12 Partner Relationship Management Best Practices for 2026

Partner programs often stall not because of bad partners, but because your internal processes are scattered. Onboarding lives in one place, deal registration in another, and communication happens wherever someone remembers to send an email.

The teams that scale partner revenue treat PRM as an operational discipline, not a collection of disconnected tools. Below are 12 partner relationship management best practices that keep partner data clean, partners engaged, and pipeline visible — without adding complexity.

What is partner relationship management?

Partner relationship management (PRM) focuses on building trust, enabling partners through technology, and driving mutual profitability. PRM includes structured onboarding, consistent communication, deal registration workflows, and performance tracking — all designed to improve collaboration between your company and your channel partners.

PRM sits alongside your CRM but serves a different purpose. While CRM tracks your direct relationships with customers, PRM tracks your relationships with the resellers, referral partners, distributors, and implementation partners who sell on your behalf.

What PRM typically covers

- Partner onboarding: Getting new partners trained and ready to sell your product

- Deal and lead registration: Tracking partner-sourced opportunities and protecting them from conflict

- Enablement: Providing sales materials, training, and ongoing support

- Performance tracking: Measuring each partner’s contribution to pipeline and revenue

- Communication: Keeping partners informed, engaged, and aligned with your goals

When onboarding, registration, enablement, tracking, and communication work together, partner programs become measurable and operationally tight — not a side project running on spreadsheets.

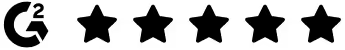

Key components of partner relationship management

Before diving into partner relationship management best practices, it helps to name the building blocks of any partner program. The components below form the foundation that PRM software supports at scale.

Each component addresses a specific operational gap. The best practices below show how to implement each one effectively — and how to keep it founder-friendly: simple, measurable, and scalable.

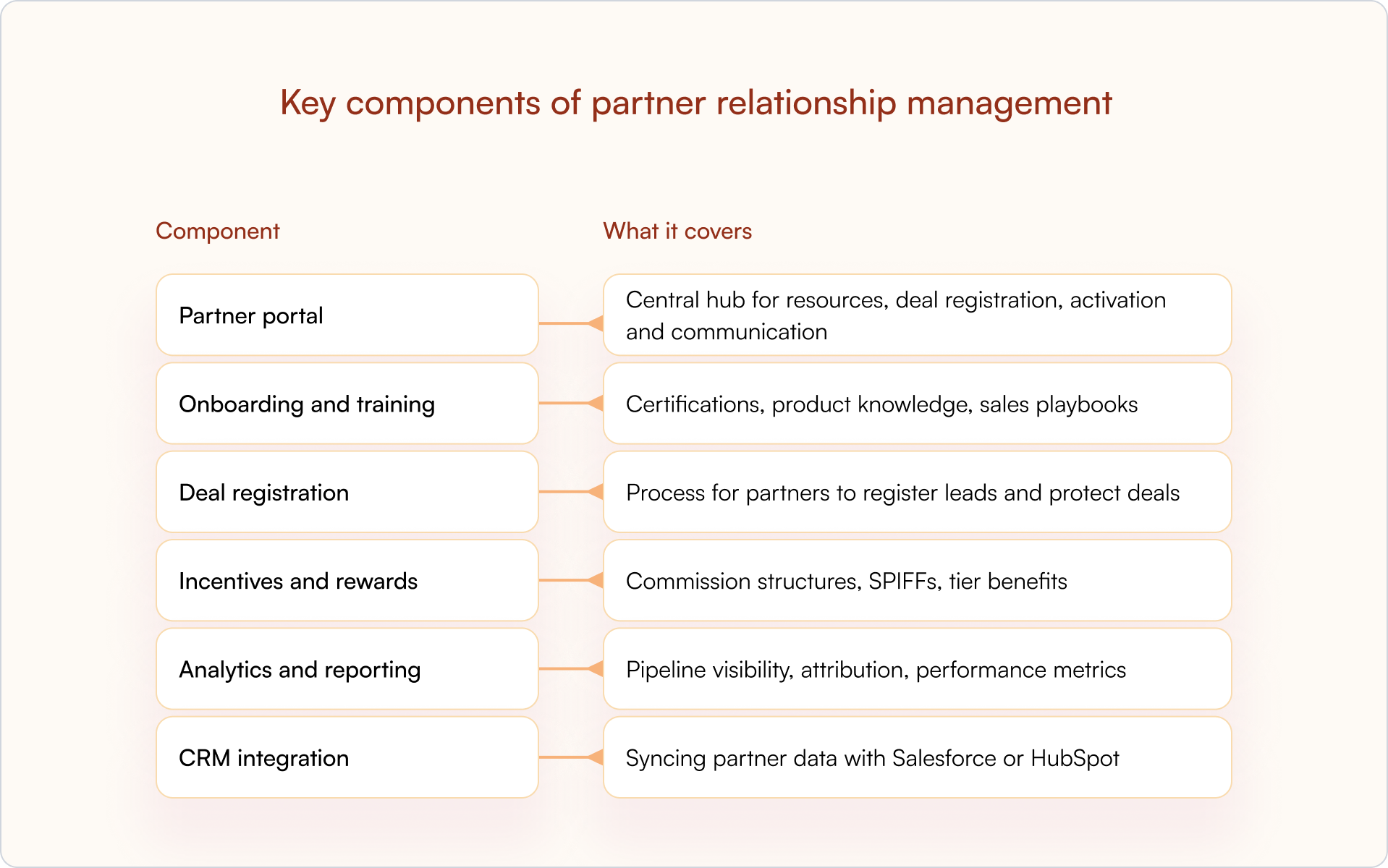

12 partner relationship management best practices to grow your program

1. Build a structured partner onboarding program

Partners who complete onboarding quickly tend to sell faster. Yet many programs leave new partners to figure things out on their own, which leads to slow ramp times and early disengagement.

A structured onboarding program gives every partner the same foundation: a welcome sequence, product training, certification paths, and defined milestones so partners know exactly what “ready to sell” looks like.

Key onboarding elements

- Welcome kit: Program overview, key contacts, and first steps

- Product training: Core features, use cases, and competitive positioning

- Sales certification: Ensures partners can represent your product accurately

- Defined milestones: Clear checkpoints that signal readiness

Self-serve onboarding works better than scheduled calls for most partners. Partners can move at their own pace without waiting on your team’s availability.

2. Provide on-demand training and enablement resources

Onboarding gets partners started. Ongoing enablement keeps them sharp.

Partners juggle multiple vendor relationships. The vendors who make it easy to find answers and stay current usually earn more mindshare. That means battle cards, demo scripts, objection handling, and pricing documentation — all accessible without emailing a partner manager.

Resources that drive engagement

- Battle cards: Competitive comparisons partners can reference mid-conversation

- Demo environments: Sandbox access so partners can show the product themselves

- Pricing and packaging guides: Clear documentation to avoid quoting errors

- Case studies: Customer stories partners can share with prospects

If a partner has to ask for basic information, you’ve added friction that slows deals.

3. Integrate your PRM directly with your CRM

When PRM lives outside the CRM, partner pipeline becomes invisible to sales and RevOps. Forecasting suffers. Attribution breaks. And you end up with two systems that don’t agree on what’s happening.

CRM-first PRM solves this by keeping partner data inside HubSpot or Salesforce, where your revenue team already works.

Benefits of native CRM integration

- Single source of truth: No duplicate records or conflicting data

- Pipeline visibility: Sales and partner teams see the same deals

- Accurate attribution: Partner-sourced revenue is trackable for comp and planning

- Automated workflows: Deal registration triggers can route approvals and alerts inside the CRM

If your PRM creates a separate database, you’re building a visibility gap that grows with every new partner.

4. Implement deal and lead registration workflows

Deal registration is how partners claim an opportunity and receive protection from conflict. Without deal registration, you’re left resolving disputes after the fact, which damages trust and slows deals.

A good registration workflow includes required fields, approval SLAs, protection windows, and clear expiration rules. Partners know what to submit, how long they’re protected, and what happens if a deal stalls.

Workflow elements to define

- Required fields: Company name, contact info, estimated deal size, expected close date

- Approval SLA: How quickly you commit to approving or declining registrations

- Protection window: How long the partner has exclusivity on the deal

- Expiration and extension rules: What happens when protection expires or deals go quiet

When registration is fast and fair, partners participate. When registration is slow or opaque, partners stop submitting — and you lose visibility into partner-sourced pipeline.

5. Create a self-service partner portal

A partner portal gives partners a single destination for resources, deal registration, deal status, and communication with your team. Done well, it reduces the back-and-forth that bogs down partner managers.

The key is reducing friction, not adding it. Partners don’t want to email someone for basic information or log into multiple systems to check on a deal.

Portal capabilities that matter

- Resource library: Training materials, sales collateral, product docs

- Deal registration forms: Submit and track opportunities

- Pipeline visibility: Partners see status updates on their deals

- Announcements: Policy changes, new resources, program updates

A portal that’s hard to access or navigate will be ignored. One that’s fast and useful becomes the default way partners engage with your program.

6. Establish consistent partner communication channels

Partners disengage when they don’t hear from you. And when partners are surprised by policy changes, trust erodes quickly.

Consistent communication means defining what you share, how often, and through which channels. Email, Slack, and portal announcements all work. The key is predictability.

Communication types to establish

- Program announcements: Policy changes, new incentives, product launches

- Pipeline updates: Deal status changes, approval decisions, expiring protections

- Enablement broadcasts: New training, updated collateral, competitive intel

- QBR invitations: Quarterly reviews for strategic partners

Partners manage multiple vendor relationships. The vendors who communicate clearly and consistently tend to stay top of mind.

7. Design incentive programs that motivate partners

Incentives shape behavior. If you want partners to bring new logos, incentivize new business. If you want partners to expand accounts, reward upsells.

The most effective incentive programs are simple to understand and easy to claim. Complexity kills participation.

Align incentives with your program goals. And make sure partners can actually track their progress. Hidden or delayed payouts undermine trust.

8. Track partner performance with real-time analytics

You can’t improve what you can’t measure. Partner performance tracking gives you visibility into who’s contributing, who’s stalling, and where to focus your attention.

Dashboards that live in or sync to your CRM make tracking easier. Partner managers don’t want to pull manual reports just to understand what’s happening.

Key metrics to track

- Deal registration volume: How many opportunities partners are submitting

- Pipeline value: Total value of partner-sourced deals in progress

- Conversion rate: Percentage of registered deals that close

- Partner engagement: Portal logins, training completions, resource downloads

Real-time visibility helps you spot problems early and double down on what’s working.

9. Automate routine partner operations

Partner managers often spend too much time on tasks that could be automated: registration approvals, status notifications, expiration reminders, welcome sequences.

Automation reduces manual work and ensures nothing falls through the cracks. It also makes it possible to scale your program without proportionally scaling headcount.

Automation opportunities

- Registration routing: Auto-assign approvals based on deal size or territory

- Status notifications: Alert partners when deals move stages

- Expiration reminders: Warn partners before protection windows close

- Onboarding sequences: Trigger welcome emails and training assignments automatically

The goal isn’t to remove the human element. The goal is to free up partner managers for relationship-building instead of administrative tasks.

10. Prevent channel conflict with clear rules of engagement

Channel conflict happens when partners compete with each other, or with your direct sales team, for the same deal. Channel conflict is one of the fastest ways to damage partner trust.

Prevention starts with clear rules: territory definitions, deal registration policies, and escalation paths. When everyone knows the rules upfront, disputes become rare.

Conflict prevention elements

- Territory and segment rules: Who can sell to which accounts

- First-to-register protection: Registered deals get exclusivity

- Direct vs. partner prioritization: When direct sales can engage partner accounts

- Escalation process: How to resolve disputes when conflicts occur

Practical tip: Publish your rules of engagement in your partner portal so partners can reference them anytime, not just when a dispute arises.

Ambiguity creates conflict. Clarity prevents it.

11. Give partners pipeline visibility without login friction

Partners disengage when they can’t see what’s happening with their deals. But requiring portal logins for every update creates friction that slows engagement.

The solution is off-portal collaboration. Partners can receive updates via email and respond without logging into a separate system. Partner replies sync back to your CRM automatically.

Visibility approaches that reduce friction

- Shared pipeline views: Partners see their deals and current status

- Email notifications: Automatic alerts for stage changes and approvals

- Reply-by-email: Partners respond to updates without portal login

- Property-level controls: Show partners relevant fields without exposing sensitive data

Visibility keeps partners motivated. Friction kills momentum.

12. Continuously evaluate and optimize your partner program

Partner programs require iteration. What works at 20 partners often breaks at 100. Reviewing performance quarterly, gathering partner feedback, and adjusting based on results keeps your program healthy as it scales.

Optimization activities to build into your cadence

- Quarterly business reviews: Deep-dive with strategic partners on performance and roadblocks

- Partner feedback surveys: Understand what’s working and what’s frustrating

- Incentive analysis: Check if incentives are driving desired behavior

- Process audits: Identify bottlenecks in onboarding, registration, and support

The best partner programs treat optimization as ongoing work, not a one-time project.

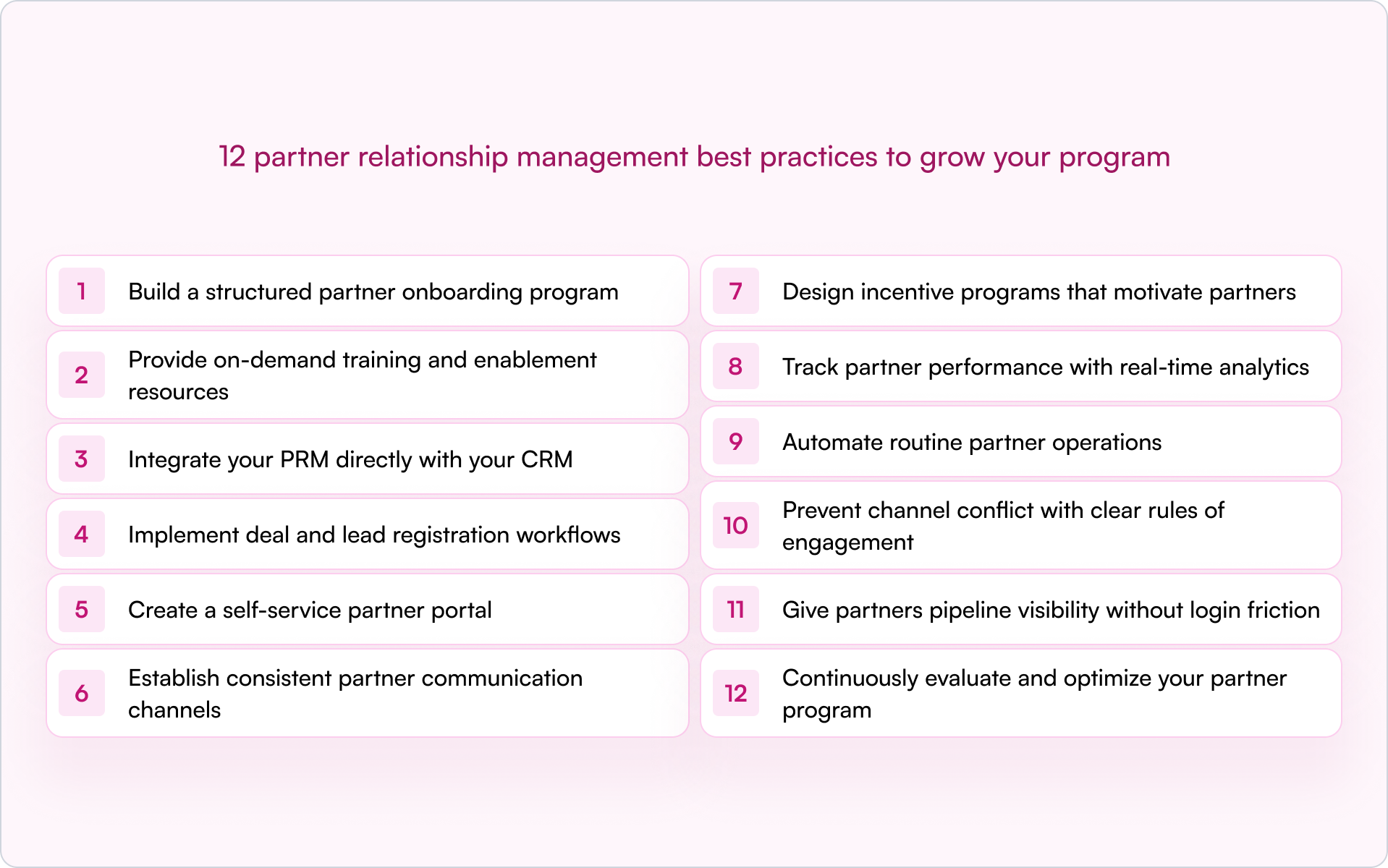

How PRM software supports partner relationship management best practices

PRM software operationalizes the best practices above. The right platform integrates with your CRM, reduces manual work, and gives partners a professional experience that keeps them engaged.

How software capabilities map to these best practices

- Partner portal: Centralizes onboarding, resources, and deal registration (practices 1, 2, 5)

- Deal registration workflows: Automates submissions, approvals, and protection tracking (practice 4)

- CRM integration: Keeps partner data in Salesforce or HubSpot (practice 3)

- Announcements and notifications: Streamlines communication (practice 6)

- Analytics dashboards: Tracks performance in real time (practice 8)

- Off-portal collaboration: Lets partners engage via email without logins (practice 11)

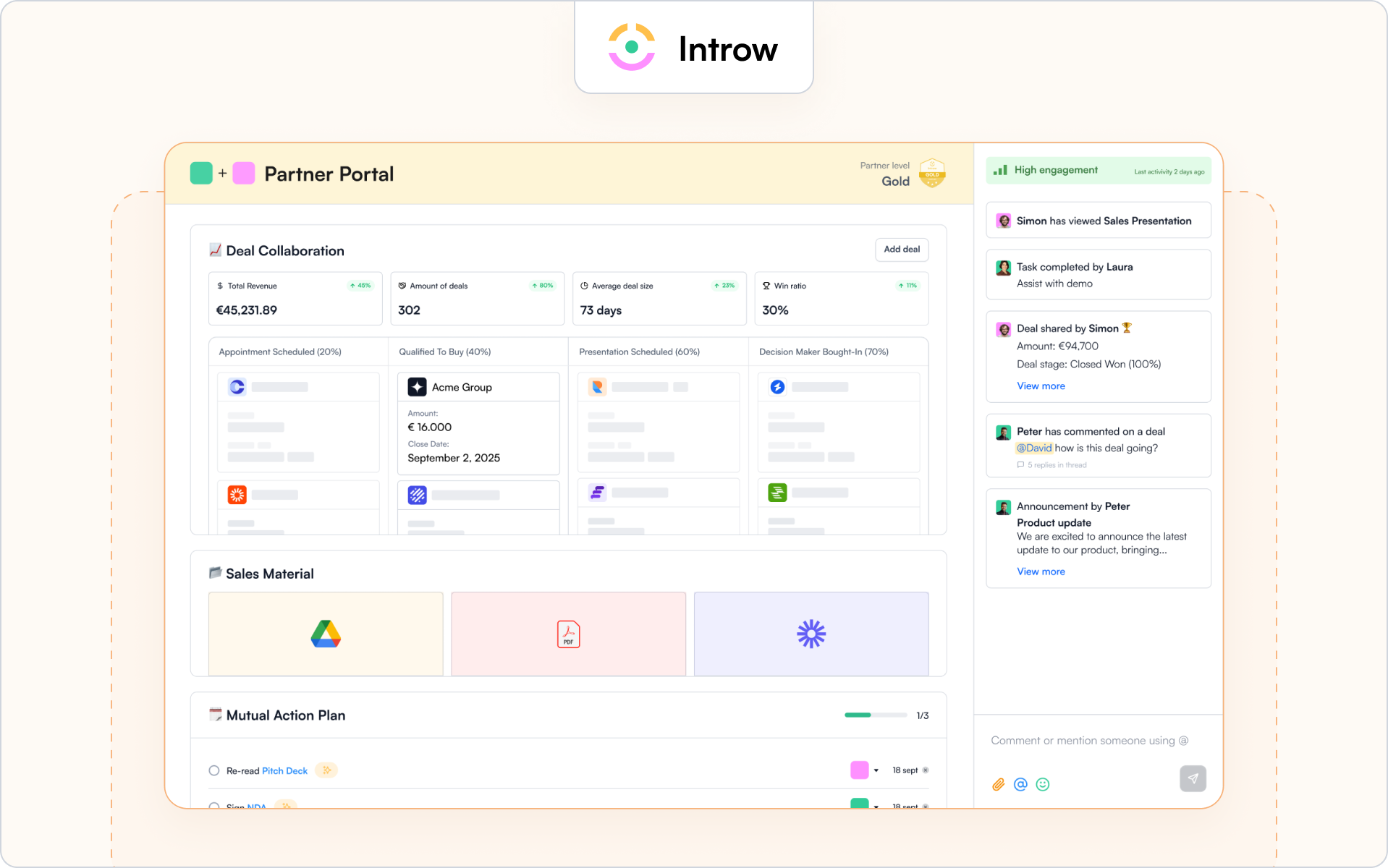

Introw is built on a CRM-first approach. Partner data stays inside HubSpot or Salesforce, partners can engage without managing another login, and your team gets real-time visibility into partner-sourced pipeline.

Get a demo to see how Introw helps partner teams put partner relationship management best practices into action.

Conclusion: keep PRM simple, measurable, and CRM-first

If you’re building a partner motion as a founder, the biggest unlock is treating PRM like revenue infrastructure. Start with clean data in your CRM, make partner participation easy (self-serve + low-friction collaboration), and automate the operational noise.

Do that, and your partner program stops being “extra pipeline” and becomes a predictable channel you can actually forecast.

Partner Content Enablement Guide (That Actually Reaches Your Partners in 2026)

If you have ever asked what is content enablement, think of it as the connective tissue between creating content and closing deals. It is the discipline of organizing, delivering, and measuring sales enablement materials so sellers and partners can move prospective customers through the sales funnel with less friction. In a partner context, content enablement meaning widens: you are equipping external channel partners with up to date partner content and giving your internal sales team visibility into how it was used before a purchase order shows up.

Why is this urgent in 2026? Creation points keep multiplying. Marketing teams ship pages, playbooks, and videos. Sales reps record custom demos. Product managers publish technical specifications and security FAQs. Without a content enablement strategy, valuable content scatters across drives and chat threads. Partners guess which version is current, legal fees rise because brand risk slips through, and sales cycles drag while people hunt for the right slide. A thoughtful partner enablement strategy fixes this by aligning business content to buyer engagement and making it simple for partners to find, send, and track.

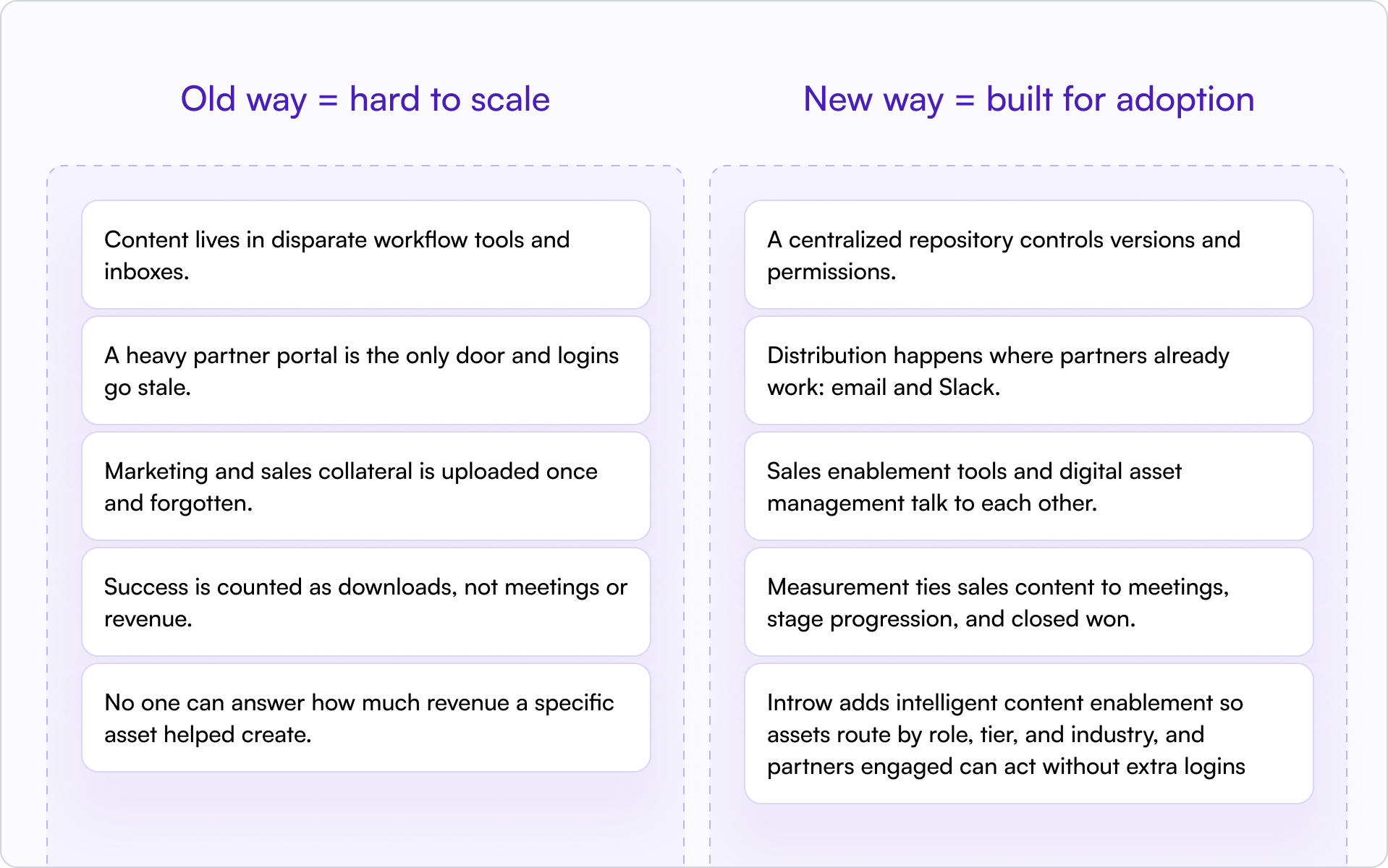

The old way versus the new way of enabling partners

It helps to name the shift so your partner program knows what will change and why.

Old way, hard to scale

- Content lives in disparate workflow tools and inboxes.

- A heavy partner portal is the only door and logins go stale.

- Marketing and sales collateral is uploaded once and forgotten.

- Success is counted as downloads, not meetings or revenue.

- No one can answer how much revenue a specific asset helped create.

New way, built for adoption

- A centralized repository controls versions and permissions.

- Distribution happens where partners already work: email and Slack.

- Sales enablement tools and digital asset management talk to each other.

- Measurement ties sales content to meetings, stage progression, and closed won.

- Introw adds intelligent content enablement so assets route by role, tier, and industry, and partners engaged can act without extra logins.

The new way respects how sales partners actually sell and how marketing teams want to manage brand consistency.

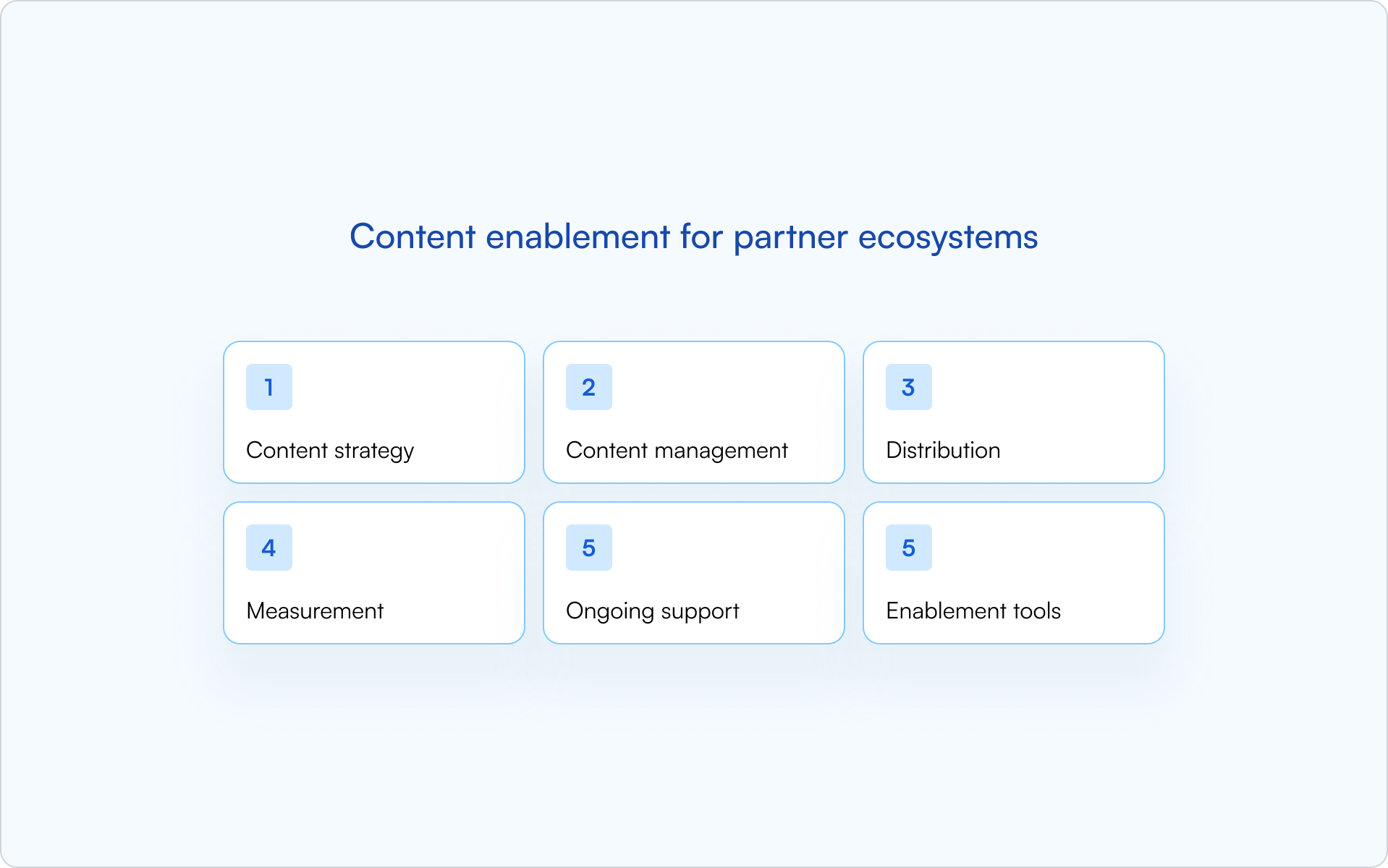

The expanded definition: content enablement for partner ecosystems

Let’s expand the definition so you can design an effective partner enablement strategy that fits a modern partner ecosystem.

- Content strategy maps formats to customer personas, objections, and stages. This is where value propositions are clarified and marketing materials are prioritized.

- Content management ensures managing content is safe and simple. Digital asset management, access controls, and data security keep everything current and compliant.

- Distribution puts partner enablement content into the flow of work. Think push delivery for urgency and a partner content hub for browsing and training.

- Measurement connects actions to outcomes. Key performance indicators live in your CRM and show what content actually shortens the sales cycle and improves sales performance.

- Ongoing support keeps partners engaged. Sales training, partner enablement training, and office hours help partners apply the message on real sales calls.

- Enablement tools automate the boring parts. Sales AI tools can flag stale claims, suggest next best content, apply AI powered spell checking to drafts, and even trigger document generation for localized one pagers.

This expanded definition turns a pile of files into a repeatable system.

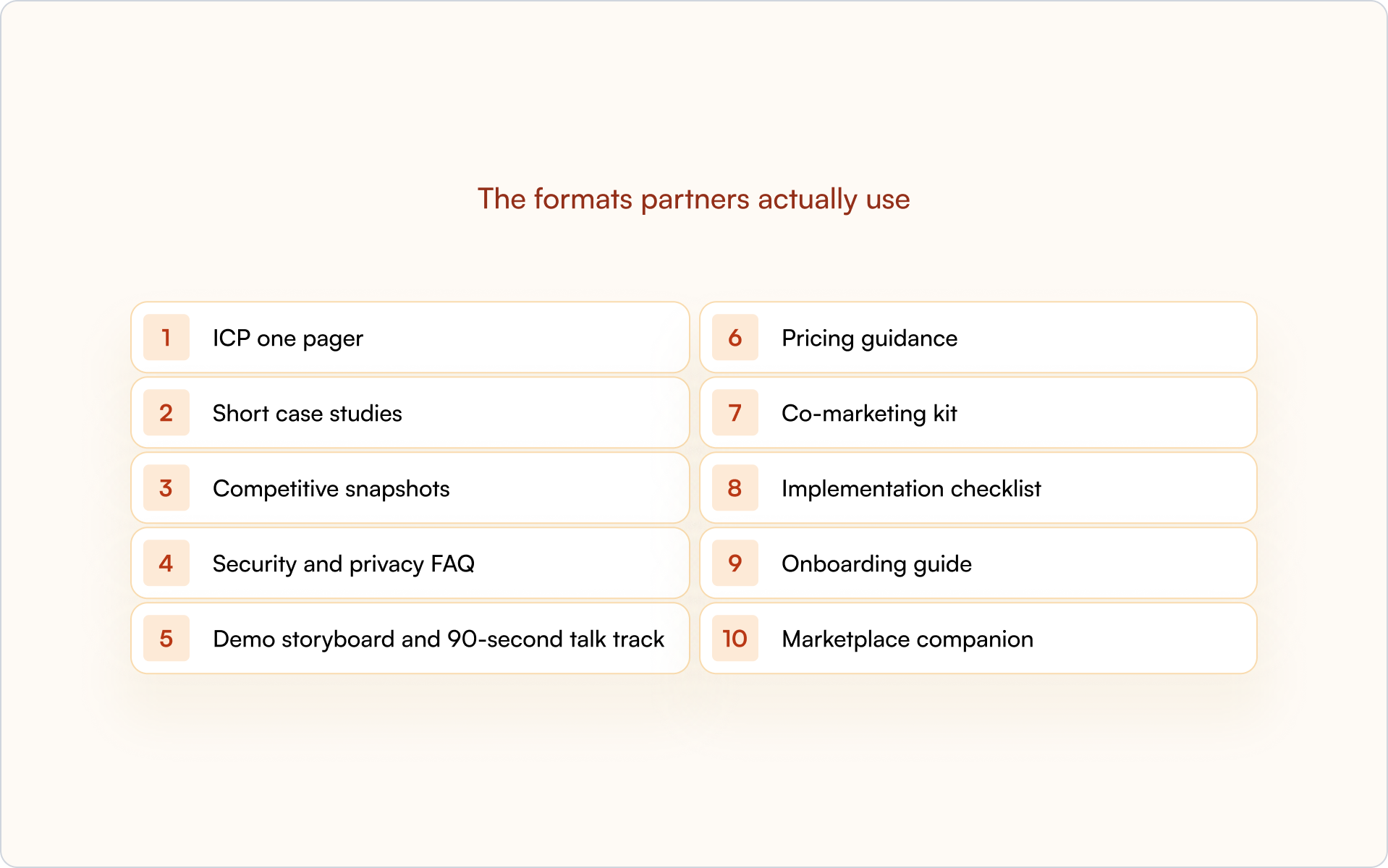

The formats partners actually use — and why they work

You do not need hundreds of assets to support channel partners. You need a tight core mapped to the buyer journey, plus a plan to keep it up to date. Here is a practical short list that consistently moves deals:

- ICP one pager that captures pains, triggers, and crisp value propositions for your target audience.

- Short case studies with outcomes, named roles, and a quote you can reuse.

- Competitive snapshots with three differentiators and traps to avoid.

- Security and privacy FAQ that answers procurement’s first questions and reduces back-and-forth.

- Demo storyboard and 90-second talk track that link features to jobs-to-be-done.

- Pricing guidance that explains models without revealing internal margins.

- Co-marketing kit with a landing page outline, two emails, and three social posts that partners can localize.

- Implementation checklist for services partners, including technical specifications and boundaries.

- Onboarding guide that sets expectations for handoff and adoption.

- Marketplace companion if you transact through AWS Marketplace or Google Cloud Marketplace.

Each item should show an owner, a version date, and a stage. That simple metadata is how sales and marketing teams keep confidence high.

Building your partner content engine in five steps

Every step here flows into the next, so avoid skipping ahead. You are building a system, not just uploading files.

Step 1. Align on audiences, motions, and use cases

Start with segmentation. Split your partner ecosystem by motion — resell, referral, ISV, and services. Within each motion, separate sellers and consultants, then overlay partner tier and region. This gives you the targeting you need so a consultant does not receive first-call decks, and a reseller AE is not reading deep implementation playbooks.

Outcome: clear audiences for content and reporting, fewer irrelevant pings, better partner satisfaction.

Step 2. Audit existing content with ruthless clarity

Map every asset to discovery, evaluation, selection, or onboarding. Identify duplicates and outdated claims. Keep winners, merge near-duplicates, and retire risky files. Capture gaps that stall deals, like an absent security FAQ or a weak competitive snapshot. This is where content related technologies help: a digital asset management tool will expose duplicates, and enablement tools will surface low-use files to replace.

Outcome: a trimmed library that your internal team trusts and partners will actually reuse.

Step 3. Create the minimum viable set and standardize quality

Create marketing and sales collateral with a shared checklist: audience, use case, stage, owner, review cadence, legal status. Use standardized templates to speed document generation and maintain brand consistency. Where possible, add short narration guidance so sales reps know when and how to use the asset during sales calls.

Outcome: fewer, sharper pieces that are easier to keep up to date and safer to send.

Step 4. Distribute in the flow of work, not just the portal

A partner portal is useful, but it should not be the only door. Push content by email and Slack when timing matters. Let partners browse a partner content hub for training and self-serve discovery. Surface the next best asset inside your CRM when a sales rep opens an opportunity. Distribution should feel like today’s digital HQ, not a scavenger hunt.

Outcome: higher adoption, faster response, and less time spent hunting links.

Step 5. Measure what leaders care about and iterate quarterly

Replace vanity metrics with outcome metrics. Track first meetings within 14 days of send, stage progression on opportunities that received specific assets, influenced pipeline, and win rate deltas where content was used. Add operational KPIs like training completion and asset freshness. Review quarterly with partners and your internal sales team, then tune your content enablement strategy.

Outcome: proof that content moves revenue, not just downloads.

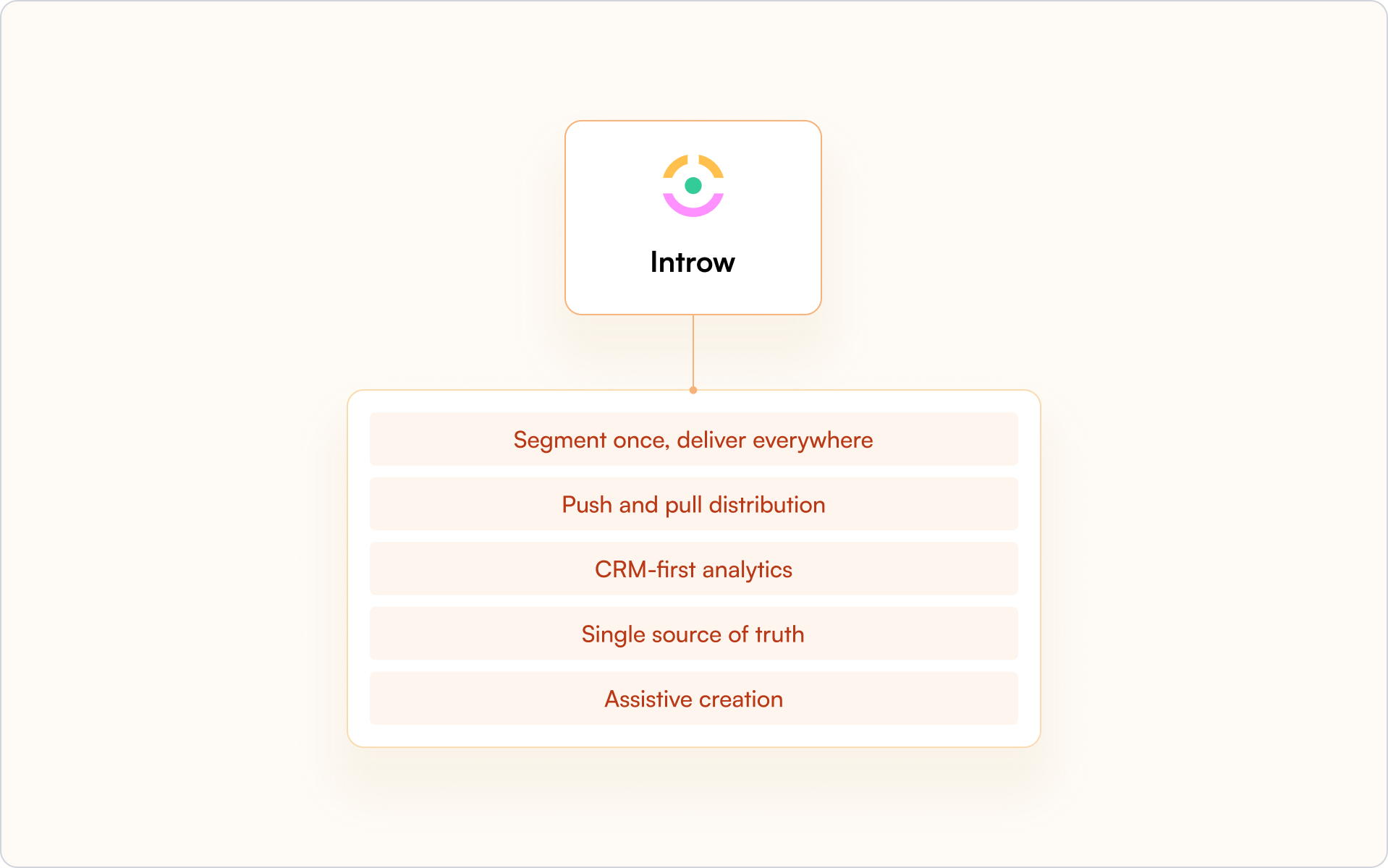

Where Introw fits — intelligent content enablement that partners adopt

Introw is built to make partner content reach the field and show up in your numbers.

- Segment once, deliver everywhere. Target by motion, tier, role, industry, certification status, or region. A reseller AE gets first-call assets and a co-marketing kit. A services architect sees implementation plays and product training.

- Push and pull distribution. Send content by email and Slack for urgency, while a lightweight partner content hub supports discovery and training. Partners do not need to learn a heavy system to stay current.

- CRM-first analytics. Engagement rolls up next to account and opportunity records so leaders can see which assets improve first-meeting rate, stage progression, and close won.

- Single source of truth. A centralized repository handles managing content, permissions, and data security. Owners and review cadences keep everything up to date.

- Assistive creation. Sales AI tools inside the workflow suggest next best content, flag stale messages, apply AI powered spell checking, and trigger document generation for localized one pagers.

This is partner content marketing that respects how partners sell and how marketing and sales teams want to measure.

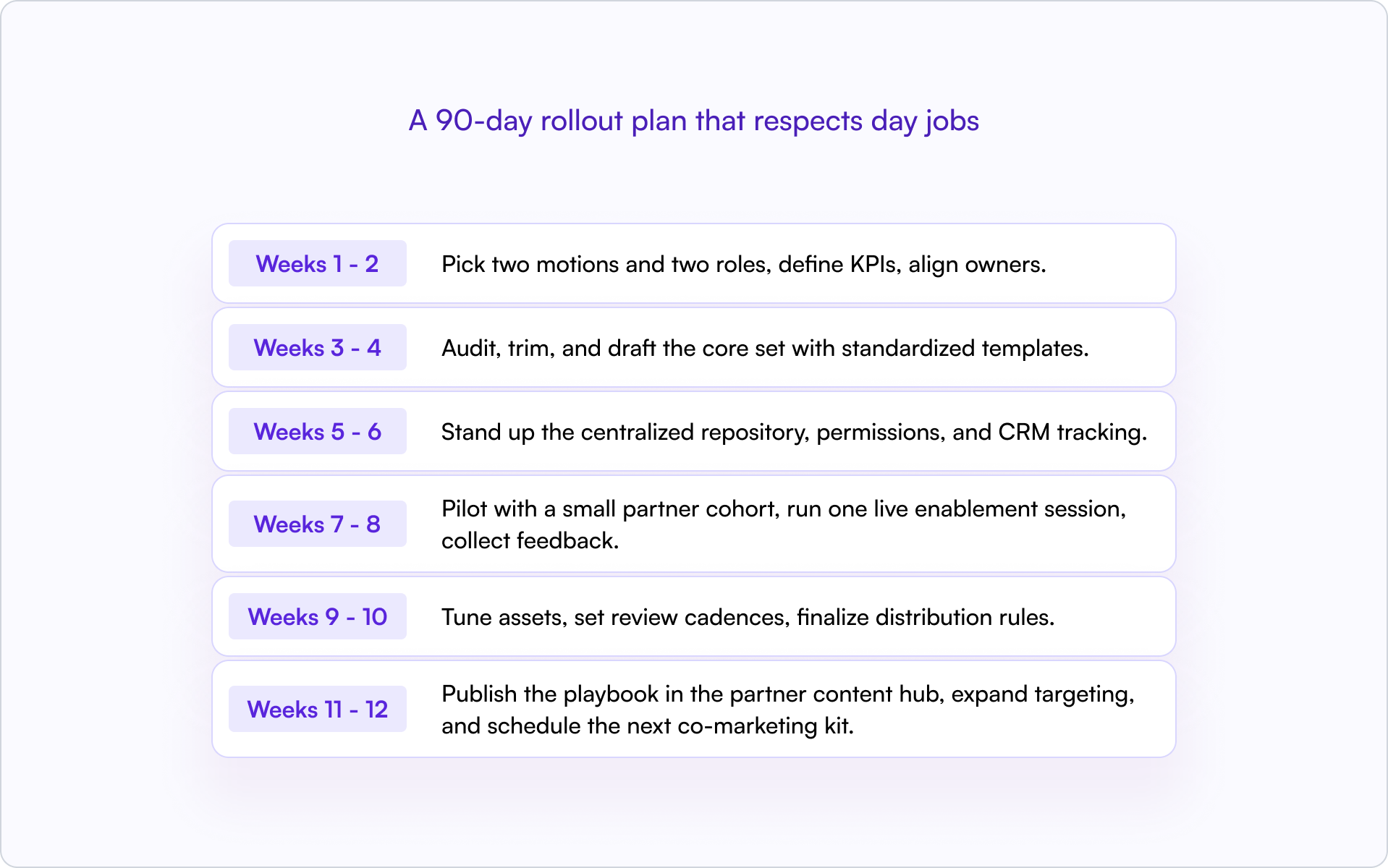

A 90-day rollout plan that respects day jobs

Long rollouts lose momentum. This plan gets you live fast and gives you space to improve.

Weeks 1–2 — pick two motions and two roles, define KPIs, align owners.

Weeks 3–4 — audit, trim, and draft the core set with standardized templates.

Weeks 5–6 — stand up the centralized repository, permissions, and CRM tracking.

Weeks 7–8 — pilot with a small partner cohort, run one live enablement session, collect feedback.

Weeks 9–10 — tune assets, set review cadences, finalize distribution rules.

Weeks 11–12 — publish the playbook in the partner content hub, expand targeting, and schedule the next co-marketing kit.

Because Introw connects segmentation, delivery, and analytics to your CRM, most of the wiring is configuration rather than custom work.

Bringing it all together

Great partner enablement is not about more files. It is about delivering relevant marketing content to the right people at the right time and proving it helped close business. When sales and marketing teams share a centralized repository, when content management is tight, and when distribution meets partners where they already work, buyer engagement improves and closing deals gets easier.

Introw adds the missing glue by combining segmentation, a partner content hub, push delivery, and CRM analytics so your channel partner enablement program turns content into revenue. If you want an effective partner enablement strategy that partners adopt and leaders can measure, Introw is ready to help.

17 Salesforce PRM Alternatives to Choose From in 2026 (Partner Cloud)

Salesforce’s native PRM — now packaged as Partner Cloud on Experience Cloud — lets you build a partner portal, run deal registration, and connect partner activity into Sales Cloud and other Salesforce products. If your team is already all-in on Salesforce, it can be compelling. Still, many SaaS companies consider alternatives in 2026 for faster rollout, lower total cost, stronger HubSpot coexistence, or deeper support for motions like hyperscaler co-selling deals and affiliate marketing. The right partner relationship management software should automate sales processes, support opportunity management, and surface real time data for pipeline inspection across partners, customers, and channel sales.

Who this guide is for: B2B SaaS teams with active partner programs, at least two channel managers, and Salesforce or HubSpot CRM as the source of truth.

How we evaluated: CRM alignment (Salesforce and HubSpot), time-to-value, partner performance and adoption without logins, co-sell capability, affiliate needs across various industries, governance for RevOps, and reporting in the CRM. We also looked at AI capabilities, content management for enablement, and operational efficiency to drive long term success.

What to look for instead of Salesforce PRM

If you are replacing Experience Cloud for partners, prioritize CRM-first operations so sellers never leave Sales Cloud or HubSpot. Look for partner relationship management PRM workflows that reduce channel conflict, guide partners with in app guidance, and enable real time collaboration by email or Slack. You also want clean attribution and forecasting in the CRM, outcome based enablement that helps partners track progress and monitor performance, plus role-based access that keeps RevOps happy as you scale. Tools that automate sales processes, support custom objects, and give a complete view of customers, partners, and deals on a single platform will help many businesses improve market reach and reduce costs.

How to shortlist in 10 minutes

- Map motions — reseller, referral, co-sell, affiliate.

- Pick your CRM center — Salesforce only or Salesforce + HubSpot.

- Choose three to trial — e.g., Introw, Channeltivity, and Magentrix for CRM-first PRM; Impartner, ZINFI, Unifyr for enterprise channel scale; impact.com or Everflow for affiliate-heavy strategies; WorkSpan for hyperscaler co-sell.

- Score pilots on — time to first live deal registration, partner engagement without logins, CRM visibility, pipeline inspection, and forecast accuracy.

The 17 best Salesforce PRM alternatives in 2026

Whether you lean into referrals, resellers, co-sell, or affiliate, the options below span pure PRM software, co-sell orchestration, and performance-partner tools. For each, we highlight key features that affect partner productivity, customer data hygiene, and how easily channel managers can manage leads and opportunities across third party partners while staying fully integrated with your AI CRM and other Salesforce products like Service Cloud.

1) Introw

Best for: SaaS companies running referral, reseller, and co-sell motions that want the entire partner workflow to live in Salesforce or HubSpot — while keeping partners engaged through email and Slack so no one is forced to log in.

Why it’s an alternative: Instead of building a heavy Experience Cloud site, Introw keeps deal registration, collaboration, and reporting in your CRM and uses off-portal notifications so partners can reply to updates by email or collaborate via Slack — all synced back to Salesforce or HubSpot. That is a practical way to reduce portal fatigue, track deals and track leads with real time data, and speed time-to-value.

Callouts: Native integrations for Slack, HubSpot, and Salesforce help you capture leads and opportunities quickly. Partners can submit leads via public forms, email, or Slack, and every submission maps to the right CRM fields for clean attribution. If you are scaling a mixed motion — reseller, referral, MSP — the no-code partner portal, content management for enablement, and analytics make it easy to personalize experiences by partner type and monitor performance.

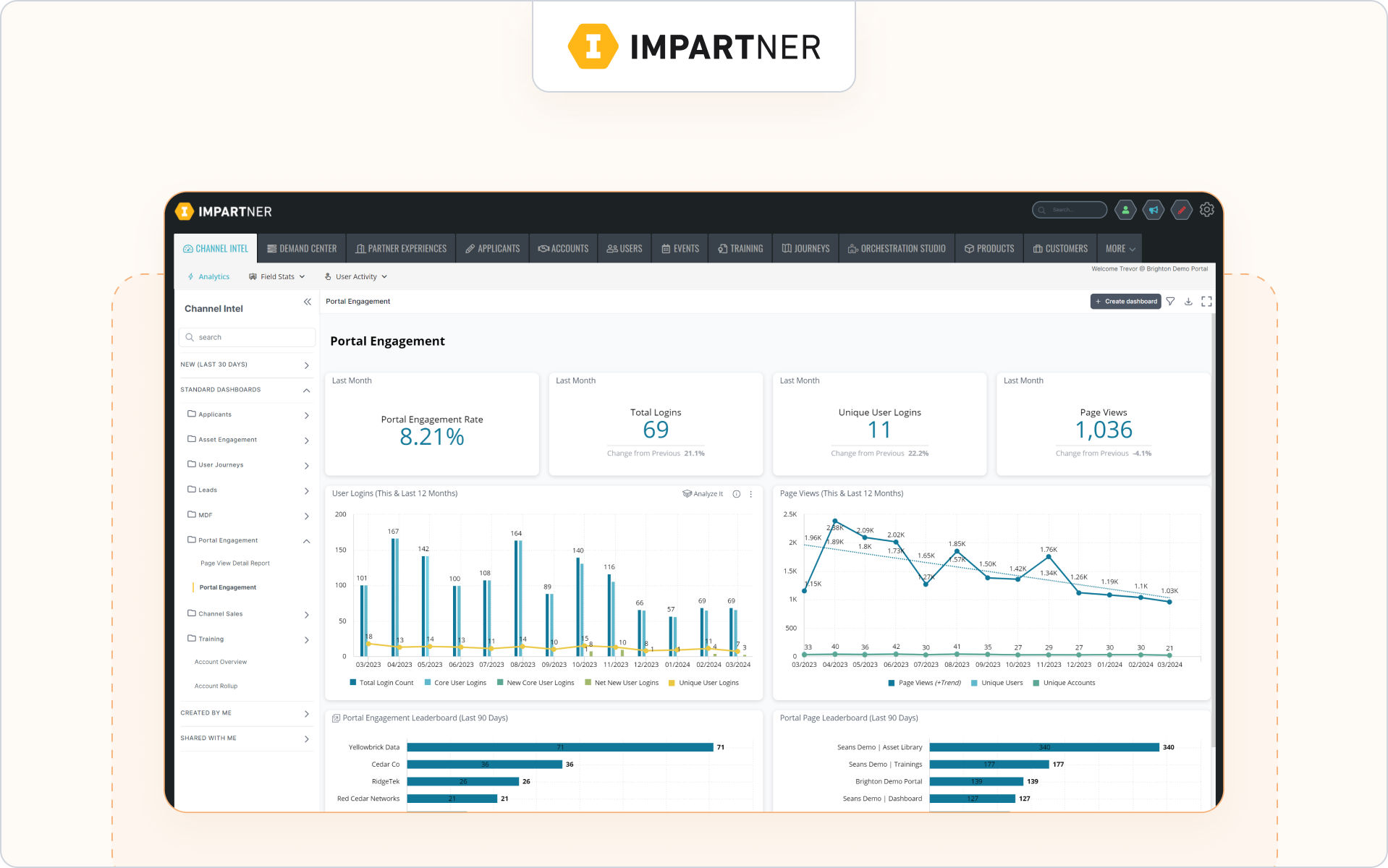

2) Impartner

Best for: Enterprises with global channels that rely on structured tiering, incentives, and MDF — and need proven governance at scale.

Why it’s an alternative: If custom-building PRM on Experience Cloud is too slow or complex, Impartner delivers mature modules out of the box — recruitment, enablement, deal reg, and MDF — with a track record in large channel programs.

Callouts: Its MDF tooling stands out — budgeting, approvals, reimbursements, and notifications are built into the PRM, which is valuable if partner funding drives growth. Third-party directories and analyst sites also show broad deployments and comparisons, plus AI functionality appearing across enablement and analytics.

3) ZINFI (Unified Partner Management)

Best for: Teams seeking a comprehensive PRM suite with strong analyst and peer recognition, plus a steady cadence of product updates.

Why it’s an alternative: ZINFI’s Unified Partner Management spans recruit, enable, market, sell, and incentivize. In 2026 the company continues to emphasize AI-assisted workflows — useful if you want breadth without assembling point tools.

Callouts: The company highlights ease of use and modularity across UPM. If you have multiple partner types and need one platform to cover lifecycle workflows end to end, this is a credible shortlist option for partner enablement and opportunity management.

4) Unifyr (formerly Zift Solutions)

Best for: Channel-heavy orgs that prefer one vendor for PRM, through-channel marketing, and training — rather than stitching together separate systems.

Why it’s an alternative: Zift Solutions rebranded as Unifyr and now positions an AI-enabled partner ecosystem platform. If your Experience Cloud setup became a patchwork of apps, Unifyr’s all-in-one packaging can simplify operations.

Callouts: Messaging focuses on onboarding, activation, and performance insights across the partner lifecycle — helping guide partners, track progress, and align sales processes with marketing.

5) Channelscaler (Allbound + Channel Mechanics)

Best for: Companies that want modern PRM UX combined with enterprise-grade pricing, rebates, and incentive automation — all in one platform.

Why it’s an alternative: Allbound and Channel Mechanics merged and rebranded as Channelscaler. For teams that would otherwise combine a PRM front end with a separate channel automation engine, this unified approach is attractive.

Callouts: Press and analyst notes highlight scalability and intelligence post-merger, with emphasis on accelerating indirect revenue, expanding market reach, and improving operational efficiency.

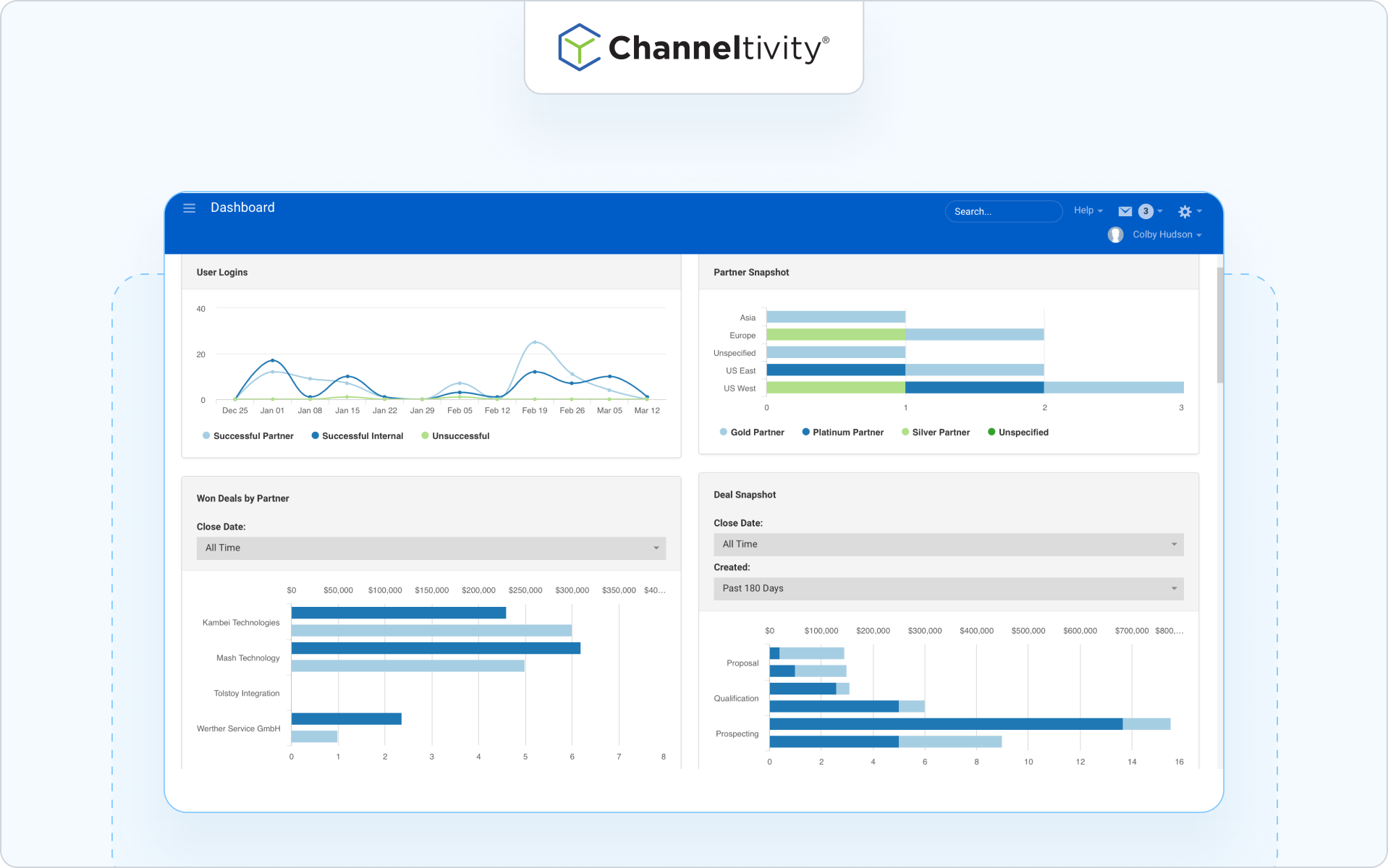

6) Channeltivity

Best for: Mid-market teams looking for fast time-to-value and clicks-not-code integrations with Sales Cloud or HubSpot.

Why it’s an alternative: Channeltivity’s plug-and-play CRM integrations minimize implementation risk versus custom sites. Deal reg and referrals sync into the CRM so sales and RevOps get partner pipeline inspection and visibility without manual work.

Callouts: The HubSpot marketplace listing and help center show two-way sync, field mapping, and setup guides — handy if you want to go live quickly without heavy IT, and still monitor performance and track deals.

7) Magentrix

Best for: Salesforce-centric programs that want a configurable partner portal tightly coupled to CRM objects and data.

Why it’s an alternative: Magentrix is a long-standing AppExchange PRM. Its approach centers on mirroring CRM structure and reducing brittle syncs, which can be smoother than building and maintaining a bespoke Experience Cloud site.

Callouts: Features include deal registration and assignment with automated notifications. The company also publishes guidance on CRM-to-PRM data mirroring — useful for teams managing customer data at scale.

8) PartnerStack

Best for: SaaS teams combining affiliate, referral, and reseller motions — and wanting marketplace reach plus automated payouts.

Why it’s an alternative: PartnerStack pairs PRM-like workflows with a robust rewards engine and partner marketplace. If paying many partners on time is your bottleneck, this can be more turnkey than building equivalents on Salesforce.

Callouts: Flexible commission triggers and scheduled payouts help finance and ops keep partners confident, especially when scaling long-tail programs across partners and customers.

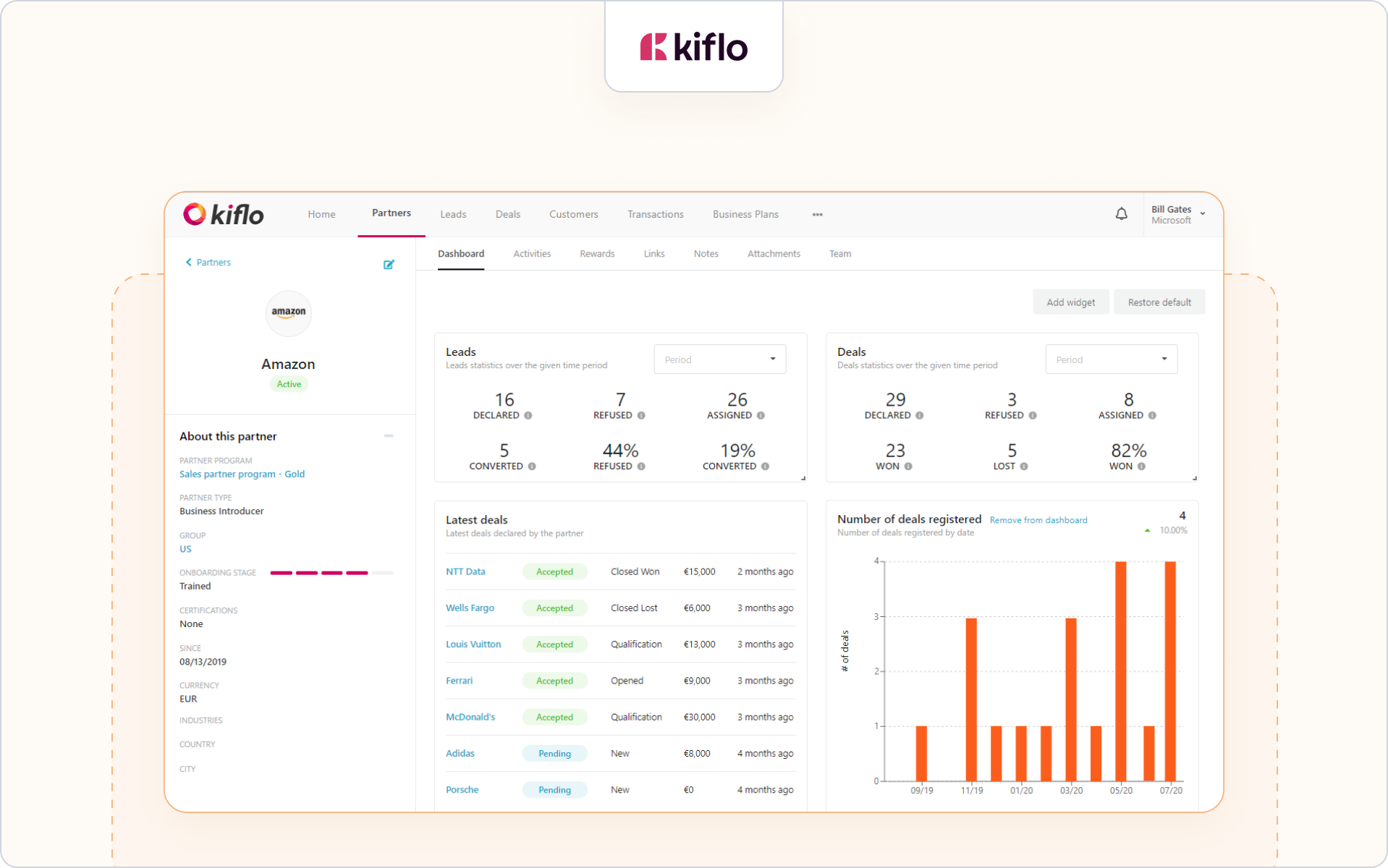

9) Kiflo

Best for: SMBs and scale-ups formalizing their first partner program with a straightforward CRM sync.

Why it’s an alternative: Kiflo focuses on PRM basics — referrals, resellers, simple enablement — and integrates natively with HubSpot to sync leads, deals, and contacts. If Experience Cloud feels over-powered for your stage, this is a pragmatic start.

Callouts: Marketplace listings and docs show two-way sync and mapping, which reduces swivel-chair work for partner managers and RevOps.

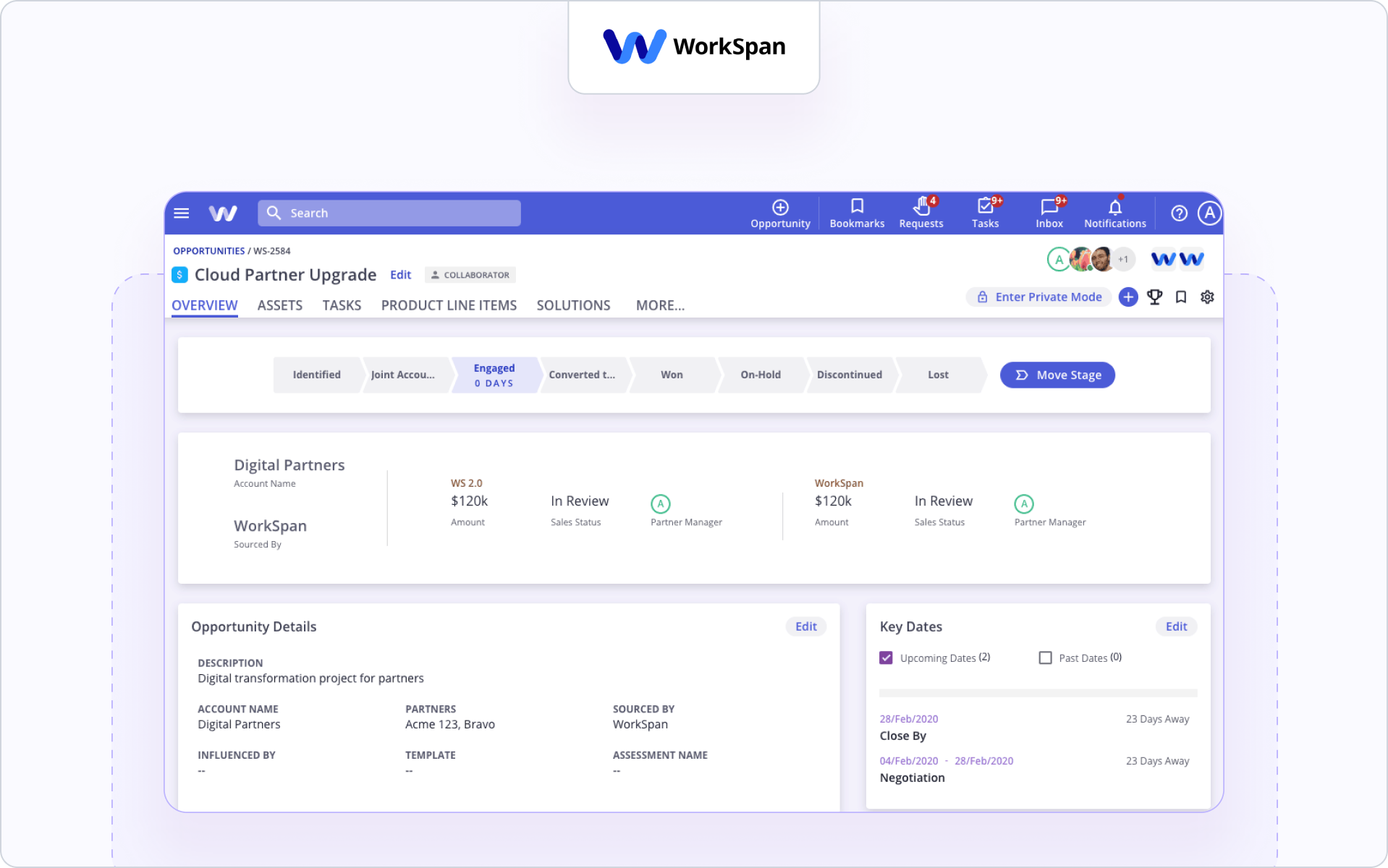

10) WorkSpan

Best for: ISVs pursuing hyperscaler co-sell with AWS, Microsoft, or Google — and running marketplace private offers — who want those processes embedded in Salesforce.

Why it’s an alternative: WorkSpan is purpose-built for co-sell and marketplace operations and ships a Salesforce app to automate referral sharing with AWS ACE and Microsoft Partner Center. If your gap with Salesforce PRM is hyperscaler motion, this is a strong fit.

Callouts: The Hyperscaler Edition supports marketplace listings and private offer workflows and integrates with Salesforce, HubSpot, and Dynamics so alliance teams and AEs can operate from the CRM with real time data.

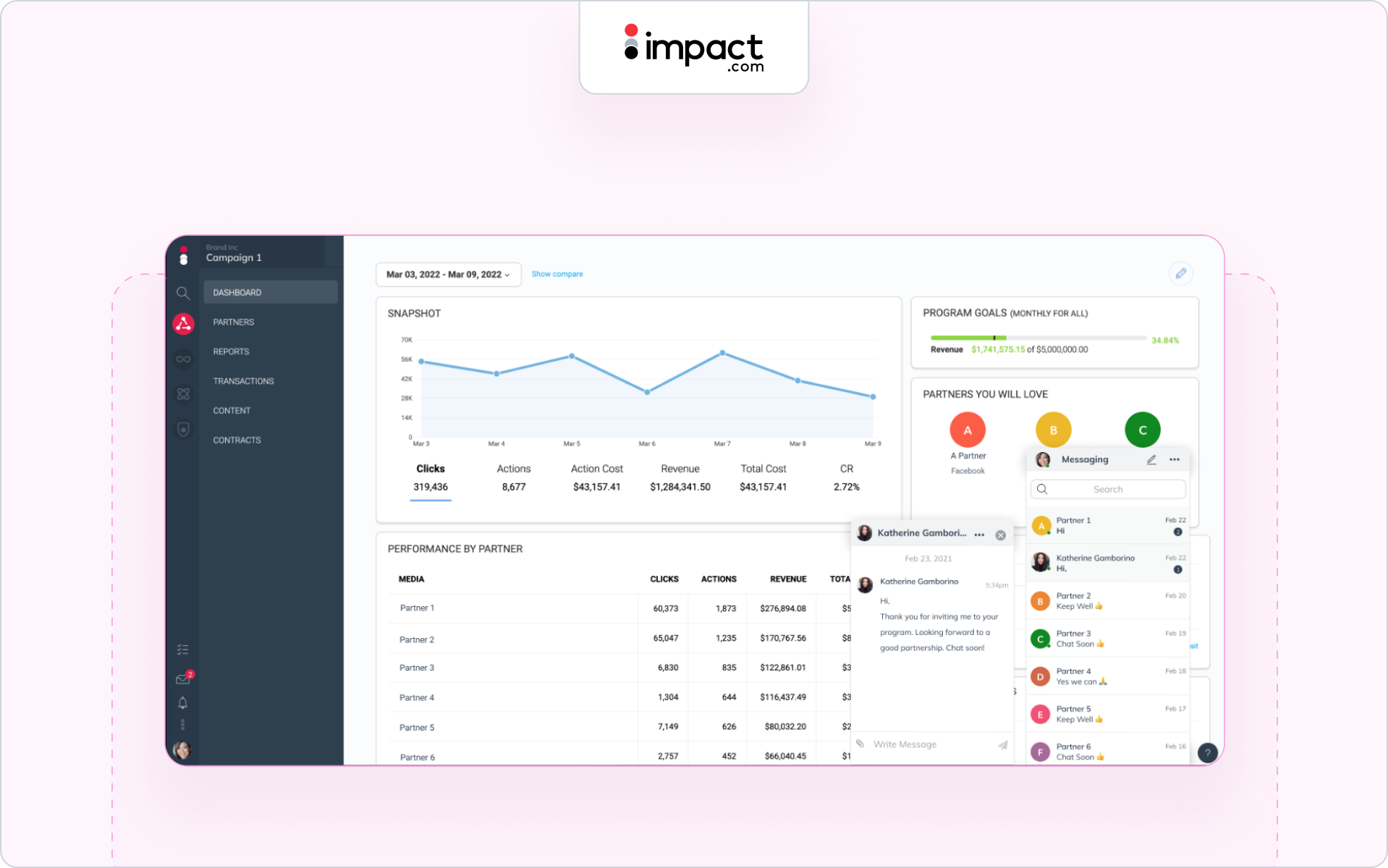

11) impact.com

Best for: Affiliate, influencer, and advocacy programs where discovery, contracting, tracking, and payouts need to live together.

Why it’s an alternative: Rather than bolt affiliate tools onto a PRM, impact.com centralizes the performance side of partnerships and automates contracts and payments. Many B2B brands pair it with CRM reporting to measure influenced revenue.

Callouts: Reviews and third-party roundups repeatedly highlight automation, fraud controls, and reporting — useful if partner marketing is your growth lever.

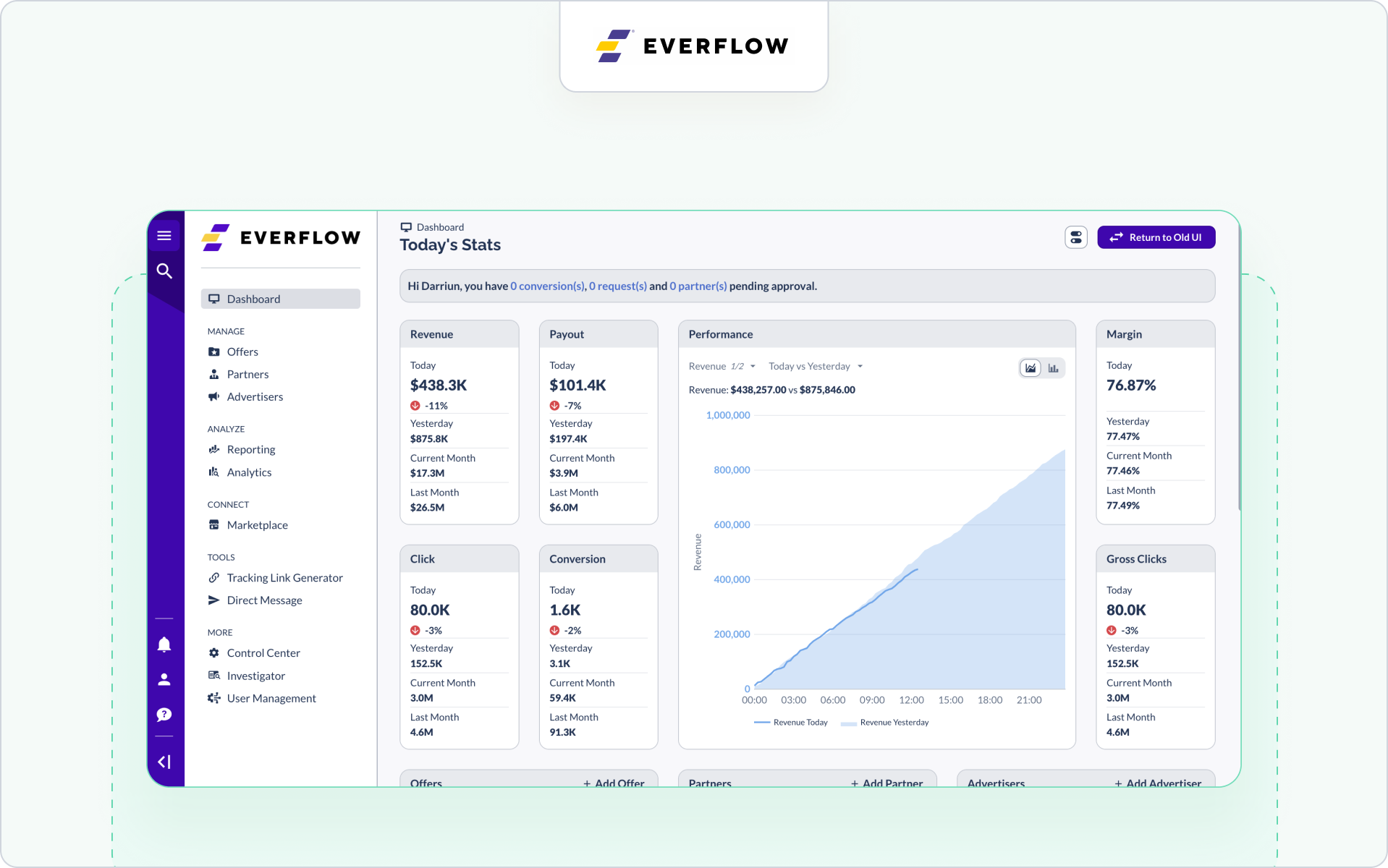

12) Everflow

Best for: Advanced partner and affiliate programs that need granular tracking, analytics, and a white-label experience for agencies or multi-brand portfolios.

Why it’s an alternative: Everflow emphasizes measurement — cross-channel tracking, detailed attribution, and integrations — so you can quantify pipeline and revenue without stitching multiple tools.

Callouts: Independent reviews point to robust analytics, clickless tracking, and marketplace options that help teams scale efficiently and track leads from various industries.

13) TUNE

Best for: Marketers who need a highly customizable partner marketing platform — flexible commissioning, deep tracking, and brandable partner experiences.

Why it’s an alternative: TUNE is known for configurability. If your commissioning logic or partner types do not fit a standard mold, TUNE’s platform can be easier than forcing that complexity into a generic affiliate add-on or a DIY Experience Cloud build.

Callouts: The product’s positioning around flexibility across mobile and web, plus pricing options, makes it an option when you want control more than templates.

14) Partnerize

Best for: Global brands scaling affiliate and partnership channels with AI-assisted optimization.

Why it’s an alternative: Partnerize has invested in AI functionality and data intelligence — helpful for predictive insights in partner recruitment and optimization. If your Salesforce PRM alternative needs performance marketing depth, shortlist this.

Callouts: Public posts underscore ambitions for category growth and an AI-powered roadmap, pointing to continued velocity.

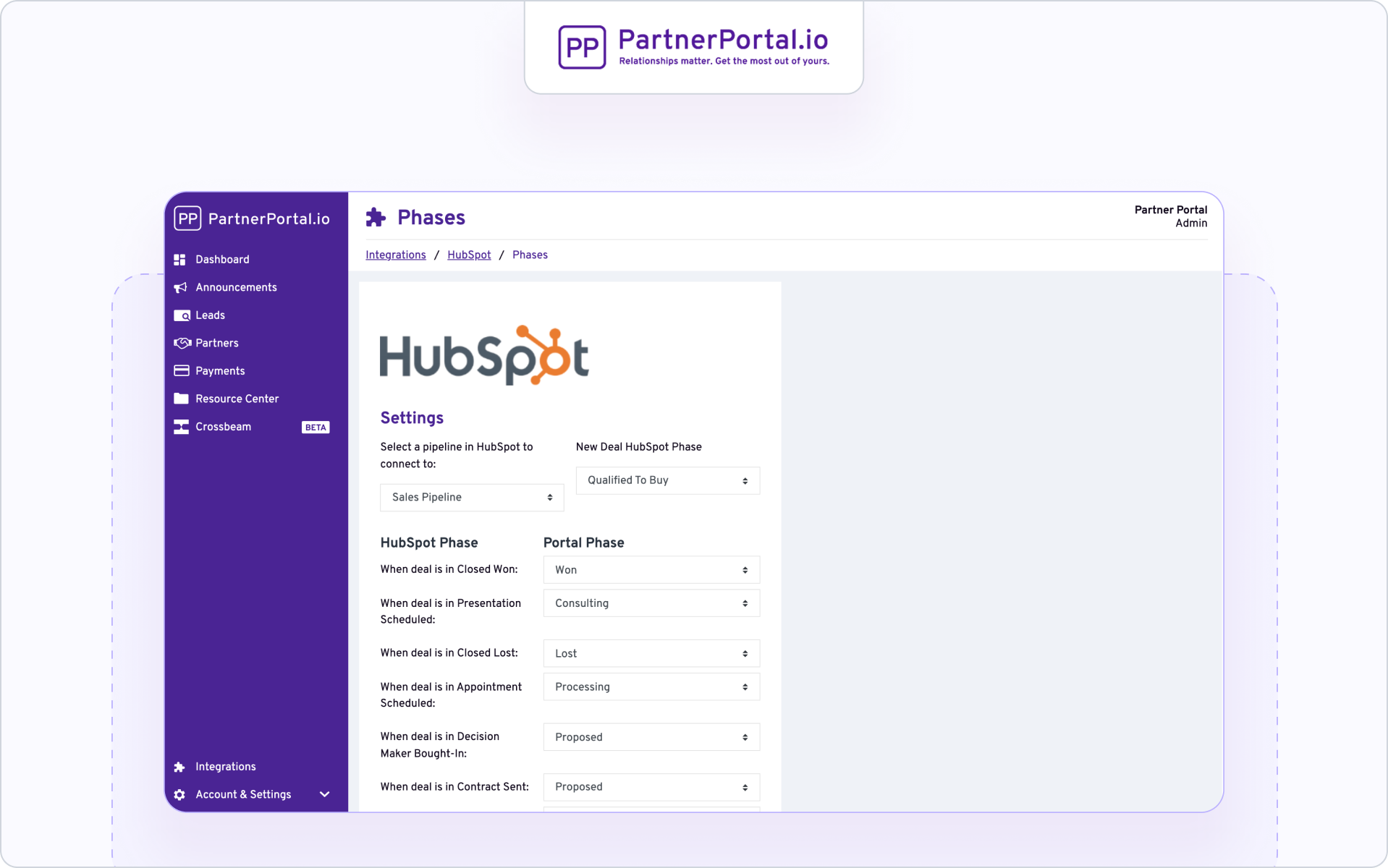

15) PartnerPortal.io

Best for: HubSpot-centric channel managers who want a portal to capture leads and deals, share resources, and push updates — without heavyweight implementation.

Why it’s an alternative: Rather than rolling your own Experience Cloud site, PartnerPortal.io is plug-and-play for HubSpot. Partner-submitted leads can create or link deals, and the product ships a simple resource center and accounting integrations. There is even native Crossbeam support for attribution and account mapping.

Callouts: The marketplace pages show quick deployment, two-way sync, and a focus on keeping everything inside HubSpot — handy for teams trying to avoid net-new systems.

16) Partnero

Best for: Lean partner teams that need low-friction lead submission and simple affiliate or referral flows rather than a full PRM suite.

Why it’s an alternative: Partnero makes it easy to accept partner or public lead submissions through a customizable page and manage the accept or reject workflow — a lightweight way to operationalize referrals without a big build.

Callouts: Product updates highlight continued investment in lead submission, attribution, and payouts — useful when simplicity and speed matter most.

17) RocketPRM (Impulse Creative)

Best for: Organizations that are all-in on HubSpot and want a turnkey PRM built entirely on HubSpot CRM and CMS — no separate platform to administer.

Why it’s an alternative: RocketPRM lives inside HubSpot, so you can keep your existing deal pipeline and manage a partner-facing portal with HubSpot page layouts and forms. If your team wants to avoid juggling another vendor while staying native to HubSpot, this is a clean option.

Callouts: The vendor site and community posts explain the architecture and implementation, emphasizing a HubSpot-only approach that keeps partner data and workflows in one place.

When to stay with Salesforce PRM

Stick with Salesforce Partner Cloud when your GTM is truly Salesforce-only, you want to keep data and AI CRM investments under one roof, and your team can support an Experience Cloud build. Salesforce provides native deal registration, lead distribution, and partner portals within that ecosystem — which can be the most straightforward path if you are standardized on Sales Cloud, Service Cloud, and related platform services that collaborate with other Salesforce products on a single platform.

Switch when you need HubSpot coexistence, faster rollout, off-portal engagement, or hyperscaler co-sell. Those needs are precisely where the alternatives above usually win on time-to-value, partner productivity, and adoption.

Why Introw is your choice in 2026

If your team wants partner relationship management that is fully integrated with your CRM, Introw’s CRM-first approach keeps partners, AEs, and RevOps in one workflow. You can create and manage leads and opportunities, use custom objects where needed, and rely on real time data for tracking deals, attribution, and forecasting.

Off-portal email and Slack let third party partners collaborate without friction; outcome based enablement and a lightweight content management layer help guide partners, share resources, and monitor performance. The result is higher partner productivity, fewer sync issues when managing customer data, and measurable revenue impact across sales, marketing, and service teams — without the overhead of a custom Experience Cloud build. For many businesses, this combination of automation, AI capabilities, and operational efficiency translates to lower total cost and long term success. Book a demo to see for yourself.

.svg)