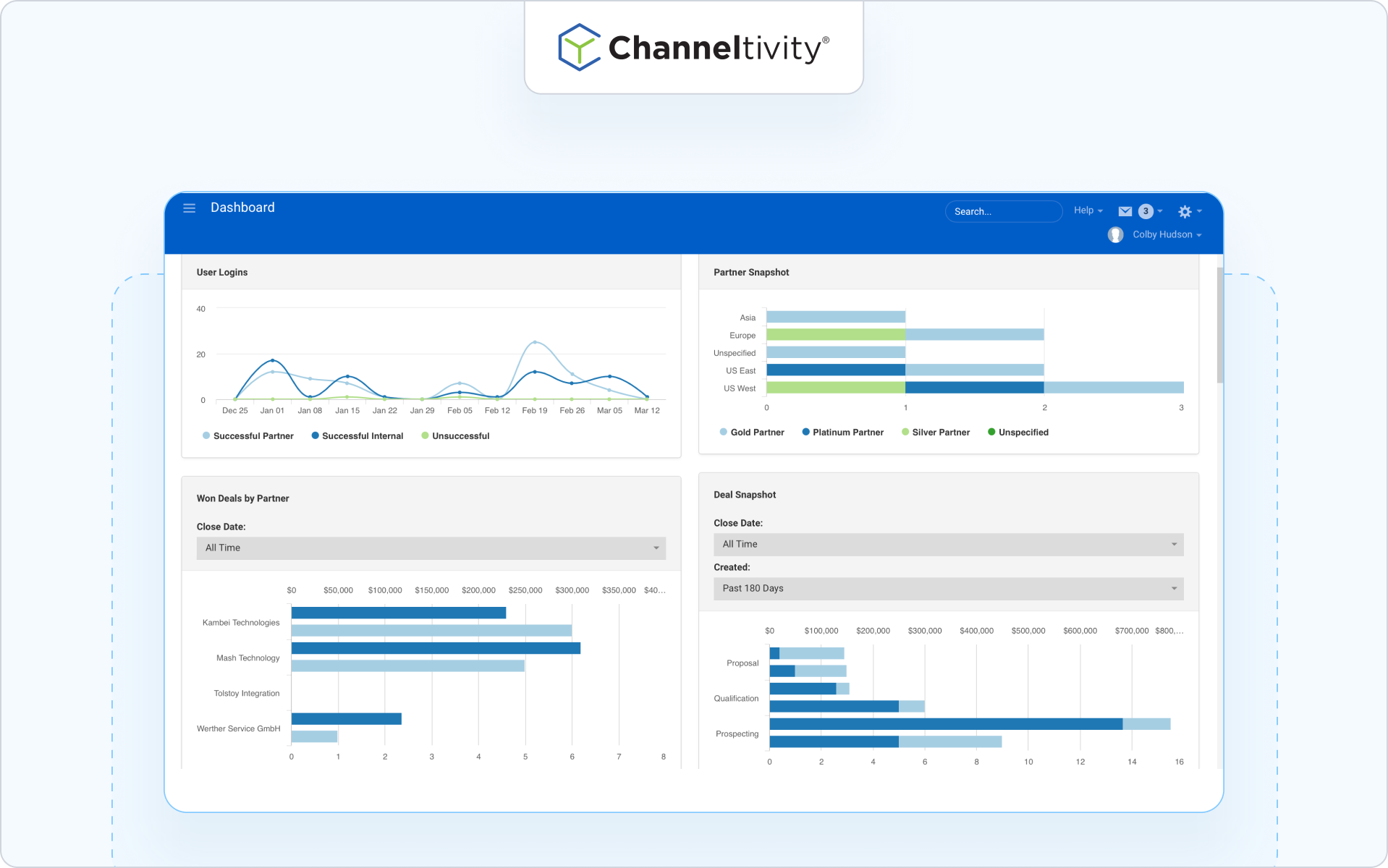

#10 Channeltivity

Channeltivity is a Partner Relationship Management platform designed to streamline channel management, enhance partner engagement, and drive revenue growth.

The software offers a comprehensive suite of tools — including deal registration, lead distribution, and partnership performance tracking — tailored to optimize channel operations for technology companies.

Meanwhile, its analytics and reporting suite, empowers leaders to make data-driven decisions and improve resource allocation.

Quick Feature Rundown:

- Deal registration

- Lead distribution

- Referrals and commissions

- Distributor management

- Partner dashboards

- Analytics and reporting

- Notifications and reminders

- Partner portal

- Training and certification

- Business planning

Pros: Streamlined partner engagement and deal tracking and responsive support to ensure customer satisfaction

Cons: Customization limitations

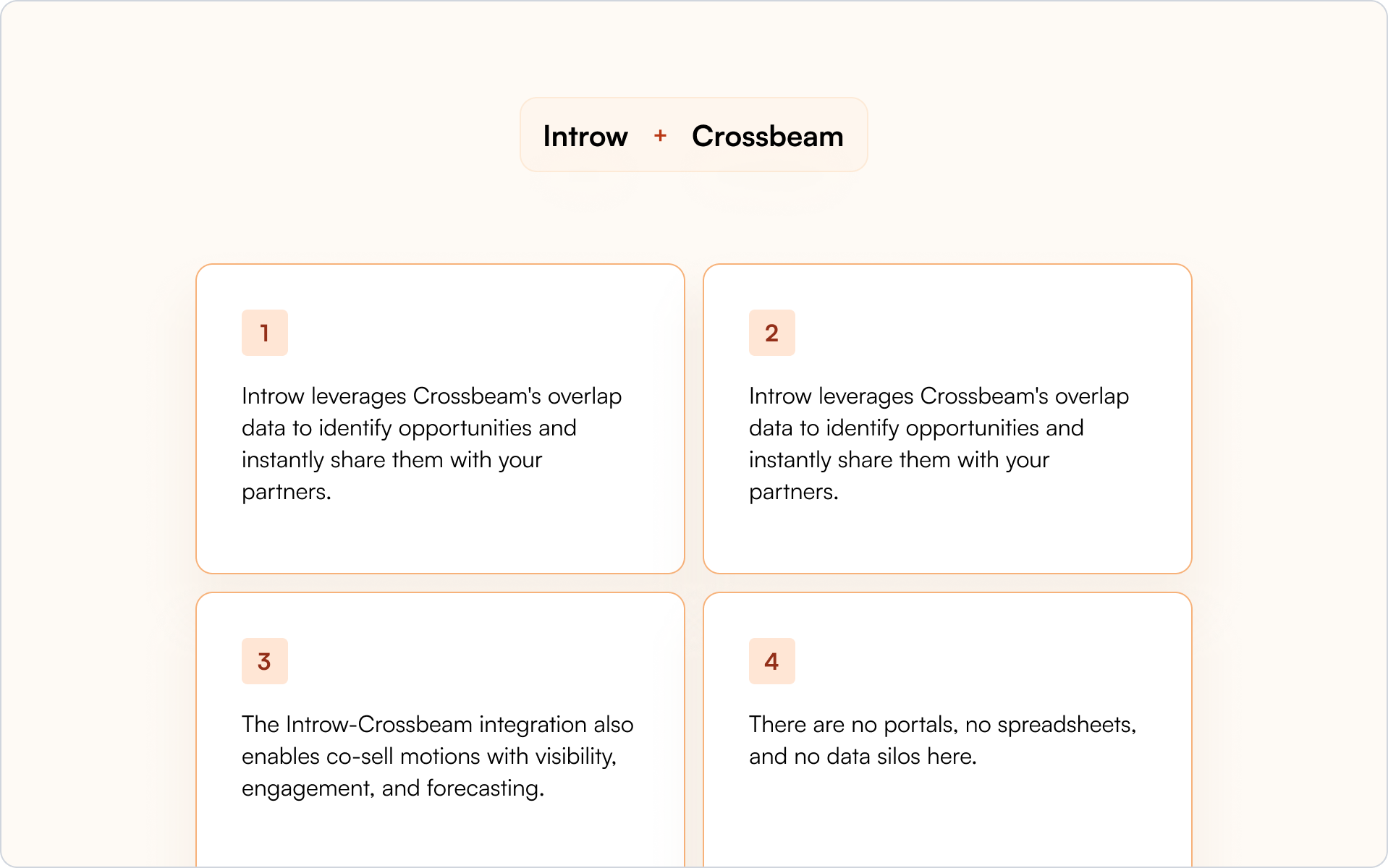

Why Introw + Crossbeam is the Best Partnership Tracking Stack in 2026

If you're ready to integrate account mapping into your PRM, consider Introw with Crossbeam.

So, how do the two platforms work together?

Introw leverages Crossbeam's overlap data to identify opportunities and instantly share them with your partners.

Essentially, Crossbeam finds the opportunity, and Introw then turns it into revenue.

This process is super simple too — one-click integration connects the partner overlap data to the actual pipeline.

What's more, Introw (with Crossbeam) syncs seamlessly into Salesforce or HubSpot, empowering you to manage your partner tracking process from inside your CRM.

The Introw-Crossbeam integration also enables co-sell motions with visibility, engagement, and forecasting.

And Introw is built for scale!

There are no portals, no spreadsheets, and no data silos here.

Conclusion

Today's partner programs live and die by what they can track.

Introw + Crossbeam is the only solution that handles account mapping, lead registration, engagement tracking, and forecasting — all in one flow

So, say goodbye to portal logins and spreadsheet chaos.

✅ Ready to track every opportunity and turn partnerships into pipeline? Book your personalized Introw demo

What Is a Partnership Tracker?

A partnership tracker is a tool or software that enables companies to monitor and manage business collaborations, affiliate programs, or influencer partnerships. They typically help to track: 1. Performance key metrics 2. Communication 3. Payments 4. Contractual agreements Businesses use these trackers to optimize relationships, measure success, and streamline operations — improving their partnerships and boosting the bottom line.

How Does Introw Track Partner-Sourced Pipeline?

Introw tracks partner-sourced pipelines by integrating with your CRM, automatically detecting partners, and providing a shared sales pipeline. This set-up allows partners to access and manage their deals directly, helping you manage relationships and ensuring real-time alignment and transparency. Additionally, Introw automates updates based on CRM data, keeping all stakeholders informed.

What Does The Crossbeam Integration Do Inside Introw?

Introw integrates with Crossbeam as a data source, allowing users to connect and leverage Crossbeam's partner ecosystem data within Introw's platform. Integrate the tools to enable automatic detection of partners and tracking of partnership revenue. This helps to ensure the CRM remains the single source of truth. By combining Crossbeam's data with Introw's features, users can manage partners, collaborate on deals, and automate updates effectively.

Can I Track Partner Engagement And Attribution In My CRM?

With the right tools, yes! With Introw, you can track partner engagement and attribution directly in your CRM. Introw integrates with your CRM to automatically detect the right partners, log interactions, and track revenue attribution from partner-sourced deals. This ensures that your CRM remains the single source of truth, giving you complete visibility into partner-driven impact

What Makes Introw Better Than Traditional PRMs?

Introw stands out from traditional Partner Relationship Management (PRM) tools by focusing on CRM integration and automation. Unlike PRMs that require manual partner input, Introw automatically detects partners, tracks deal progression and attributes revenue directly within your customer relationship management system. This eliminates friction, ensures real-time visibility, and makes managing your partnership program seamless and efficient.

.svg)

.png)