Blog

Introw Raises $3M to build the future of B2B partnerships

The Ghent-based technology startup Introw, which is already helping 100+ B2B companies to boost sales through partners, has raised $3 million in a new funding round led by Visionaries Club and with the continued support from PitchDrive. Since its launch in 2023, Introw’s AI-powered partner platform has facilitated tens of thousands of partner interactions and helped clients generate millions in additional pipeline.

The company had previously raised €1 million from Pitchdrive and angel investors including Pieterjan Bouten (Ex-Showpad) and Ewout Meyns (Ex-HubSpot).

From Local Studio to International Growth

Founders Andreas Geamanu (CEO), Laurens Lavaert (CTO), and Simon Van Den Hende (Head of AI) started Introw in early 2023, originally incubated by StarApps, the venture studio of serial entrepreneurs Lorenz Bogaert & Nicolas Van Eenaeme, also known as the “Netlog mafia.”

2025 has been a breakthrough year for Introw: the team grew from 4 to 15 people, and revenue quadrupled.

AI-Driven Partner Enablement

Buyers now expect highly personalized experiences, yet outreach fatigue and tighter privacy regulations have made it harder for direct sales teams to cut through the noise. That’s why an increasing number of companies are turning to partner sales (indirect sales) as these already have relationships, credibility, and access to customers.

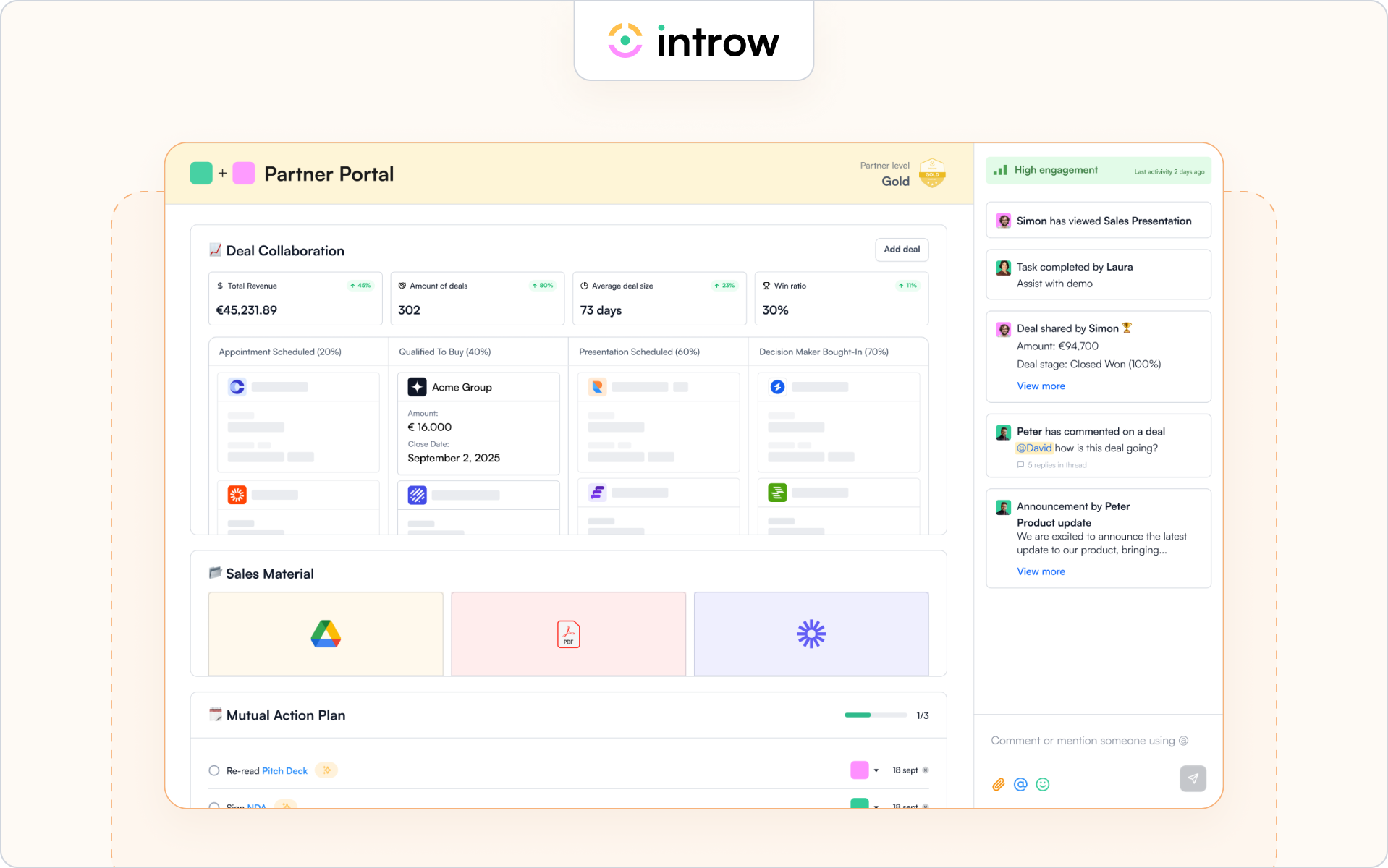

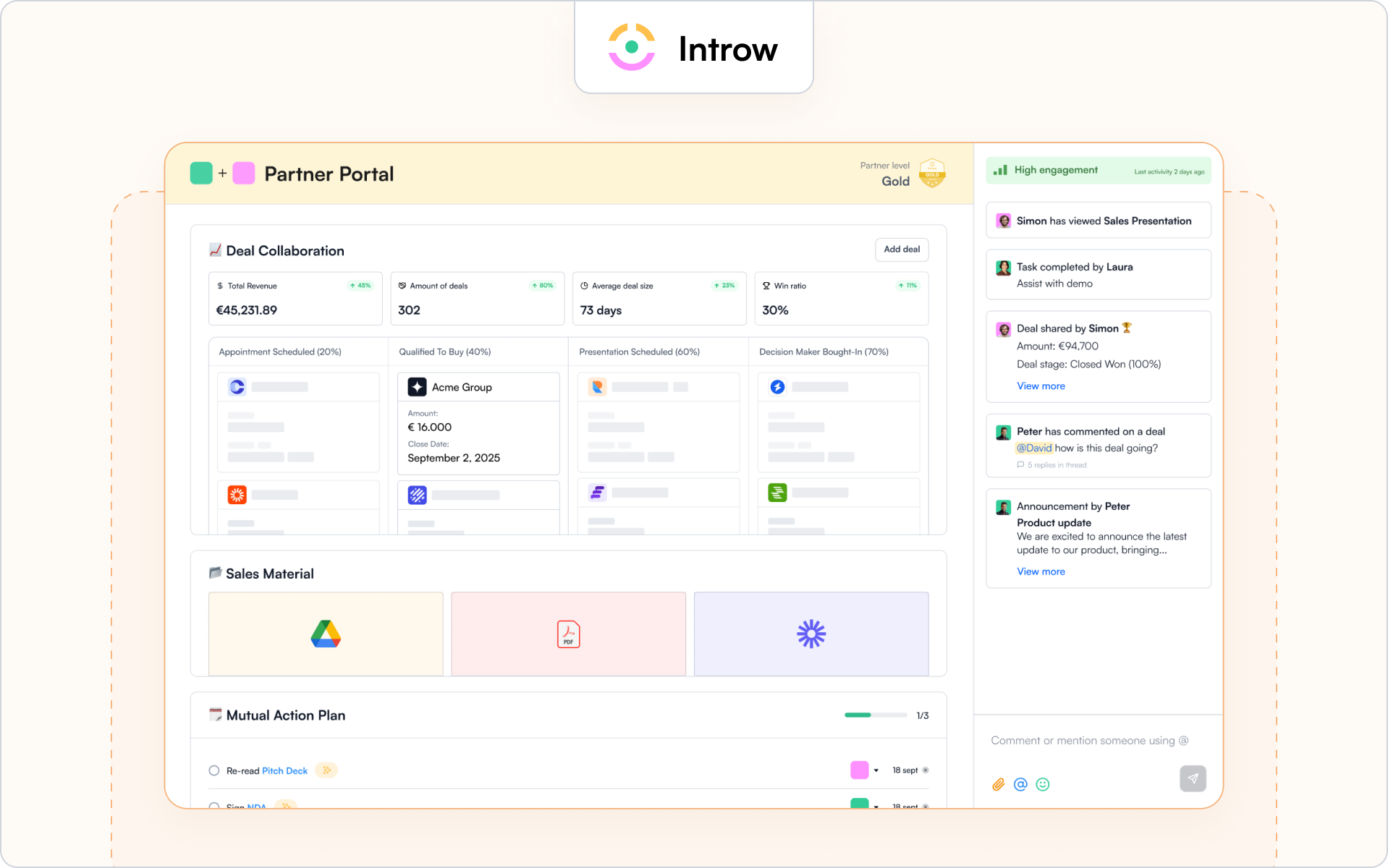

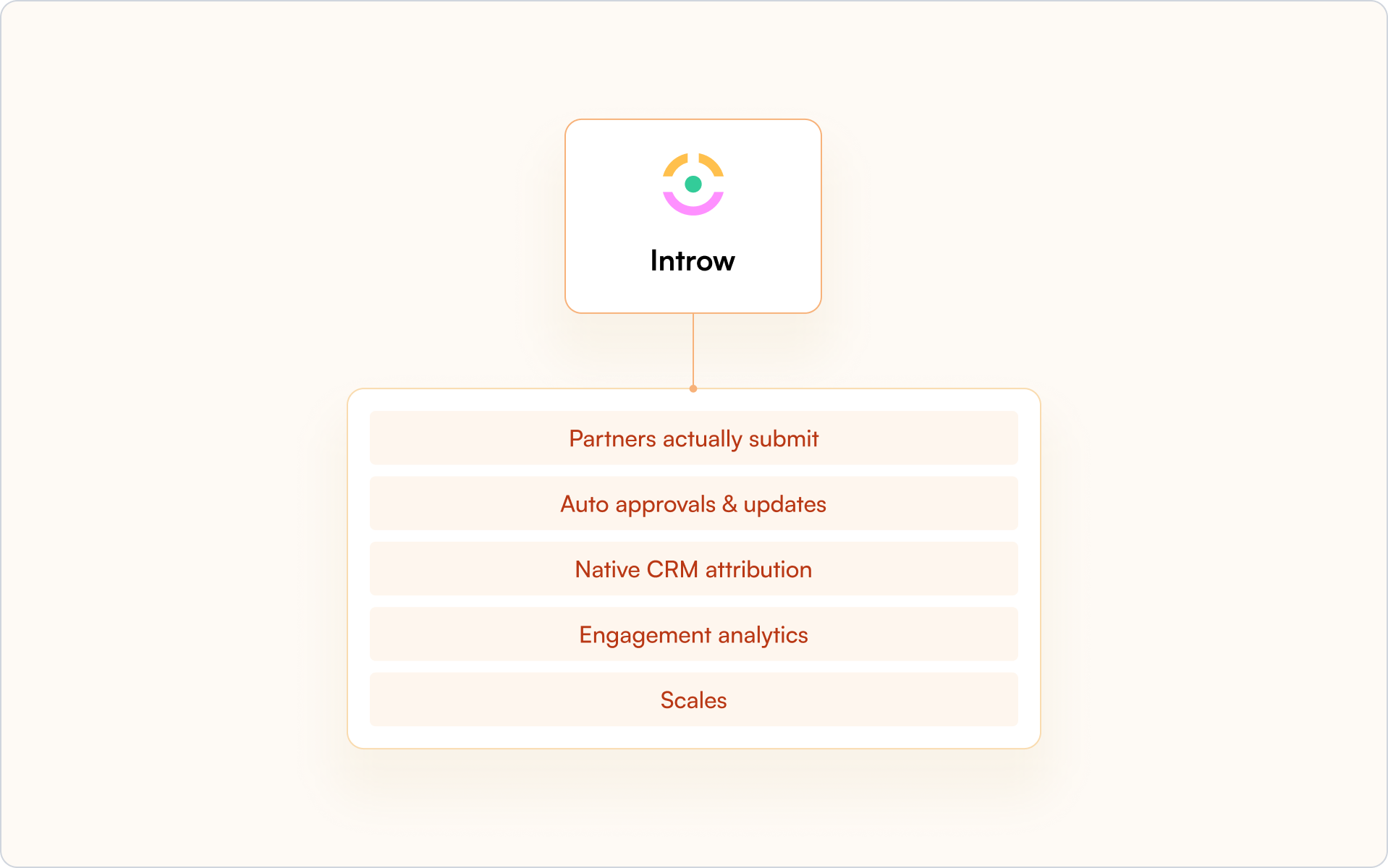

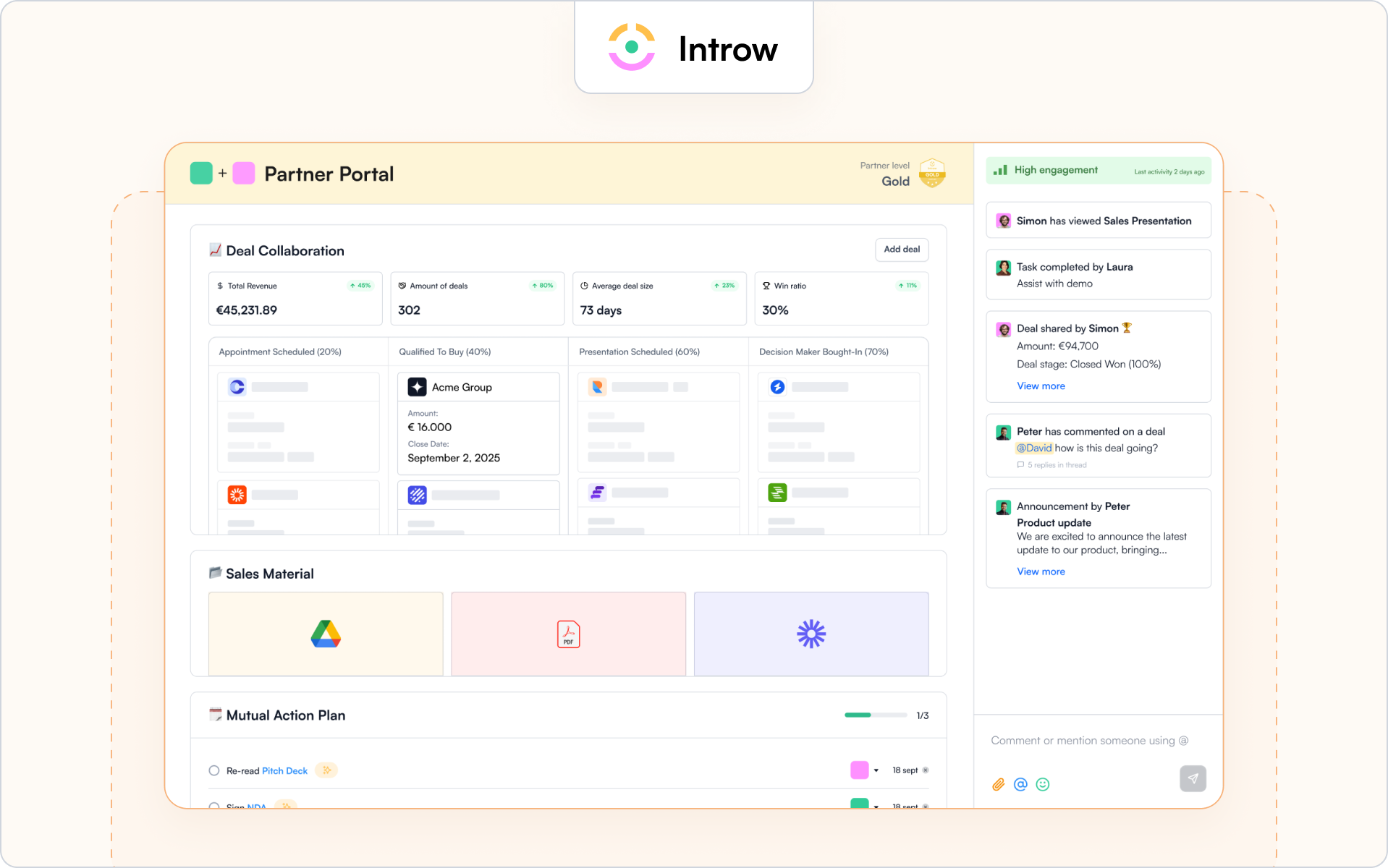

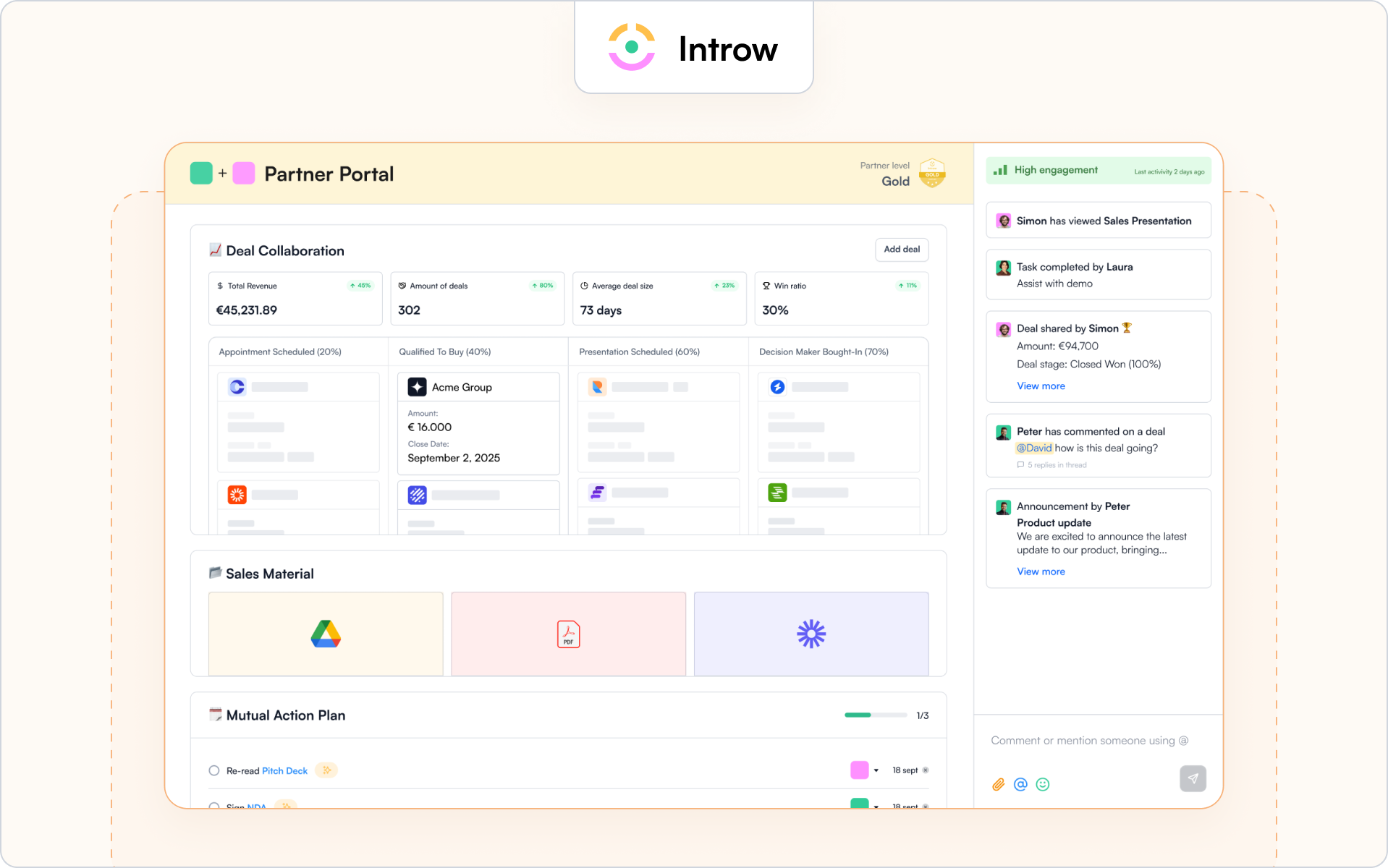

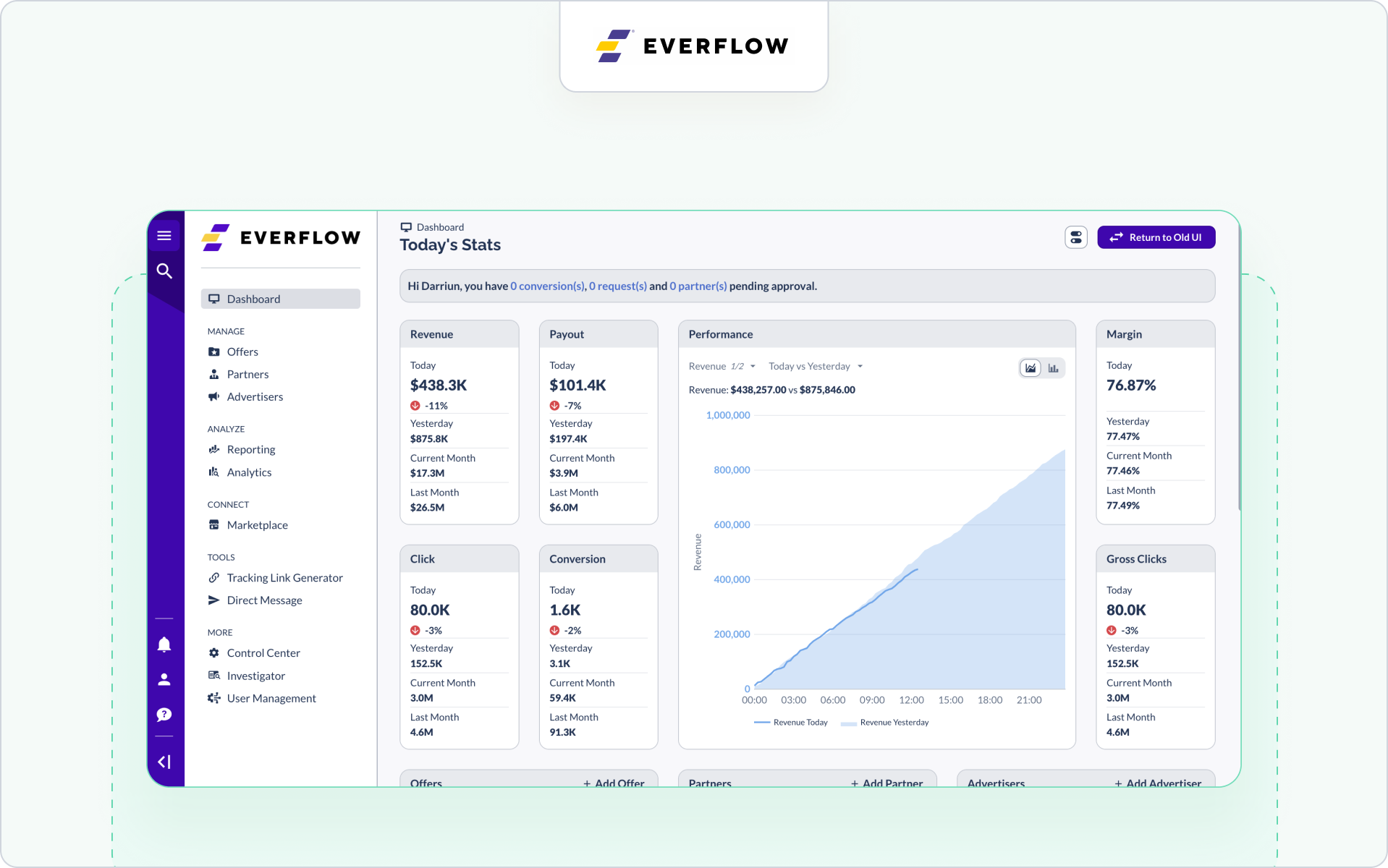

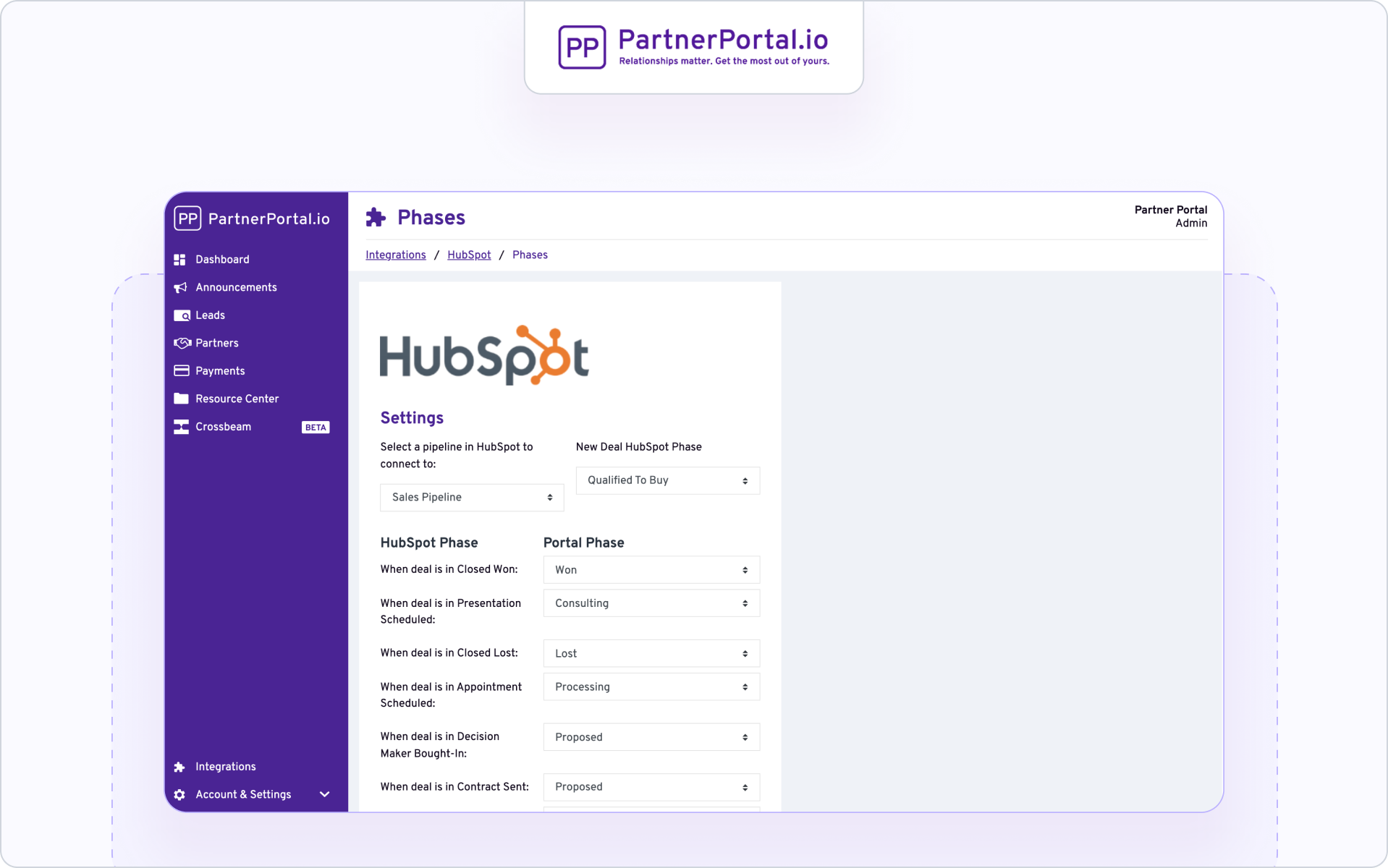

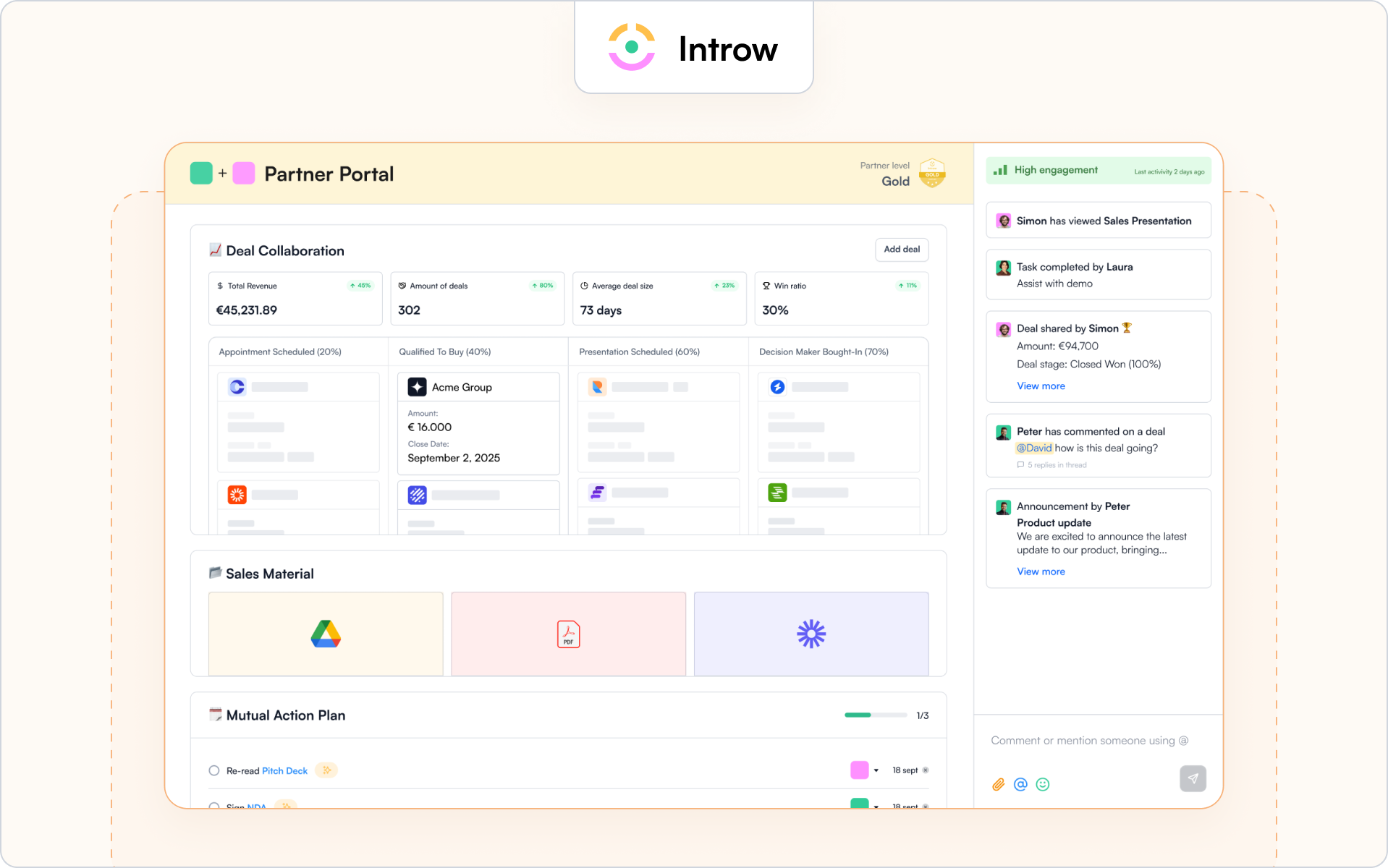

Introw’s AI-powered partner portal enables companies to onboard, train, and activate partners in minutes. Unlike legacy systems that take months to deploy, Introw connects instantly to your CRM, giving partners access to customer data, and sales tools to close more deals.

“Each day a partner lacks the right information, means lost revenue. Where other partner portals take four to six months to launch, we do it in minutes.” says CEO Andreas Geamanu.

Visionaries Club Backs a Fast-Growing Success Story

Visionaries Club, which previously invested in tech companies such as Lovable, n8n, and the Belgian Accountable (recently acquired by Visma), sees huge potential in Introw.

Partnerships drive a huge share of global B2B revenue, yet most teams still manage them with spreadsheets and outdated tools. Introw is changing that with a platform built for speed and simplicity.” said Robert Jäckle, Partner at Visionaries Club. “The team is creating the first truly intelligent partner system, turning partnerships from a ‘nice-to-have’ into a real growth engine. We’re backing them because they move fast and have the ambition to own this category

Becoming the Market Leader in Partner Enablement

A large share of Introw’s revenue already comes from the US, where the company is seeing accelerating traction. With this new funding, Introw is scaling its sales and marketing presence and doubling down on its AI-first vision.

The mission is clear: To become the global leader in AI-driven partner enablement and redefine how companies grow through partners.

About Introw

Founded in 2023 and based in Ghent, Introw is redefining how companies sell through partners. The platform empowers B2B organizations to onboard, train, and enable their partners globally through an AI-powered partner portal.

By deeply integrating with a company’s CRM, Introw enables seamless collaboration between internal sales teams and external partners, ensuring everyone has access to the right data, context, and tools to close deals faster.

Already used by 100+ companies across more than 30 countries such as Factorial, Parloa & Coder, Introw helps organizations transform partnerships into a scalable revenue engine.

About Visionaries Club

Visionaries Club is a leading European early-stage VC with offices in London and Berlin, focusing on B2B with its flagship seed and early-growth funds, alongside its industrial deeptech fund, Visionaries Tomorrow. Visionaries unites the strongest network of successful tech founders together with the family entrepreneurs behind global industrial businesses in a single LP community to supercharge the next generation of category-defining software and AI giants. It counts Personio, Lovable, Miro, Pigment, Accountable, n8n, Tacto, Apron, Choco and Xentral among its portfolio companies.

(Fun)ding video

We love building and hustling, but we also love to have some fun. Enjoy the video (powered by Hooked Visuals) 😜.

The 4 ways to manage your B2B partners in Salesforce and attribute revenue

When working with B2B partners, it's important to have a clear way of tracking who’s involved in your opportunities and how they contribute to revenue. In Salesforce, there’s no one-size-fits-all method — and that’s the beauty of it. Depending on your organization’s needs, technical maturity, and the complexity of your partner ecosystem, you can choose from several flexible approaches.

Below, we break down 4 common ways to manage partners in Salesforce and attribute revenue to them effectively.

1. Picklist field on an Opportunity

Best for: Simpler programs with one partner per Opportunity

The most straightforward method is to add a picklist field to the Opportunity object — for example, a field called Partner Name or Partner Source. You pre-define a list of your partners and let your sales team select the right one during opportunity creation.

How does it work?

What are the pros?

✅ Easy to implement

✅ No complex relationships needed

✅ Good for easy single-partner attribution

What are the cons?

❌ Not ideal for scaling or multi-touch attribution

2. Lookup field to an Account object Recommended

Best for: One-to-one attribution with better data control

A step up from a picklist is using a lookup relationship field that connects an Opportunity to an Account object. This allows you to reference a full account record (your partner) and pull in relevant details automatically.

How does it work?

What are the pros?

✅ Clean reference to partner data being stored in your accounts

✅ Can support reporting and automation more effectively

✅ Easy to update if the Account record changes

What are the cons?

❌ Limited to one partner account per opportunity

3. Via a Relation table

Best for: Multi-partner attribution or shared deals

If you need to support multiple partners per opportunity, you’ll want to use a relation table that sits between Opportunities and Partner Accounts. This creates a many-to-many relationship, enabling flexible collaboration and advanced revenue sharing logic.

How does it work?

What are the pros?

✅ Ideal for ecosystems with resellers, distributors, and co-marketing partners

✅ Enables advanced logic for revenue splits or co-selling

✅ Ideal for ecosystems with resellers, distributors, and co-marketing partners

What are the cons?

❌ Requires a more technical setup and configuration

❌ More complex for reporting unless standardized

4. Custom Object for Partners

Best for: Large-scale partner programs with tiering, statuses, and multiple partner touchpoints

For organizations that want to treat their partners as a core part of the Salesforce data model, creating a dedicated Partner object is the most robust option. You can relate this object to Opportunities, Contacts, Accounts, and more — and track custom partner attributes like tier, region, industry focus, etc.

How does it work?

What are the pros?

✅ Fully flexible and scalable

✅ Allows for richer partner data and automation

✅ Better suited for partner performance analytics and program insights

What are the cons?

❌ Requires upfront planning and schema design

❌ Needs buy-in from operations and potentially dev teams

Conclusion

Choosing the right method to manage and attribute your B2B partners in Salesforce depends on the complexity of your partnerships and the level of reporting or automation you need. While simple picklists work for early-stage programs, relation tables or custom objects are better suited for mature ecosystems.

At Introw, we help customers integrate their partner workflows directly into Salesforce — making it easy to attribute, collaborate, and scale with partners, no matter which method you use.

👉 Curious how this would work in your setup? Request a demo now.

Latest articles

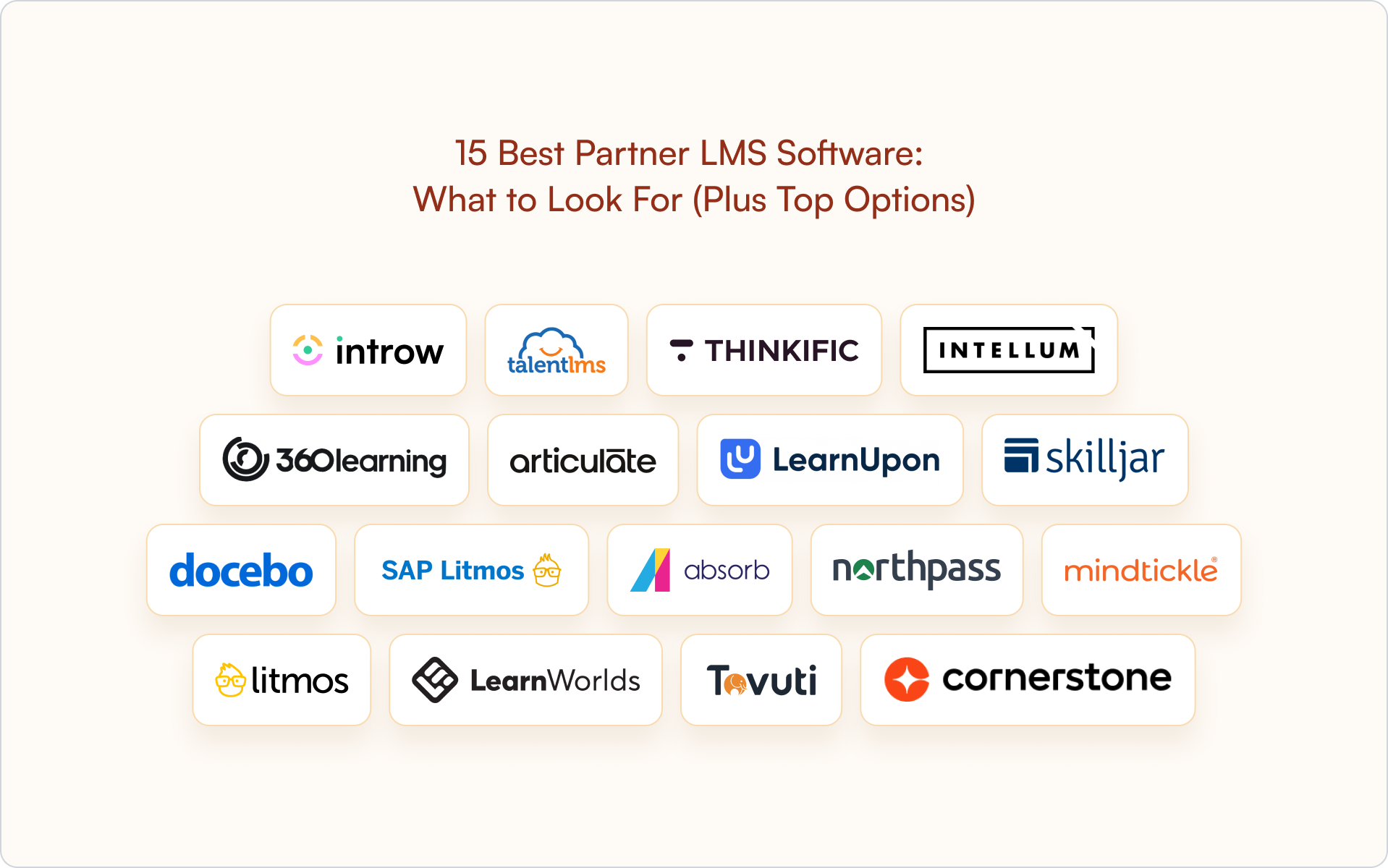

Partner LMS Software: The Top 15 Options and What to Look For in 2026

Imagine that your learning system is built for your external partners. You can speed up partner onboarding, boost partner engagement, and clearly connect training to real partner performance.

So, instead of investing heavily in partner training, you'll be able to see who’s enabled, certified, or actually ready to sell.

To understand what makes that possible, it helps to first clarify what partner LMS software actually is, and why it’s fundamentally different from an employee LMS.

Partner LMS Software - What It Is (and Why It’s Different)

Partner LMS software is a learning management system built specifically for partner training.

It helps SaaS teams:

- onboard external partners faster,

- deliver partner education at scale, run certification programs,

- and track partner progress in a way that supports real partner performance and business growth.

Unlike employee training, partner training has to work across a distributed partner network with different partner tiers, regions, and goals.

That’s why modern partner training LMS software is often part of a broader partner enablement strategy, working hand in hand with partner relationship management software to support long-term partner performance.

The difference becomes clearer when you compare it directly:

For teams comparing the best partner training LMS software, this list focuses on what actually matters in a partner LMS tool, not generic employee training features.

The 15 Best Partner LMS Software Options (2026)

When you’re choosing partner LMS software for your business, you’re not trying to pile on features. What you want is a system your partners will actually use.

Here’s the selection we put together to help you compare the options and see which ones might fit how your team works.

1. Introw Partner LMS (Best for CRM-first SaaS partner programs)

Introw's Partner LMS is designed for B2B teams that want partner training, certification programs, and partner engagement to directly support partner performance and revenue, not live in a disconnected learning management system.

Best for:

Teams using Salesforce or HubSpot that need fast external training, clear certification management, and visibility into partner progress tied to pipeline.

Why it stands out:

Introw focuses on speed, relevance, and real adoption. Instead of building training programs from scratch, an AI agent turns your existing website content, partner portal docs, or sales materials into structured courses in minutes. You can see this flow in the feature walkthrough.

Key features:

- AI-powered course creation with modules, quizzes, and assessments

- One-click certification tools to ensure only certified partners sell specific solutions

- Bulk partner enrollment by partner tier, region, or partner group

- Automated reminders and announcements via email and Slack, for example: “Company X has enrolled you in Advanced Product Training 2026.”

- Progress tracking and engagement data aligned to deals and partner performance

Keep in mind:

Introw works best when partner training, partner enablement, and partner engagement are part of the same CRM-first motion.

Integrations:

Native integrations with Salesforce, HubSpot, and Slack, with partner LMS data flowing into the wider Introw platform.

Learn more: Explore the Partner LMS or request a demo.

2. TalentLMS

TalentLMS is a learning management system often used as partner training software by teams that want to deliver external training without a steep learning curve. It’s typically chosen for straightforward partner onboarding and partner education.

Best for:

SMB to mid-market teams that need a simple way to run partner training programs, sales training, and basic certification programs.

Why it stands out:

TalentLMS is easy to use and quick to set up. Teams can create courses, organize training materials, and deliver on-demand training with minimal administration.

Partner training features:

- Separate learning spaces for different partner groups

- Course creation for product knowledge and sales training

- Certifications, assessments, and progress tracking

Keep in mind:

TalentLMS handles training delivery well, but deeper CRM visibility and advanced partner performance analytics usually sit outside the platform. This is often where teams start thinking more about partner engagement beyond training alone.

3. Thinkific

Thinkific is a platform often used to package partner education into branded academies and certification hubs. It’s sometimes chosen as partner training software when the focus is on presentation and structured learning experiences rather than deep partner operations.

Best for:

Product-led or marketing teams building partner academies, certification tracks, or external training portals.

Why it stands out:

Thinkific offers polished course and landing page experiences, with built-in support for cohorts, quizzes, and certificates.

Partner training features:

- Course creation for partner education and product knowledge

- Certificates and assessments

- Community and cohort-based learning

Keep in mind:

Thinkific is oriented toward external education. Advanced partner onboarding workflows, CRM attribution, and partner performance tracking typically require add-ons or integrations.

4. Intellum

Intellum is an enterprise learning platform used for large-scale customer and partner education programs. It’s designed to support complex training delivery across broad partner ecosystems.

Best for:

Enterprise teams running structured partner training programs at scale.

Why it stands out:

Intellum offers robust learning experiences, advanced analytics, and extensibility for complex training environments.

Partner training features:

- External audiences and partner portals

- Certification programs and events

- Reporting tools for training effectiveness

Keep in mind:

Intellum is an enterprise-grade system. Implementation effort and CRM alignment for partner performance should be evaluated early.

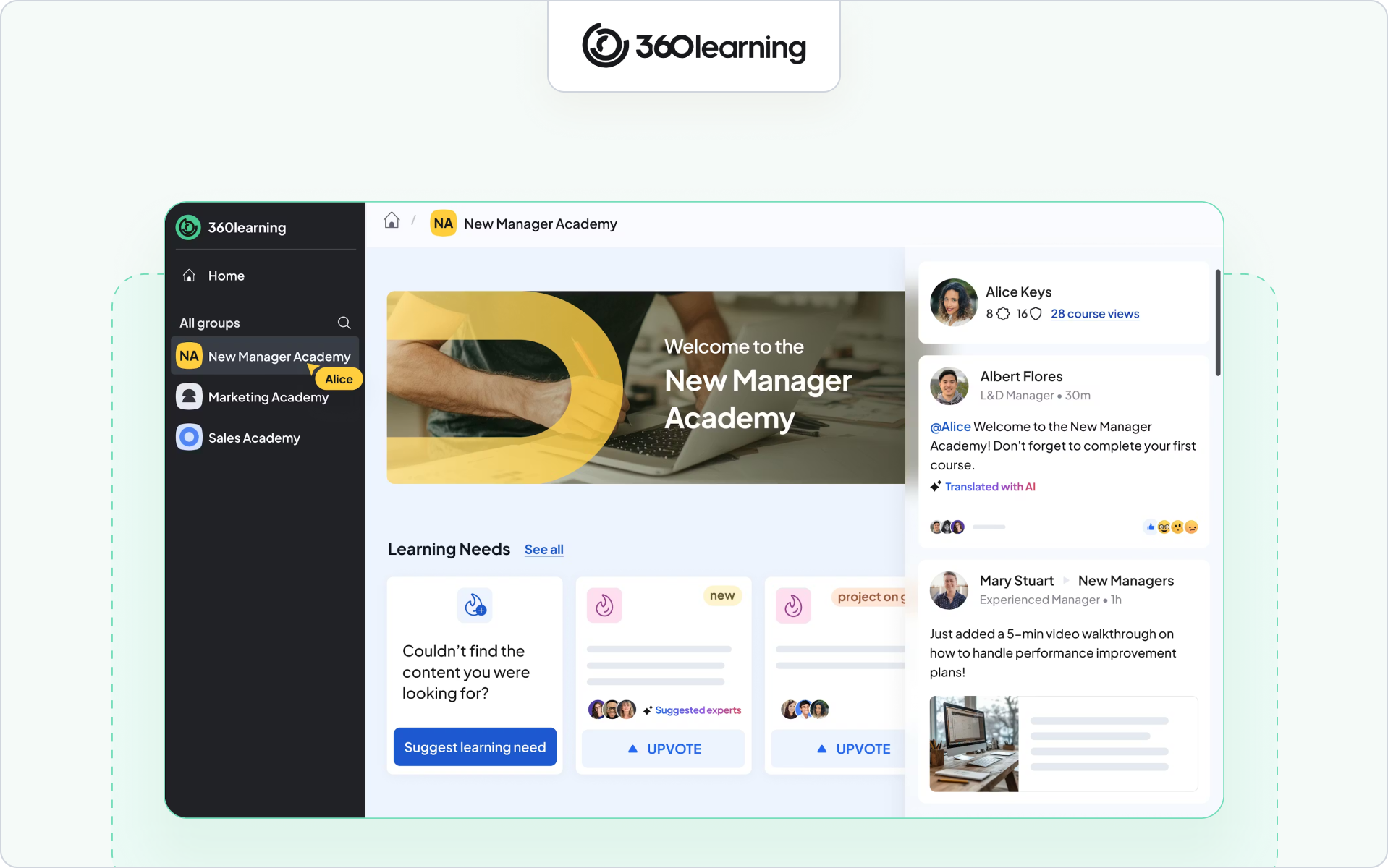

5. 360Learning

360Learning focuses on collaborative and peer-driven learning. It’s sometimes used for partner enablement training where shared knowledge and social learning matter.

Best for:

Teams that want partners to co-create content and learn from each other.

Why it stands out:

360Learning emphasizes social learning, peer reviews, and collaborative course creation.

Partner training features:

- External partner groups

- Certifications and blended learning

- Social and peer-generated content

Keep in mind:

The collaboration-first model works best with clear governance, especially when applied to external partners.

6. Articulate 360

Articulate 360 is a content creation suite rather than a full learning management system. It’s often paired with partner training software to build rich courses.

Best for:

Teams that want to author high-quality SCORM or xAPI training content.

Why it stands out:

Articulate’s tools, like Storyline and Rise, are widely used to create responsive, interactive training materials.

Partner training features:

- Advanced course creation for product knowledge and sales training

- SCORM and xAPI support

Keep in mind:

Articulate handles content creation only. You’ll need a separate LMS to deliver training, manage certifications, and track partner progress.

7. LearnUpon

LearnUpon is an LMS designed for extended enterprise use, including customer and partner training. It’s often used when teams need clear admin controls across audiences.

Best for:

Teams training customers and partners through structured portals.

Why it stands out:

LearnUpon offers a clean interface and multi-portal setup for different audiences.

Partner training features:

- Separate learning portals for partner groups

- Learning paths and certifications

- Reporting on training delivery and progress

Keep in mind:

For teams focused on channel sales performance or CRM-level partner analytics, integration depth should be reviewed.

8. Skilljar

Skilljar is a platform focused on customer and partner education, often used by teams running structured certification and compliance-driven training programs.

Best for:

Teams that need to deliver partner education at scale with an emphasis on certifications and reporting.

Why it stands out:

Skilljar is purpose-built for external training and offers strong APIs and analytics for education programs.

Partner training features:

- External partner portals

- Certification programs and badges

- Reporting tools for training effectiveness

Keep in mind:

Skilljar focuses on education delivery. Partner engagement flows and CRM-level partner performance tracking may require additional integrations.

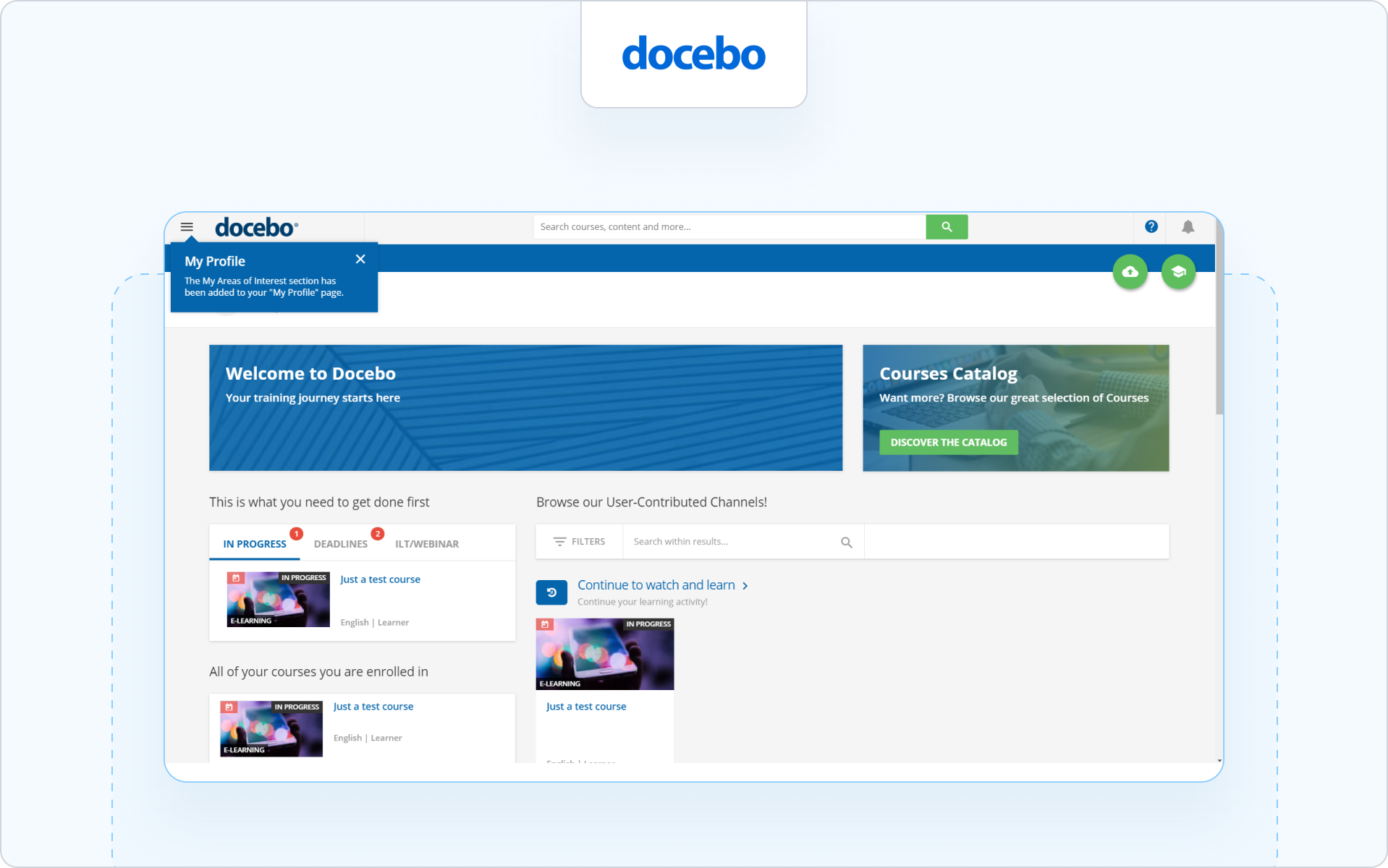

9. Docebo

Docebo is an enterprise learning management system used for extended enterprise training, including customers and partners. It’s sometimes selected as partner training software for large, global programs.

Best for:

Enterprise organizations managing complex partner training programs across regions.

Why it stands out:

Docebo offers AI-assisted content curation and a broad ecosystem of integrations.

Partner training features:

- Multi-audience portals for external partners

- Certification management and automation

- Advanced analytics and reporting

Keep in mind:

Implementation can be complex. Teams should validate CRM alignment and partner performance visibility early.

10. Litmos

Litmos is an LMS commonly used in compliance-heavy environments with large partner networks.

Best for:

Organizations that need consistent training delivery and compliance tracking for global partners.

Why it stands out:

Litmos offers compliance tooling, assessments, and a large off-the-shelf content library.

Partner training features:

- External learners and partner groups

- Certifications and assessments

- Reporting on training completion

Keep in mind:

User experience can feel more traditional. Partner segmentation and engagement flexibility should be reviewed.

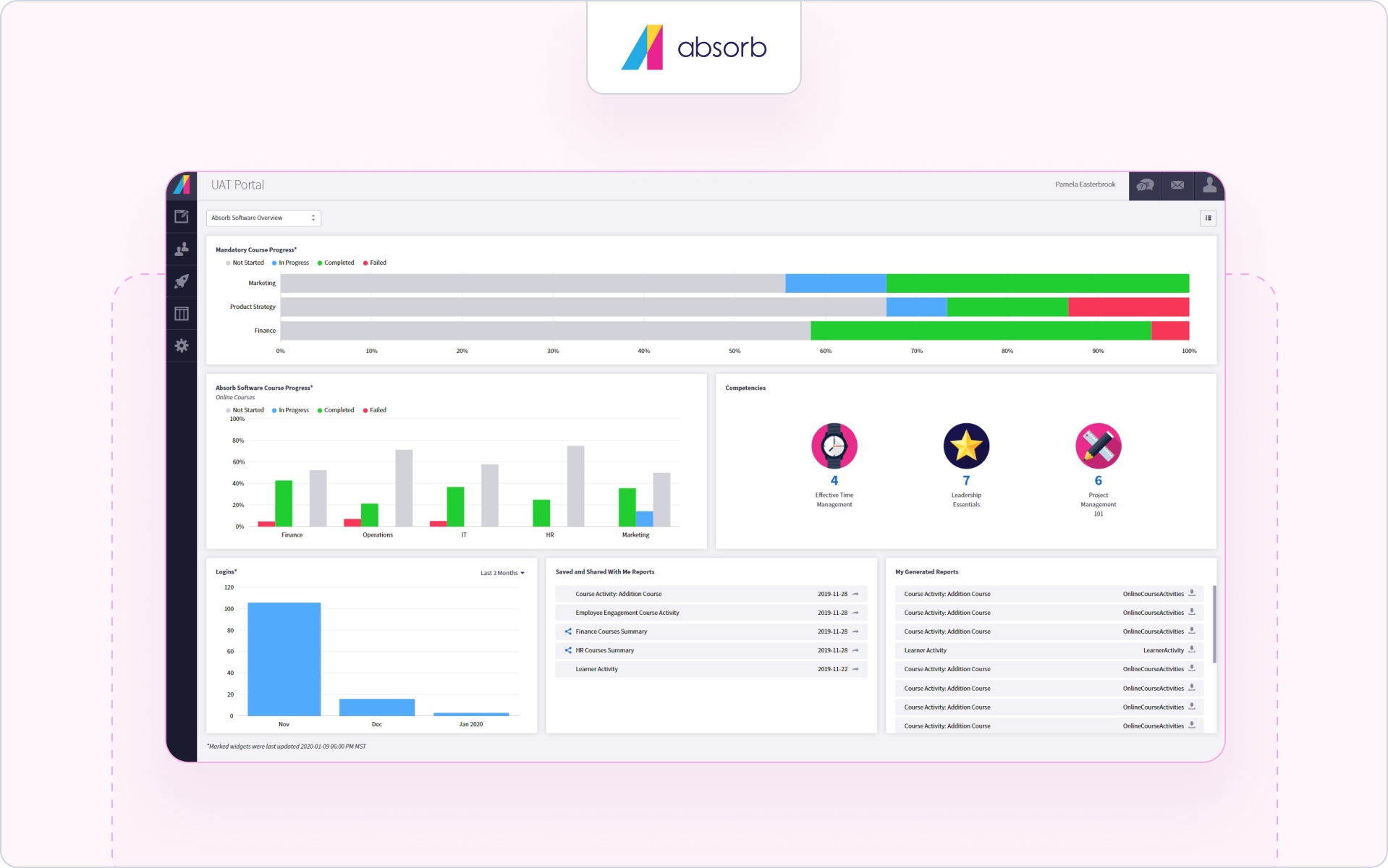

11. Absorb LMS

Absorb LMS is an LMS designed for extended enterprise training, including partner and customer education.

Best for:

Teams that want flexible portals and strong reporting across external audiences.

Why it stands out:

Absorb LMS combines configurable learning portals with solid analytics and automation options.

Partner training features:

- Multi-tenant portals for partner groups

- Certification programs and automation

- Reporting on progress tracking and training delivery

Keep in mind:

Engagement outside the LMS, such as email or Slack-based updates, may require integrations.

12. Mindtickle

Mindtickle is a sales readiness platform sometimes used for partner enablement training, particularly when the focus is on sales execution rather than broad partner education.

Best for:

Teams focused on partner sales readiness, pitching, and certification tied to sales motions.

Why it stands out:

Mindtickle emphasizes coaching, role-play, and readiness scoring to support sales performance.

Partner training features:

- Partner sales tracks and certifications

- Content, practice, and assessments

- Readiness scoring and coaching workflows

Keep in mind:

Mindtickle is readiness-first. Most teams pair it with a PRM or LMS to cover broader partner onboarding and operations.

13. LearnWorlds

LearnWorlds is a platform designed for external education, often used to build branded academies and certification hubs.

Best for:

Teams that want to launch partner education programs with strong branding and optional monetization.

Why it stands out:

LearnWorlds offers flexible course creation, interactive content, and polished learning experiences.

Partner training features:

- Course creation for partner education and product knowledge

- Certifications, assessments, and learning paths

- Branded portals for external partners

Keep in mind:

Partner-specific governance, segmentation, and CRM visibility typically require additional setup or integrations.

14. Cornerstone Customer & Partner LMS

Cornerstone Customer & Partner LMS supports customer and partner training through branded external learning experiences designed to scale across regions, audiences, and partner ecosystems.

Best for:

Large enterprises that already use Cornerstone and want to extend customer and partner training through branded external learning experiences.

Why it stands out:

Cornerstone focuses on scalable external learning with strong governance, making it easier to manage training across complex partner ecosystems and regions.

Partner training features:

- Branded external learning portals for partners and customers

- Certifications, assessments, and structured learning journeys

- Reporting and analytics across large partner networks

Keep in mind:

Cornerstone is built for enterprise scale. Setup and customization can require more time, and teams should closely evaluate partner user experience during implementation.

15. Tovuti LMS

Tovuti LMS is a flexible learning management system used for customer and partner training, with an emphasis on configurable learning experiences rather than rigid workflows.

Best for:

Teams looking for a customizable LMS to support partner training programs, partner onboarding, and external training without enterprise-level complexity.

Why it stands out:

Tovuti offers a wide range of configuration options for courses, portals, and learning experiences, making it easier to adapt training to different partner groups and use cases.

Partner training features:

- Branded learning portals for external partners

- Course creation, assessments, and certifications

- Learning paths and engagement features

Keep in mind:

Tovuti provides flexibility, but teams should assess how well reporting, CRM visibility, and partner performance tracking align with their broader partner operations.

There’s no single best partner LMS software for every team. What matters is choosing a system that fits how your channel actually works, not just how training looks on a feature list.

The next section breaks down the must-have evaluation criteria SaaS teams should focus on when comparing partner LMS software, from course creation and certifications to engagement and CRM visibility.

Must-Have Evaluation Criteria (SaaS Channel POV)

When you’re narrowing down partner LMS software, this is usually where the decision becomes clearer.

Beyond feature lists, what matters is whether a system can support partner training at scale, fit into your existing setup, and keep working as your partner ecosystem grows, especially for channel partner training.

The table below reflects how SaaS teams typically evaluate partner LMS tools when comparing options like a channel partner LMS or the best partner training LMS software for their model.

Taken together, these criteria make it easier to compare a partner LMS, a training partner LMS, or the best LMS for partner training without over-indexing on features that won’t matter long term.

When the foundation is right, partner training supports partner knowledge, partner credibility, and partnership marketing instead of sitting in a silo.

After reviewing the criteria, it becomes easier to see why some teams look beyond a standalone learning management system and choose a platform built specifically for partner learning.

Why Teams Choose Introw for Partner Learning (in 90 Seconds)

Create partner learning without slowing teams down

Most teams already have the right content; it’s just spread across websites, docs, and partner portals.

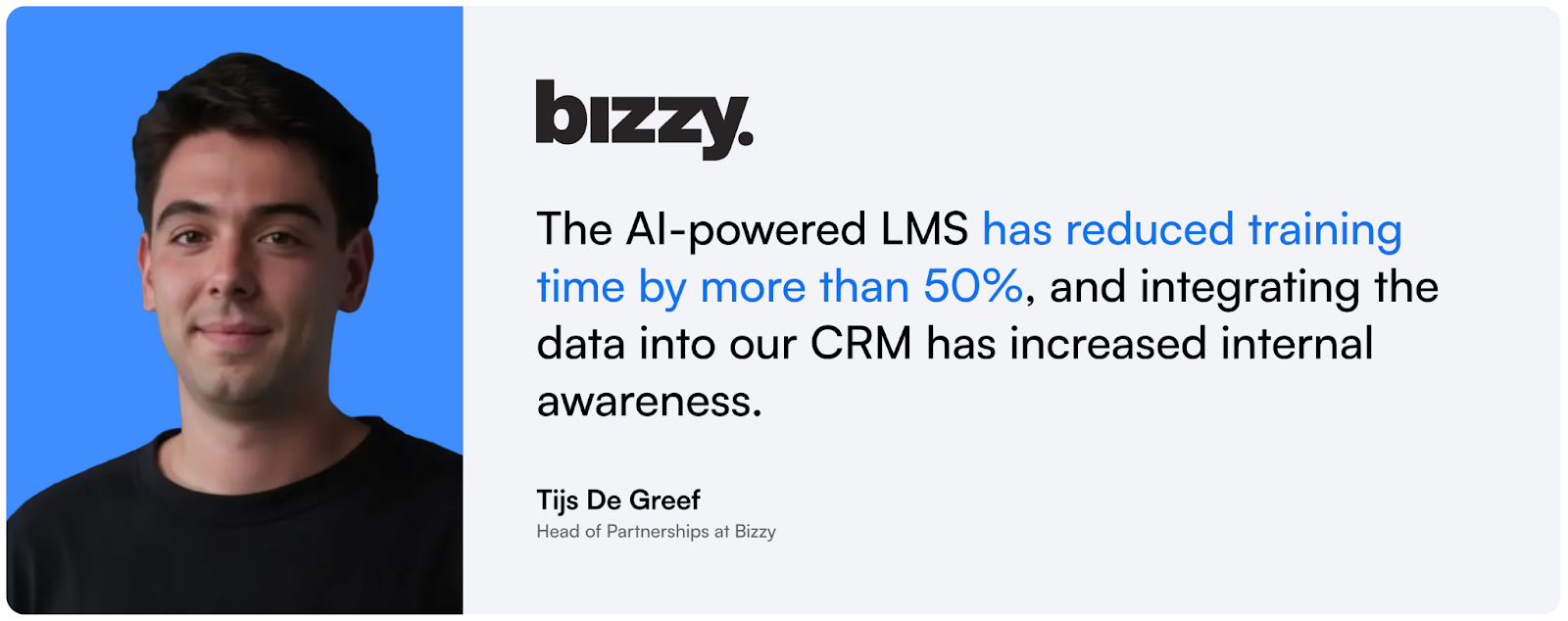

Teams like Factorial moved away from manually rebuilding training by turning existing materials into structured courses with modules and quizzes, making it easier to launch and update partner learning as the business evolves.

Use certifications to protect quality, not add friction

Introw supports certificates, expirations, and gated tracks so advanced training and selling motions stay aligned with partner readiness.

Enroll the right partners at the right time

With Introw, teams can segment partners by type, tier, or region and enroll them in bulk, keeping training relevant without adding operational overhead.

Keep partners engaged without another portal to check

One of the biggest blockers to partner learning is relying on portals that partners don’t visit regularly.

Cubbit and Factorial saw stronger adoption once training communication moved into channels partners already use, with announcements and reminders delivered through email and Slack instead of another login.

Connect learning to what matters

Training becomes far more useful when it doesn’t live in isolation. For teams like Coder, visibility into which partners were trained and ready to co-sell was essential.

By aligning course completion and certification data with Salesforce or HubSpot, Introw helps teams understand partner readiness in the context of pipeline and revenue.

If you’re at the point of making a decision, a few simple next steps can help bring everything together:

- Map your current gaps

Look at where partner learning slows down today, whether that’s course creation, partner onboarding, engagement, or visibility into partner readiness. - Pressure-test your criteria

Revisit the evaluation criteria above and shortlist the capabilities that matter most for your partner ecosystem, not just what looks good on a feature list. - See the workflow end-to-end

Before committing, make sure you understand how partner learning fits into your existing CRM, partner operations, and revenue motion.

Now it's time for you to see how this works in practice.

Request a demo and walk through the partner learning flow end-to-end.

16 Deal Registration Software Platforms Your Partners Will Actually Use

What would change if every partner could register deals from email or Slack in seconds?

Most deal registration programs still rely on long forms, portal logins, and manual updates. That slows partners down and creates a duplicate pipeline and unclear ownership.

A modern deal registration process removes those steps, automates approvals, and keeps every deal stage in your CRM. When registering deals feels easy, partners submit earlier and stay aligned with your team.

You’ll learn

- what effective deal registration software looks like today,

- how to evaluate the essentials,

- and which platforms actually help partners register deals consistently.

So where does friction come from, and how does a better workflow protect partner trust and improve forecasting?

Why deal registration still breaks (and how to fix it)

Deal registration should be simple. Partners register deals, your team reviews them quickly, and everyone stays aligned.

Yet many deal registration programs still create friction. Partners hit access issues, approvals move slowly, and deal data becomes inconsistent.

Over time, this reduces partner trust and increases channel conflict across direct and indirect sales.

Deal registration process friction

Most deal registration failures come from three predictable blockers:

- Partner portals that require logins or too many steps.

- Deal submission forms that take too long to complete.

- Approval delays that leave partners without updates.

When the process feels heavy, partners default to emailing an AE instead of using the deal registration tool.

This leads to duplicate deal data, unclear ownership, and rising tension between channel partners and the direct sales team.

Channel managers then lose visibility into deal stages and partner behavior.

A common breakdown looks like this:

- A partner tries to register deals but cannot access the partner portal easily.

- The direct sales team enters the same customer manually.

- Conflicting records appear, and no one has a clean view of deal progress.

This cycle hurts partner relationships and weakens your partner program.

What good deal registration looks like

A strong deal registration program focuses on three essentials:

- Off-portal intake through email, Slack, or lightweight links.

- Instant confirmations tied to CRM deal stages.

- Clean, CRM-native deal data that updates in real time.

With these elements in place, partners register deals earlier and more consistently.

Clear rules reduce conflict when multiple partners work with the same customer. Automated updates keep partners informed without manual data entry. And real-time visibility across your sales pipeline helps both channel partners and internal channel managers stay aligned.

Here is how modern systems solve old problems:

Platforms that follow this model, including Introw’s deal and lead registration workflow, reduce friction by syncing every submission directly into the CRM and keeping partners informed automatically.

Why this matters for deal flow

Deal registration software works only when partners trust the experience.

When partners can register deals quickly, stay informed, and see consistent deal stages, they engage more. This leads to cleaner partner pipeline visibility, fewer disputes, and faster revenue cycles.

To evaluate which deal registration software delivers on this, the next section breaks down the core features every buyer should look for in 2026.

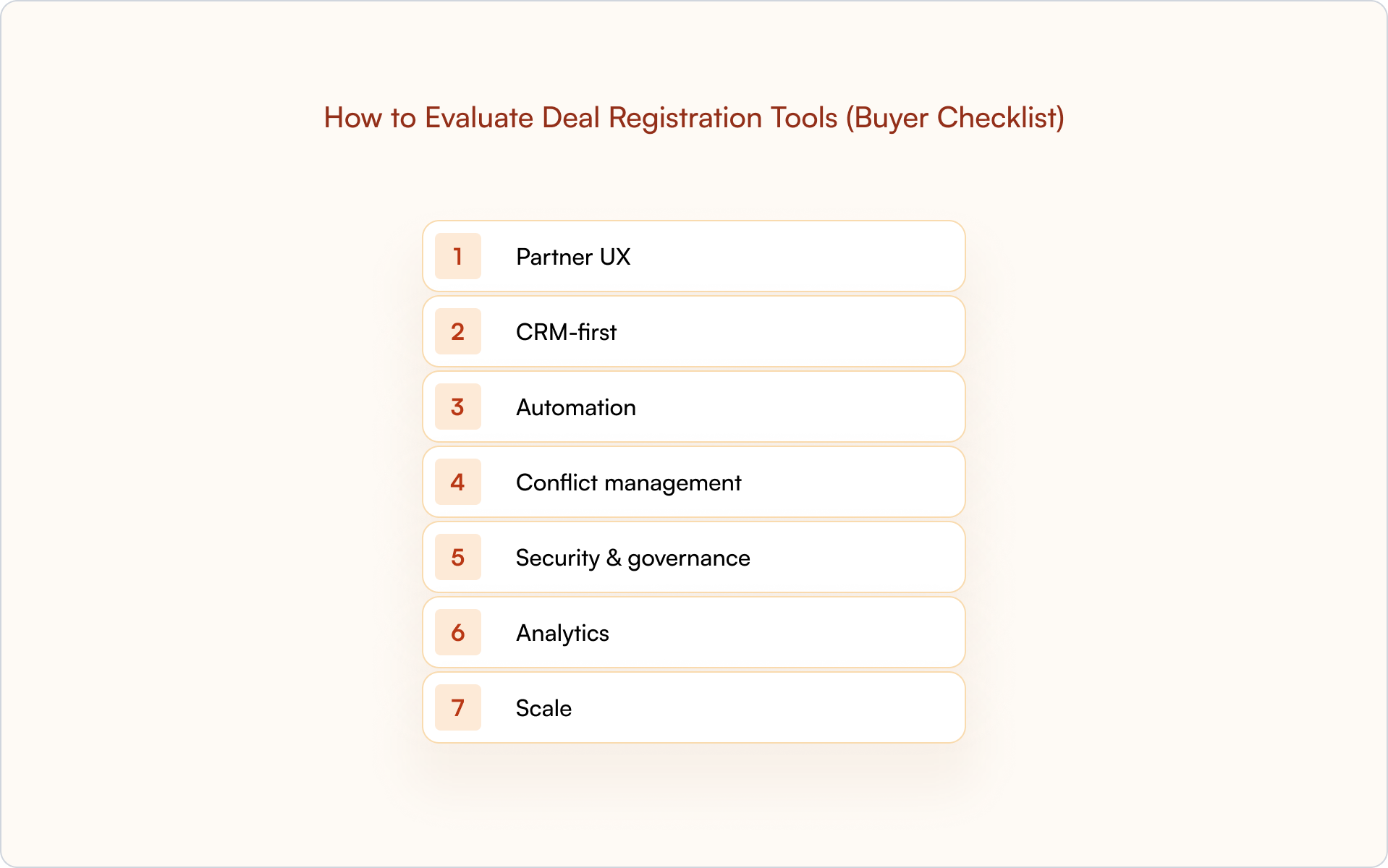

How to evaluate deal registration tools (buyer checklist)

Choosing deal registration software is easier when you know what actually drives partner adoption.

Most teams compare features, but in our experience, the real difference comes from how well the tool supports your partners day to day.

If the process feels simple, partners register deals more often, and your deal data stays clean inside Salesforce or HubSpot.

Start with partner experience

Partner experience is the biggest factor in deal registration success. If the process feels slow or confusing, partners will skip it and email someone on your direct sales team instead.

Strong tools make deal registration simple by offering:

- Fast intake through email, Slack, or a short deal submission form.

- Clear steps so partners know exactly how to register deals.

- Mobile-friendly options for partners who work on the go.

We see the best results when channel partners can register deals without touching a partner portal. It removes friction and improves partner trust from the start.

Set up a good deal registration module

A good deal registration module should help your business reduce channel conflict and keep deal progress visible across teams.

When tools automate the steps partners usually struggle with, your partner program becomes easier to run.

Look for:

- Automatic approvals based on time stamps, partner tier, or ownership rules.

- Real-time sync of deal stages inside your CRM.

- Clean deal data that does not require manual data entry.

These features keep your channel pipeline data accurate and give both partner managers and internal sales teams a single view of each opportunity.

Governance and scale as your partner program grows

As your partner program expands, you need structure. Different partner segments often need different experiences, and your internal teams need clear rules to avoid mix-ups.

We suggest checking for:

- Role-based access so partner managers and sales leadership see what they need.

- A reliable audit trail that tracks changes and partner behavior.

- Flexible segmentation for geos, partner tier, or product lines.

These guardrails help your business stay aligned as more partners register deals and your sales pipeline grows.

A quick way to compare tools

Why this checklist helps your business

A deal registration program only works when partners engage with it.

If you choose software that simplifies the process, your partners register deals earlier, your teams stay aligned, and you avoid the channel conflict that slows down revenue.

Now that you know what to look for, we can compare the deal registration tools that actually help partners register deals without friction.

The 17 best deal registration software platforms (2026)

We've put together our picks for solid deal registration tools that we see most often across SaaS partner programs.

Each one supports deal registration, but they solve different problems depending on your partner segments, tech stack, and channel strategy.

Use this section to match your program design to the right platform, not just the biggest brand.

1. Introw

Introw is a CRM-native deal registration system that lets partners register deals from email, Slack, or lightweight links instead of a portal.

Who it’s for

B2B teams on Salesforce or HubSpot running referral, reseller, or co-sell motions with 20–300+ channel partners.

Why choose it

Partners register deals without logging in, while your teams work entirely from native CRM objects with real-time deal stages.

Standout capabilities

Off-portal intake, automated approvals, deal progress updates synced to Salesforce or HubSpot, and engagement analytics across the partner pipeline.

Keep in mind

Best if you want deal registration, partner engagement, and attribution in one CRM-first platform instead of a heavy portal.

Integrations/notes

Deep Salesforce and HubSpot integrations, Slack notifications, open API, and a focused deal registration module tied to clean pipeline data.

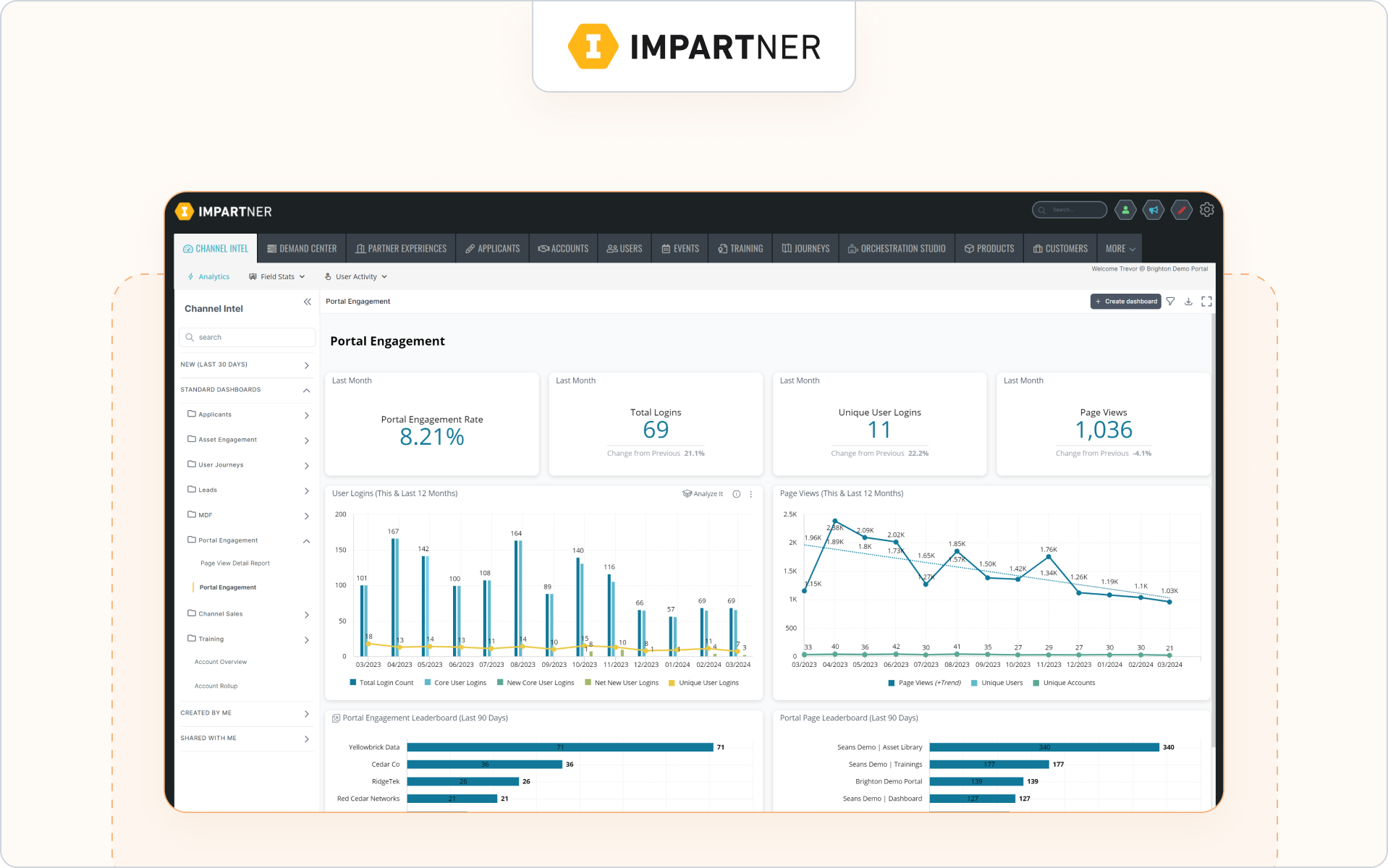

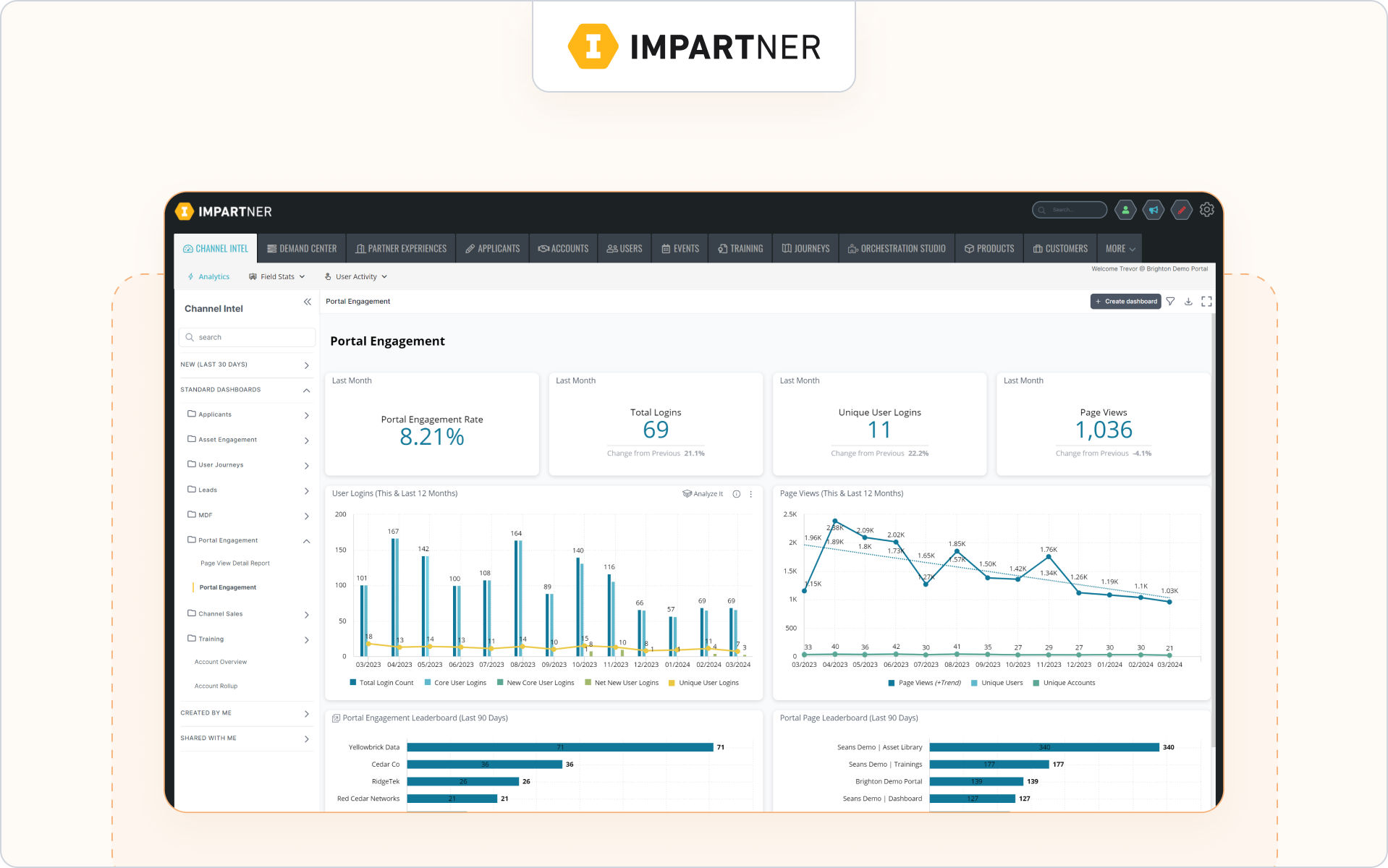

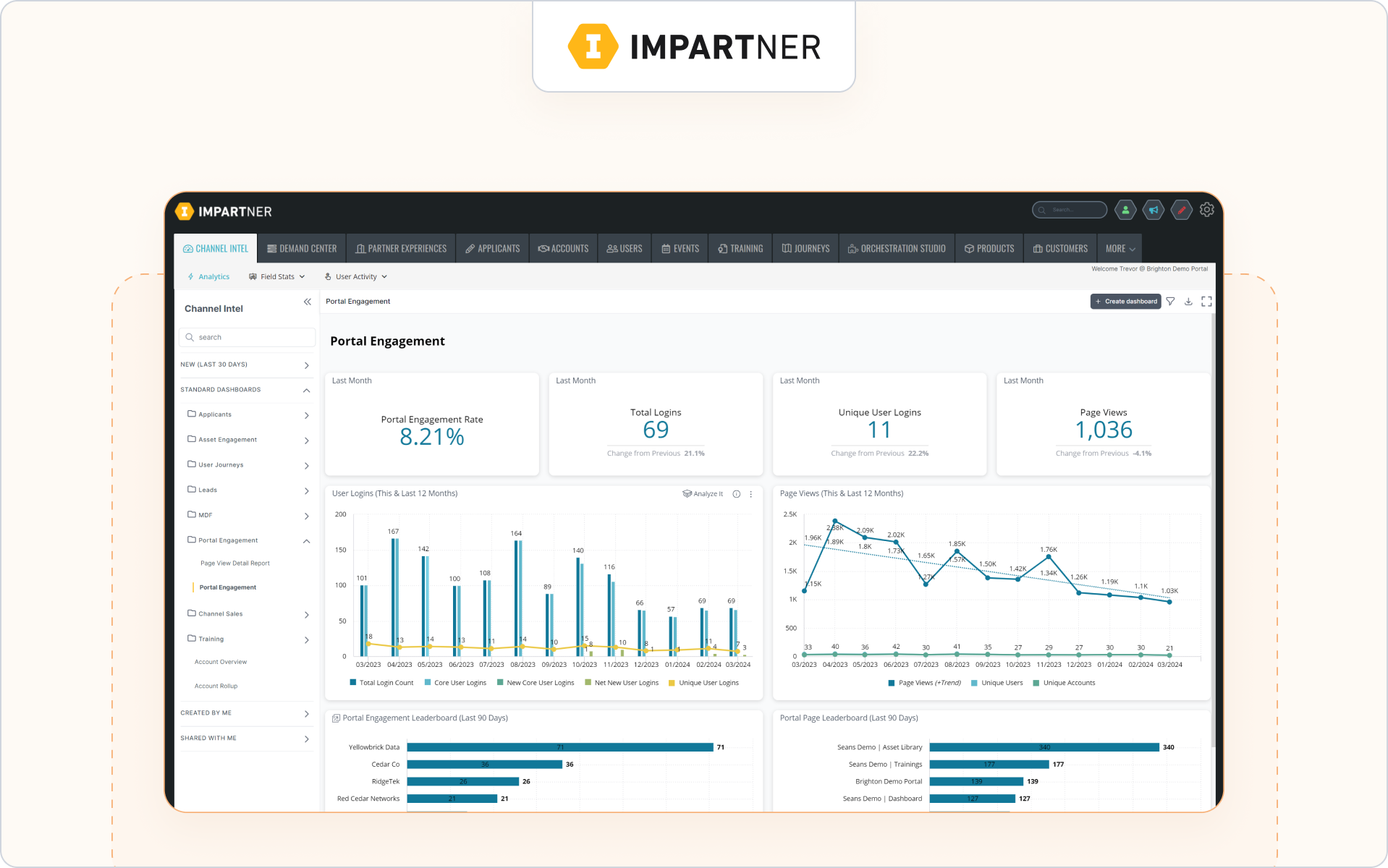

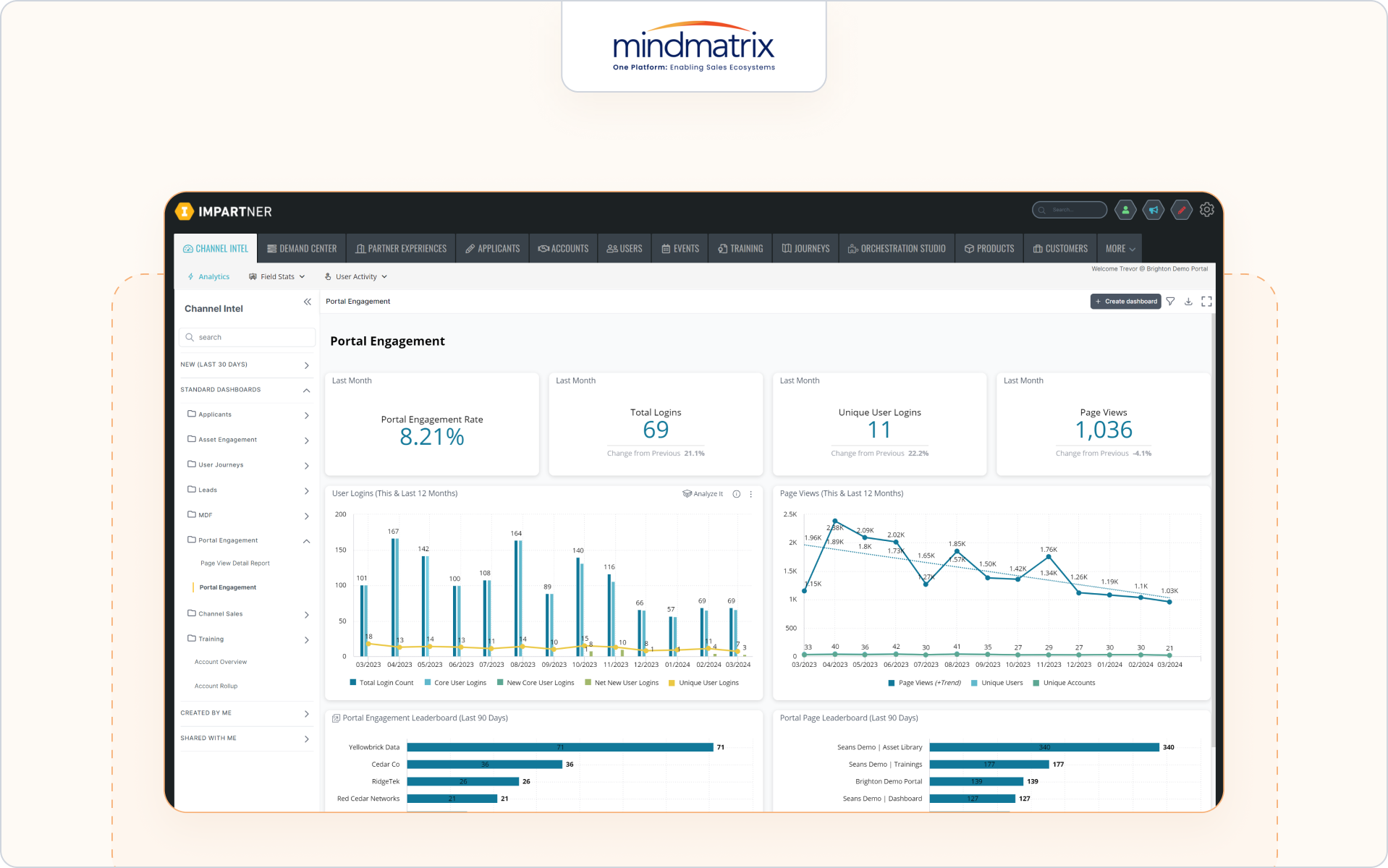

2. Impartner

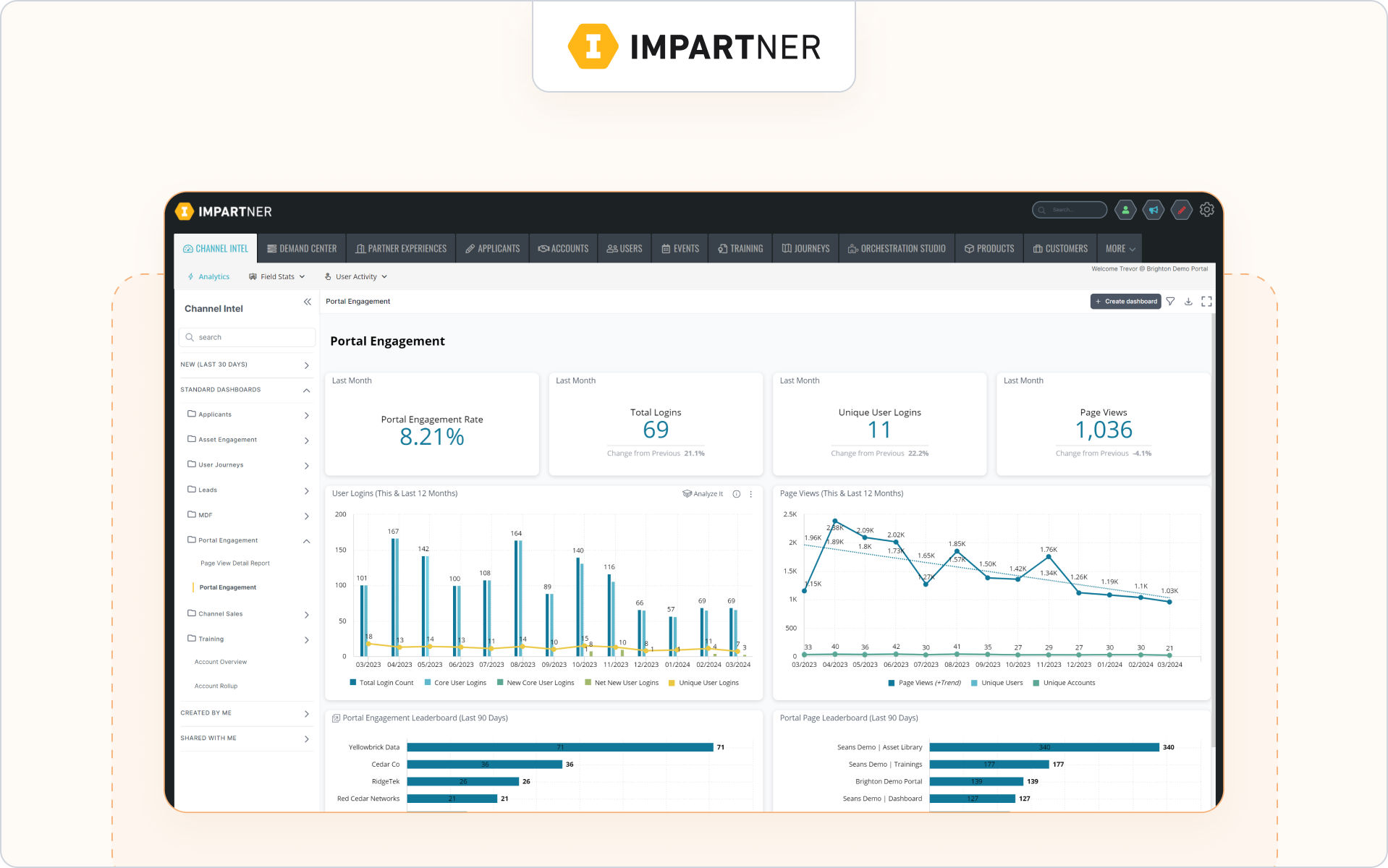

Impartner is a full PRM platform built for large channel programs with complex workflows.

Who it’s for

Global SaaS and technology companies with structured partner tiers and compliance needs.

Why choose it

Mature deal registration module, configurable approval logic, and strong governance for value-added resellers and distributors.

Standout capabilities

Tier rules, multi-step approvals, MDF, channel performance reporting, and tools to reduce channel conflict.

Keep in mind

Heavier setup; works best with dedicated channel managers and Salesforce-centric environments.

Integrations/notes

Strong CRM connectors, especially Salesforce, plus a wide ecosystem of partner marketing integrations.

3. Channelscaler (prev. Allbound)

Channelscaler combines partner training, content, and deal registration in a single portal.

Who it’s for

Teams that care about partner enablement as much as partner pipeline.

Why choose it

Partners can access marketing materials, complete training, and register deals in one place.

Standout capabilities

Content hub, learning paths, QBR support, and MDF handling with a guided partner portal.

Keep in mind

Portal-first model, so plan how you will keep partners logging in consistently.

Integrations/notes

Integrates with major CRMs and common partner marketing tools.

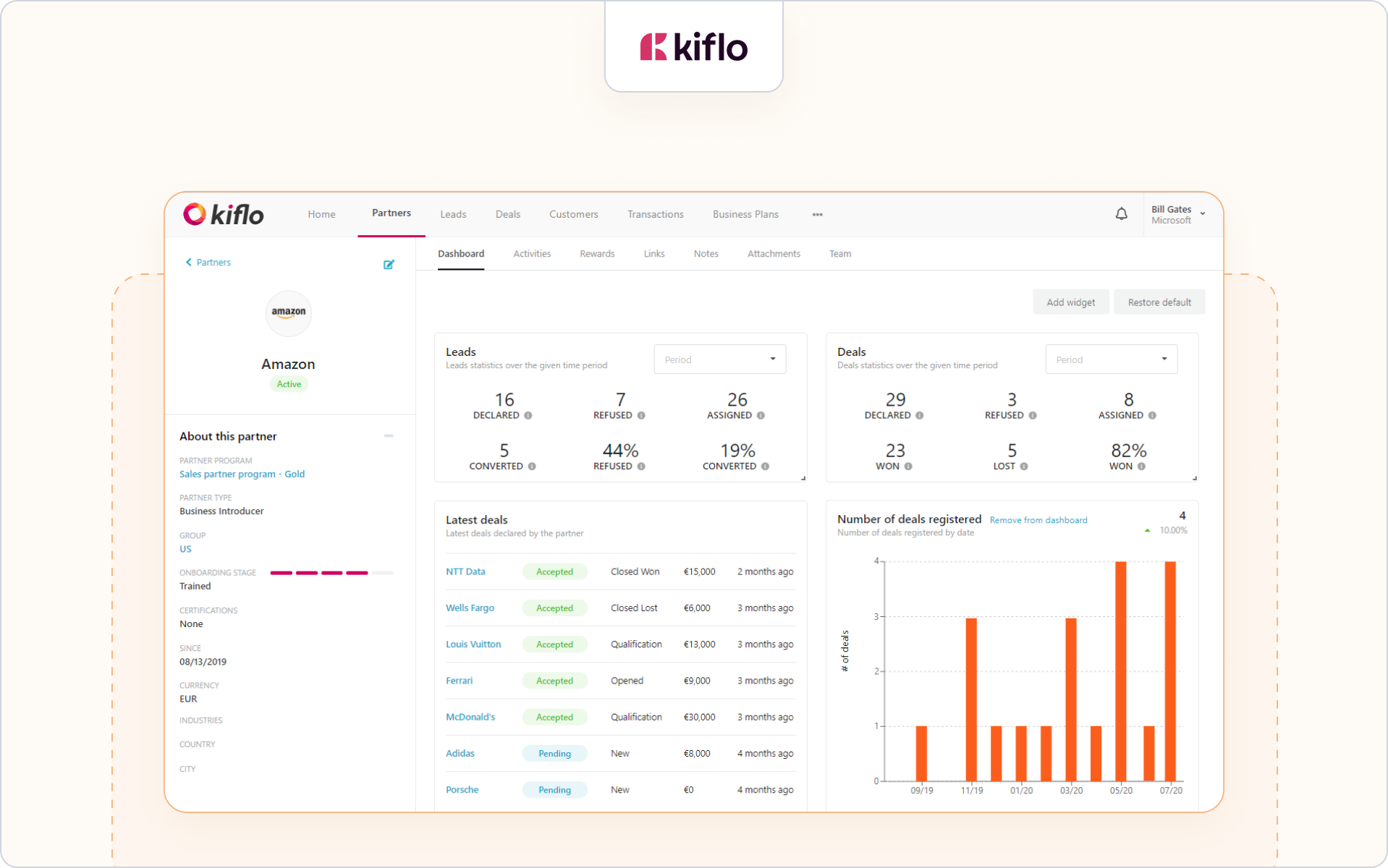

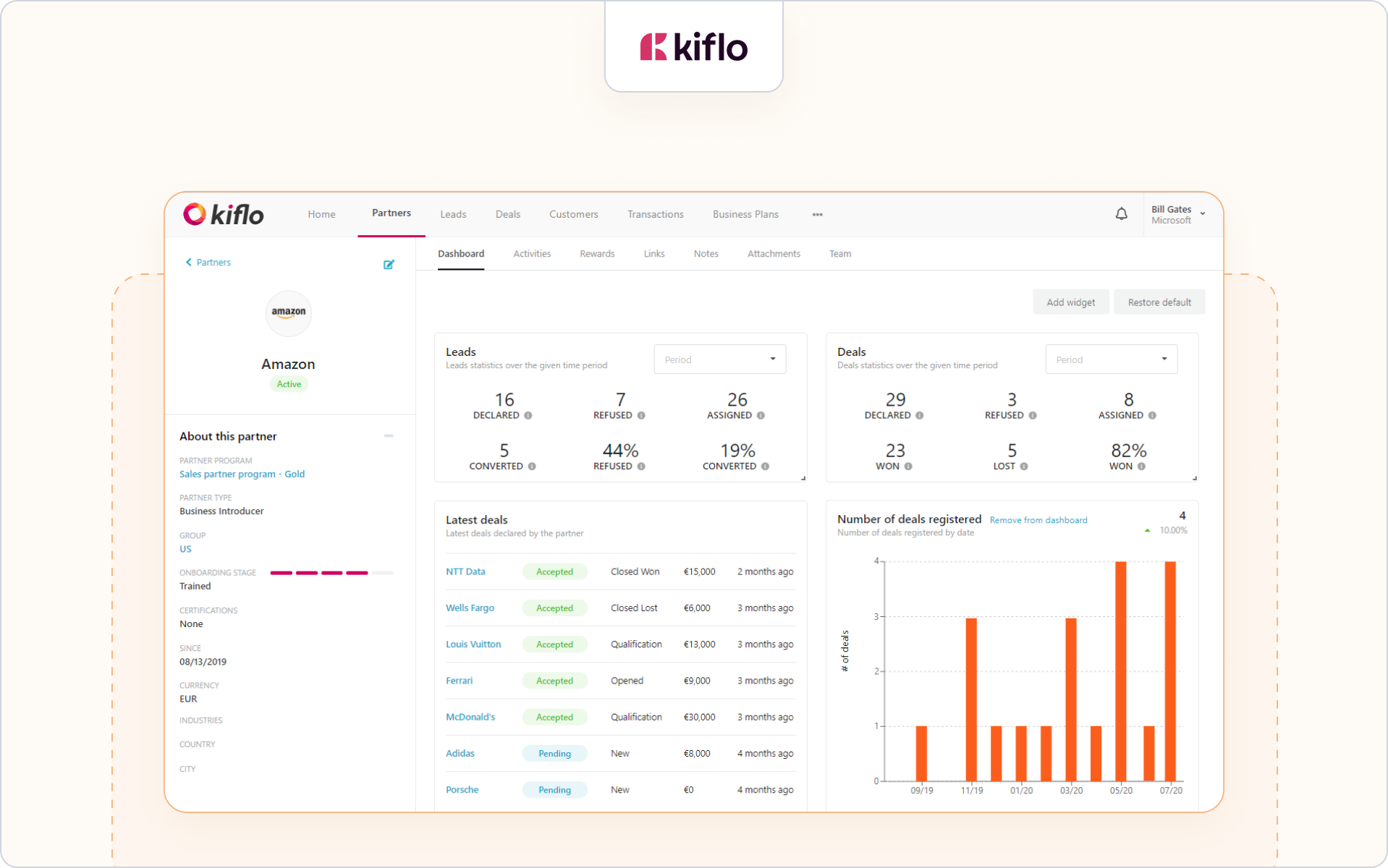

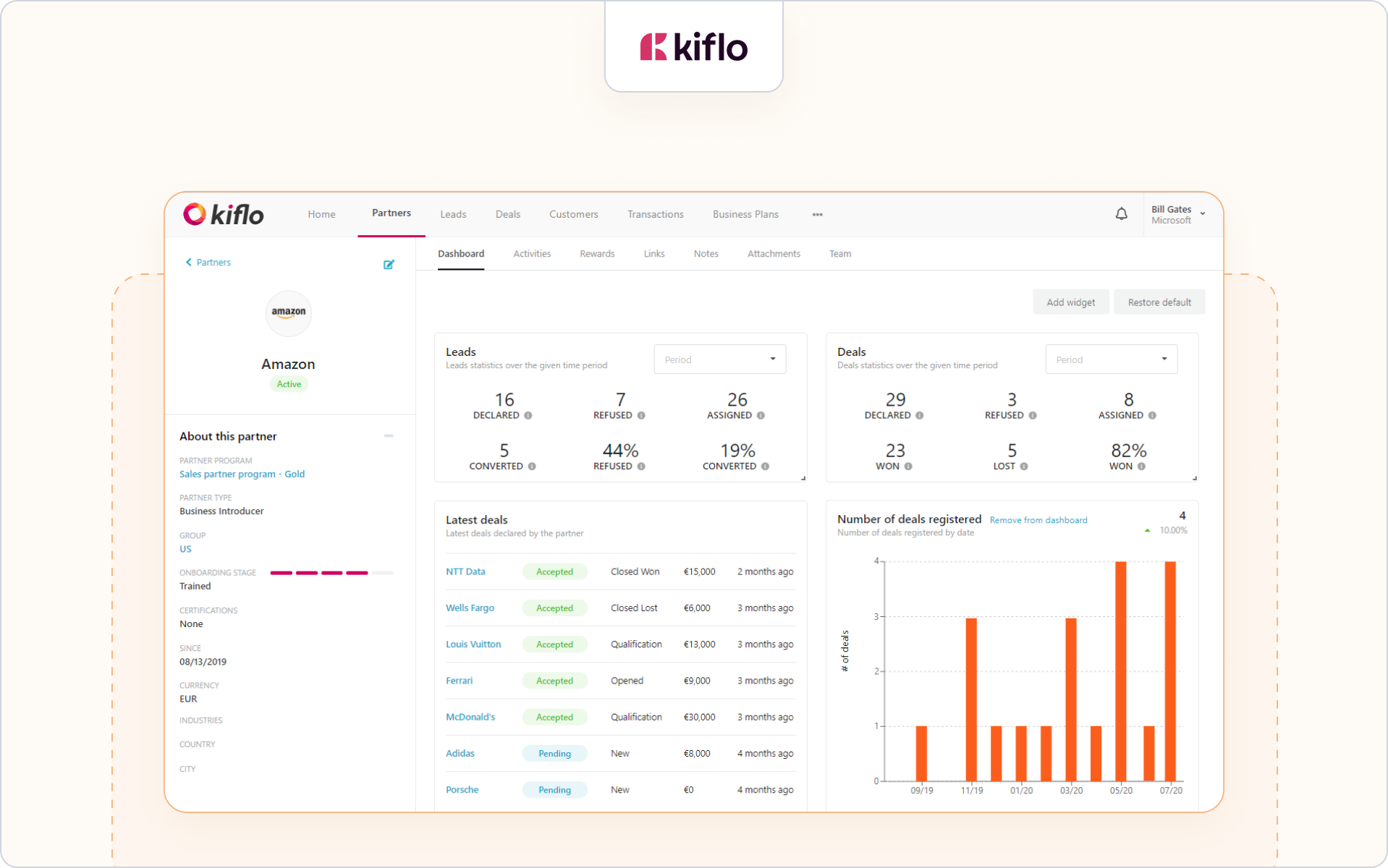

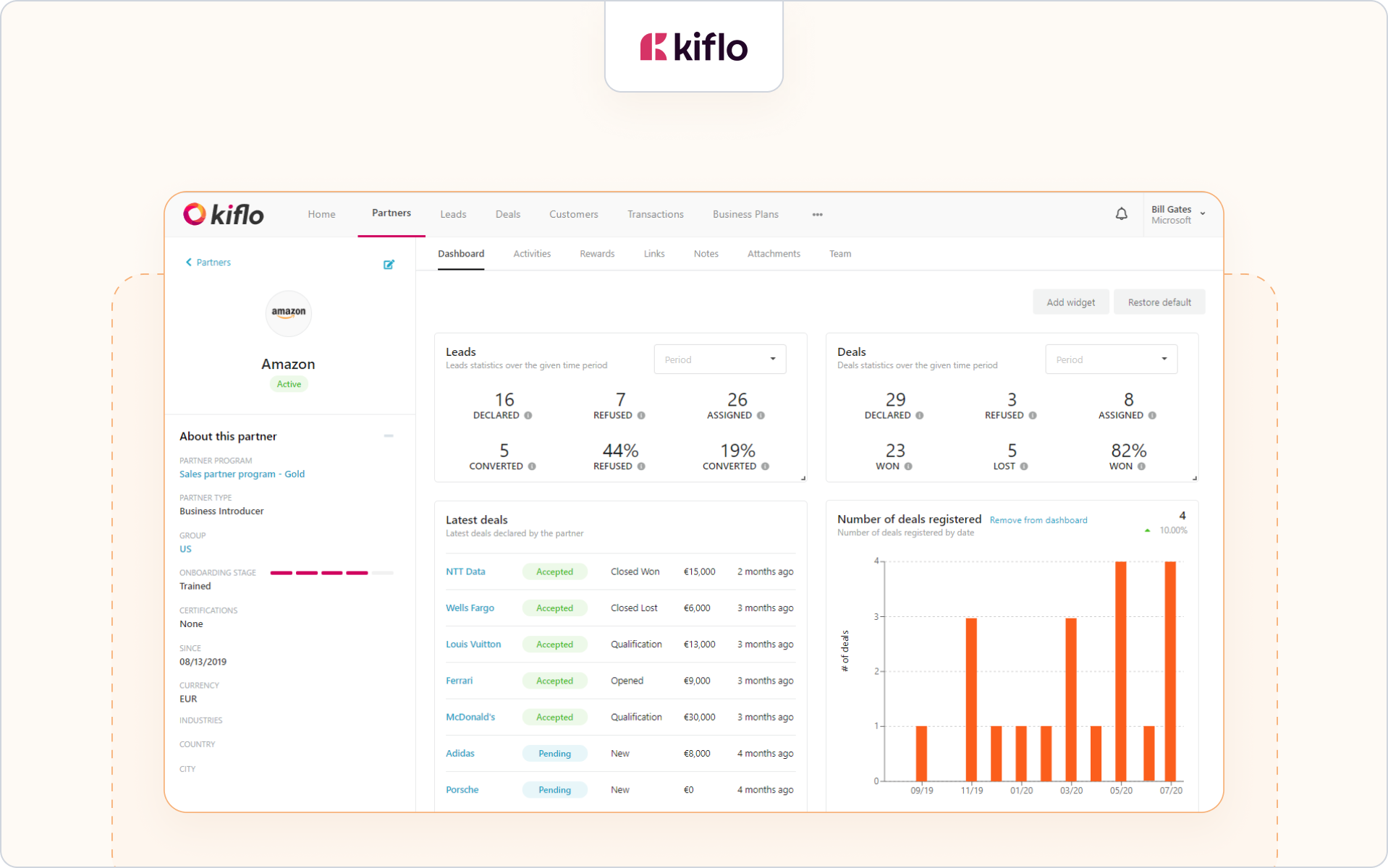

4. Kiflo

Kiflo is a simple, lightweight PRM with built-in deal registration for growing partner programs.

Who it’s for

SMB and mid-market SaaS companies launching a partner program for the first time.

Why choose it

Straightforward deal registration and onboarding without heavy admin.

Standout capabilities

Deal forms, partner onboarding, commission tracking, and basic partner performance reporting.

Keep in mind

Analytics and customization are lighter for complex global programs.

Integrations/notes

Connects with Salesforce, HubSpot, and common marketing tools.

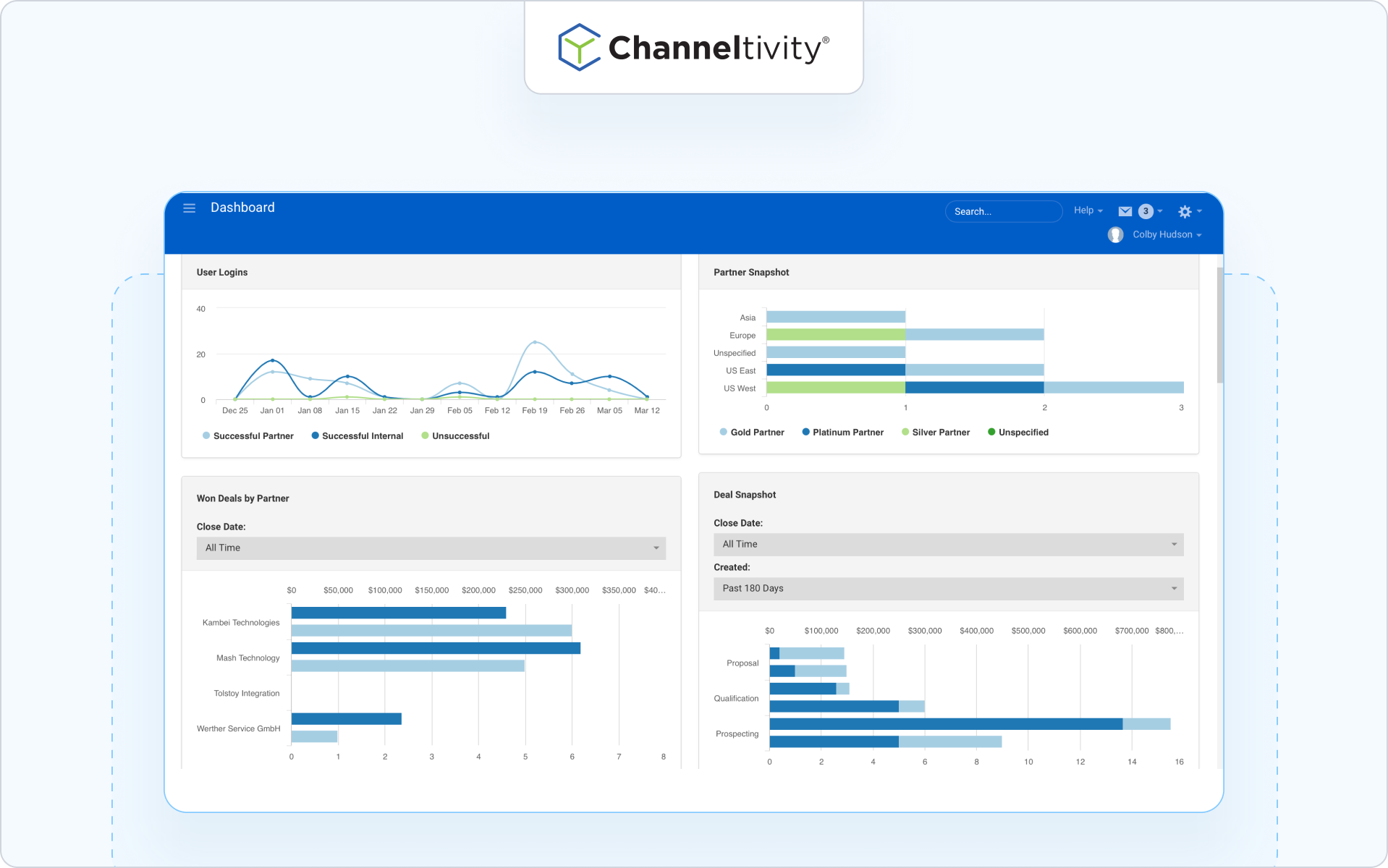

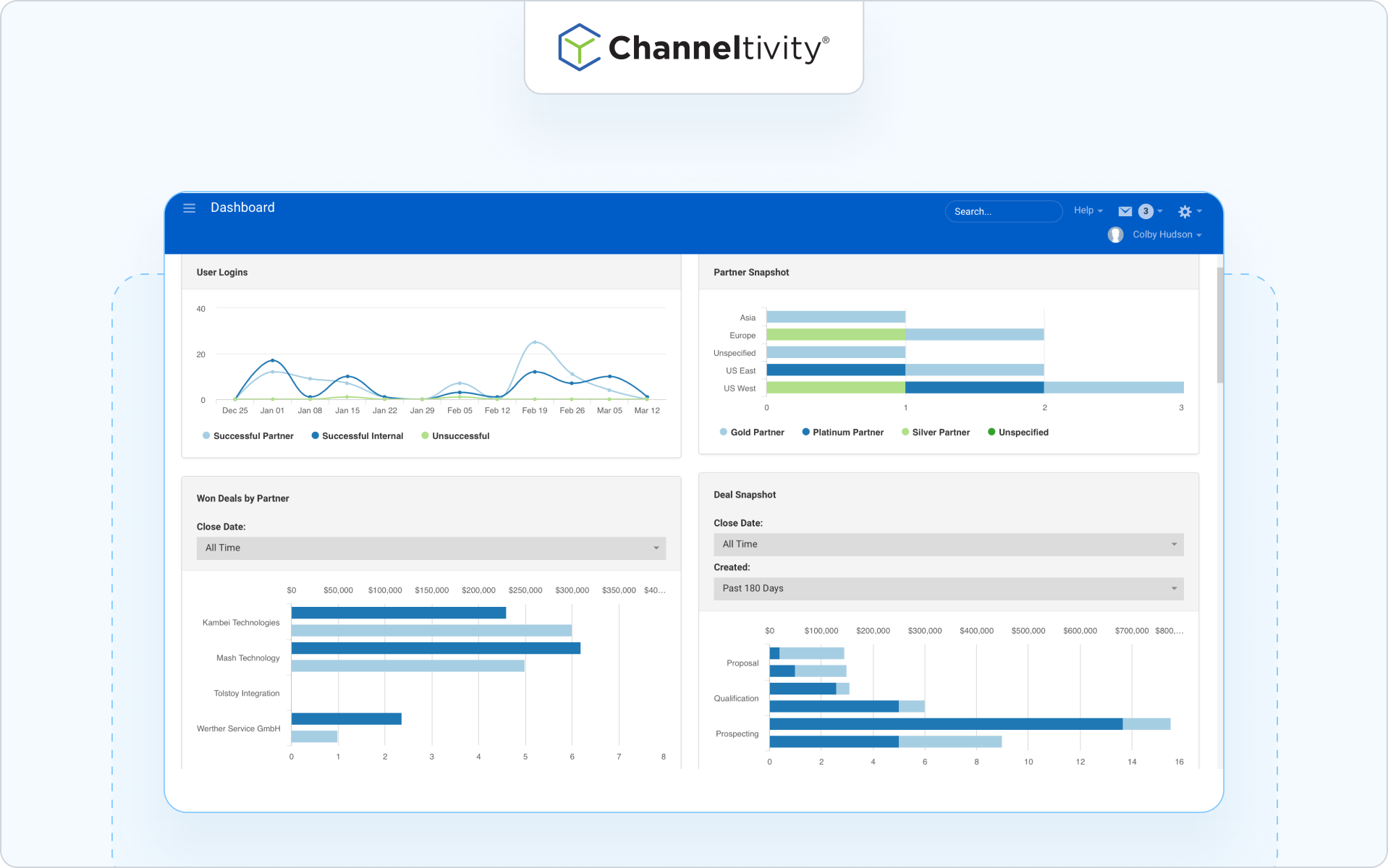

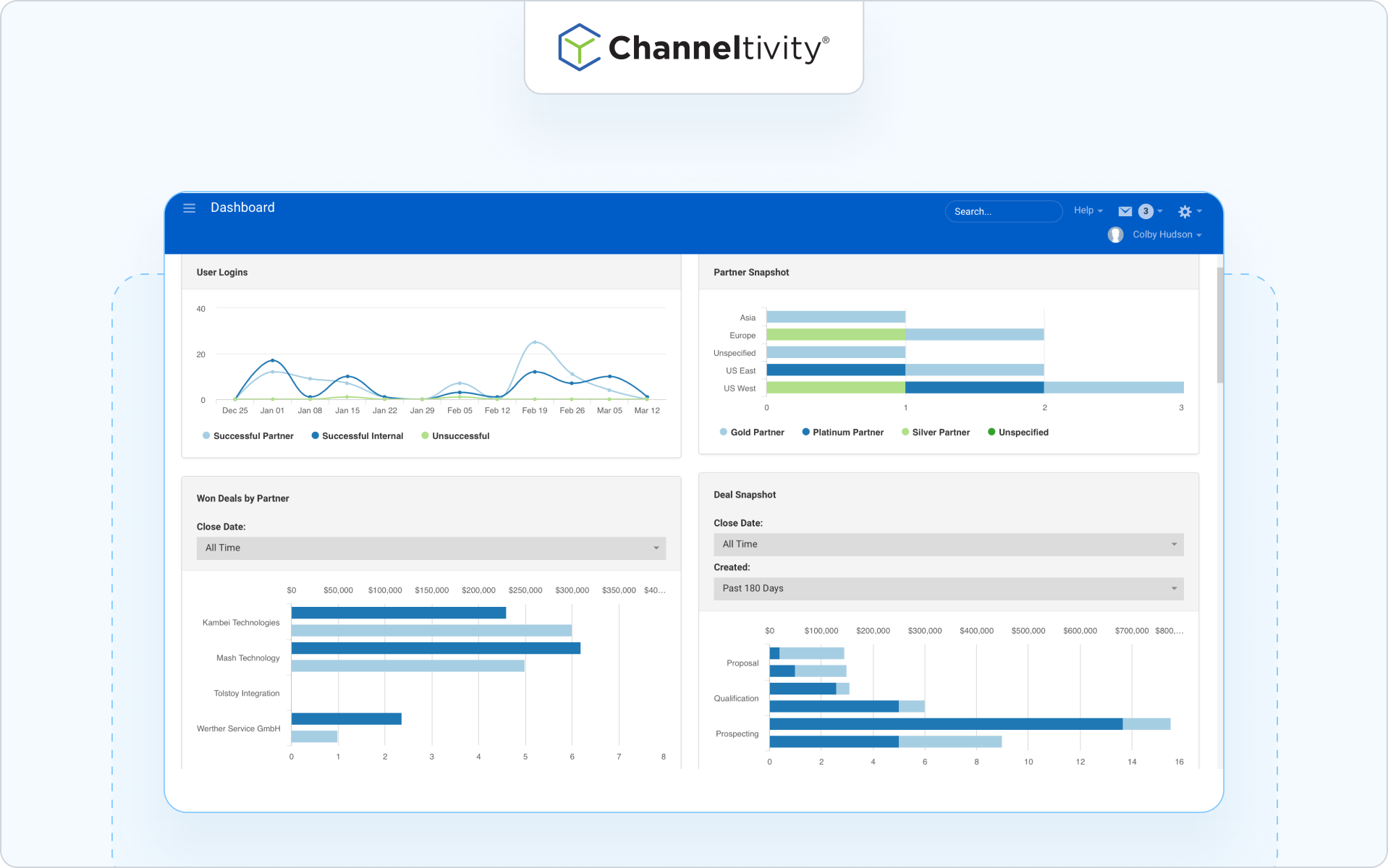

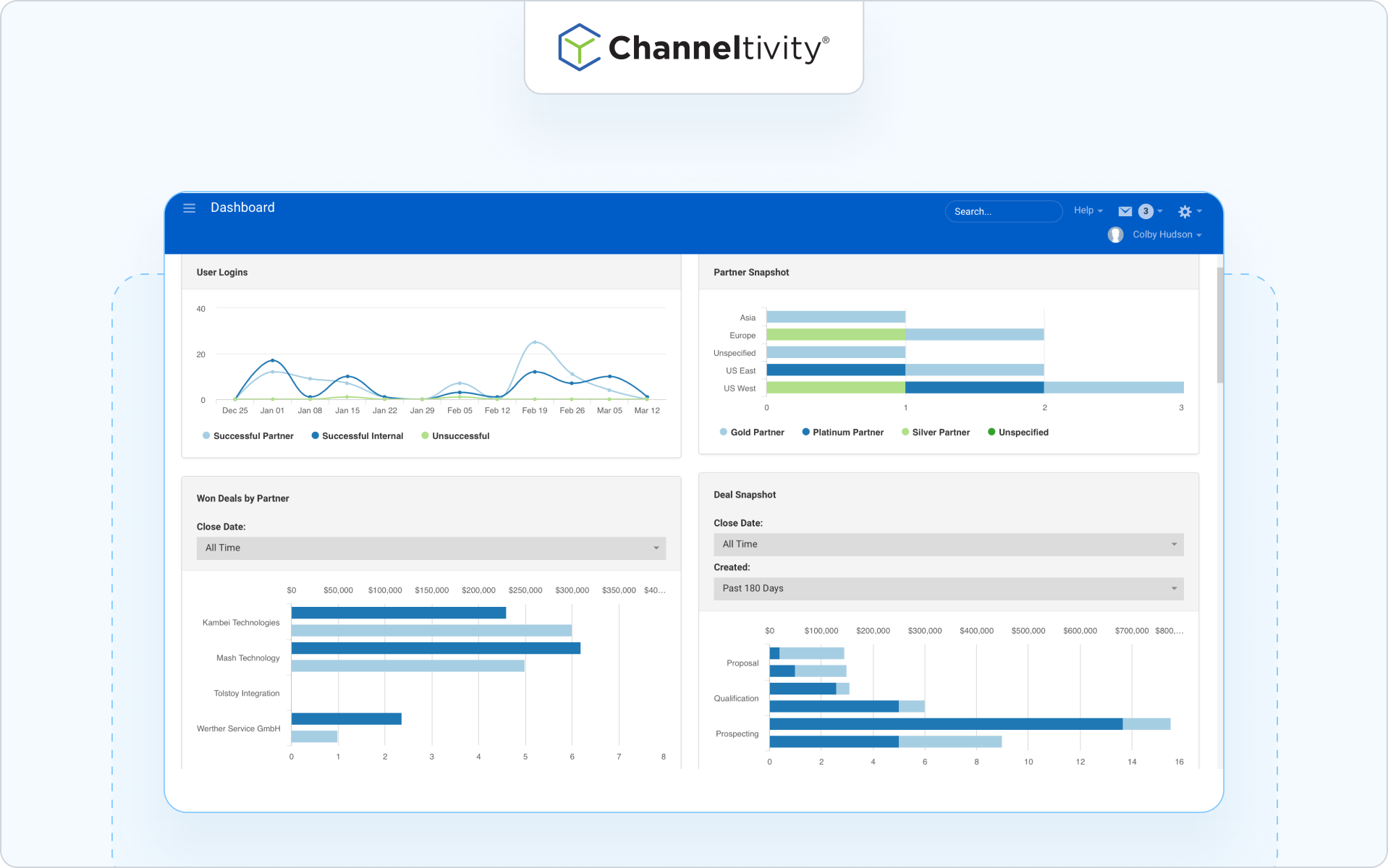

5. Channeltivity

Channeltivity delivers structured deal registration and channel operations in a clean partner portal.

Who it’s for

Tech vendors that want predictable deal registration and partner management without enterprise overhead.

Why choose it

Reliable deal registration module with lead distribution and partner onboarding.

Standout capabilities

Deal forms, MDF, lead routing, referral management, and HubSpot integration.

Keep in mind

Off-portal submission is limited, so adoption relies on partner portal use.

Integrations/notes

Strong HubSpot integration with support for Salesforce.

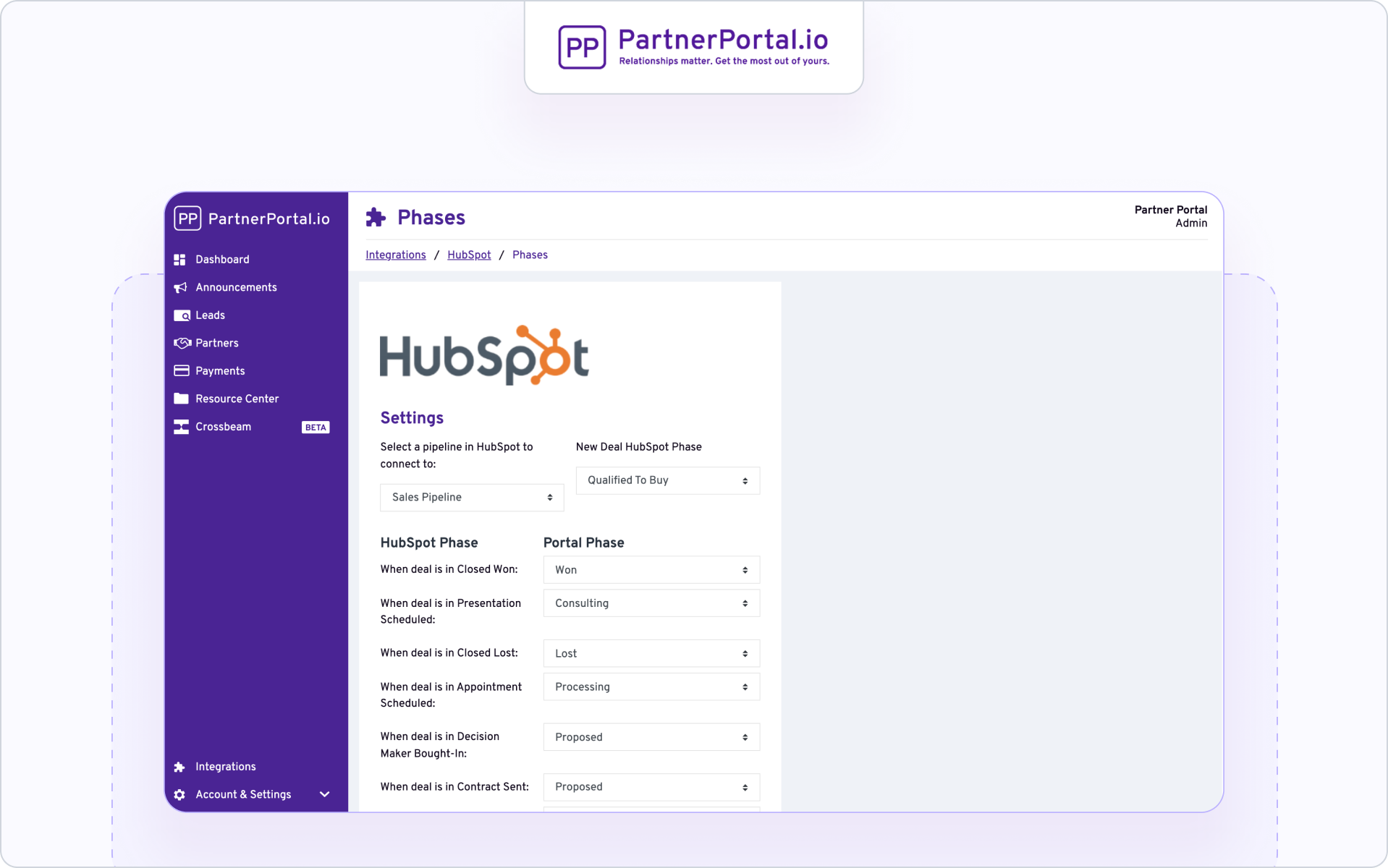

6. Magentrix

Magentrix is a partner relationship management (PRM) platform.

Who it’s for

Salesforce-centric companies that need branded partner experiences.

Why choose it

Lets you build custom partner portals with community features, content, and deal registration.

Standout capabilities

Admin is no-code with drag-and-drop capabilities (and has been for the past three years). Magentrix emphasises that it’s the only enterprise-fit PRM with 100% no-code capability. You can also create flexible portal pages and set granular permission controls.

Integrations/notes

Magentrix positions itself as an alternative to Salesforce Experience Cloud, with integrations/connectors available (including Salesforce, depending on your setup) as well as support and marketing tools.

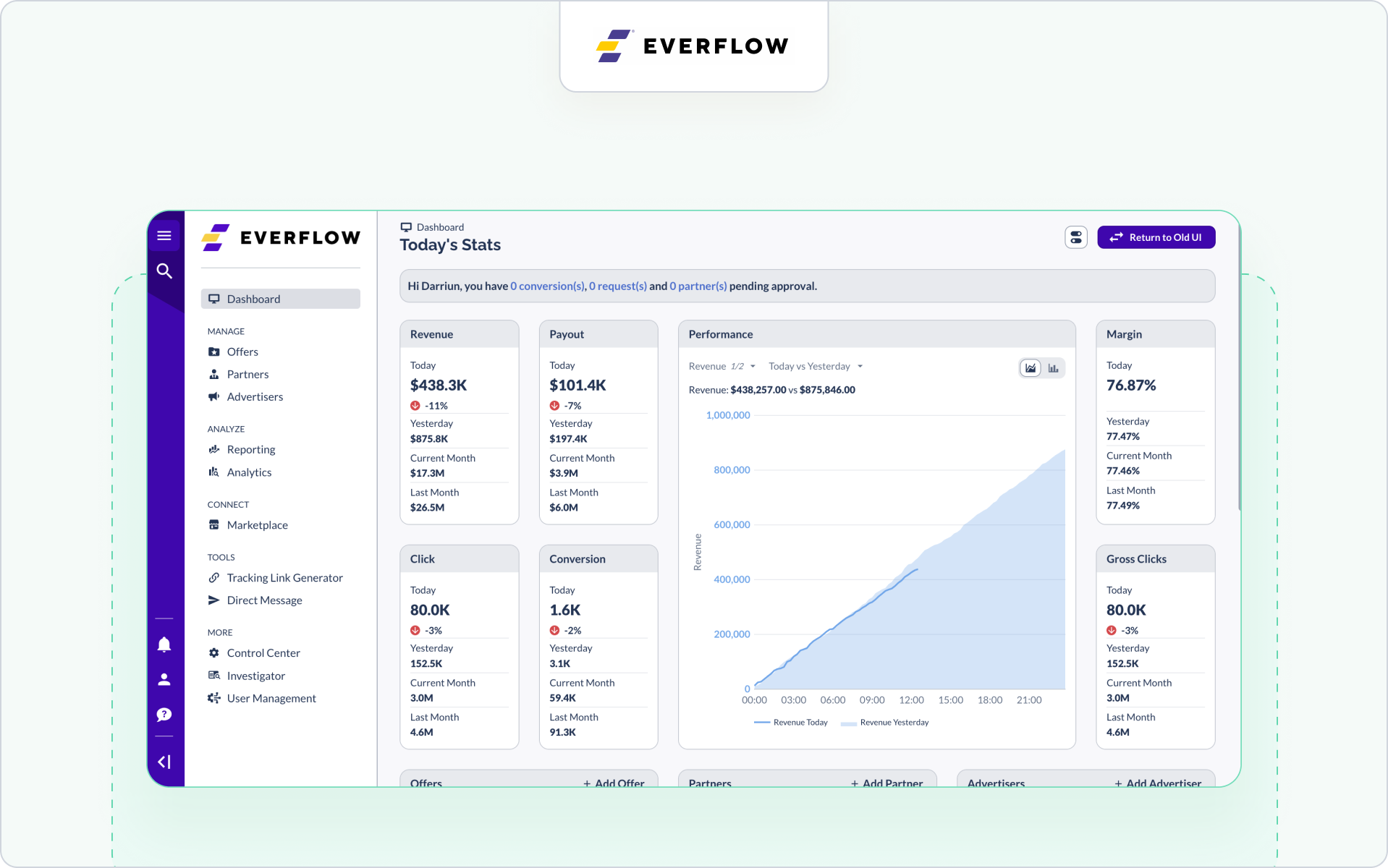

7. ZINFI

ZINFI supports large, complex channel programs that need detailed rules and compliance.

Who it’s for

Enterprises with many partner types, geos, and strict governance requirements.

Why choose it

Highly configurable approval rules and workflows for deal registration programs at scale.

Standout capabilities

Audit trails, rule engines, partner tiering, and multi-language support.

Keep in mind

Admin setup can be intensive; best for structured, mature channel programs.

Integrations/notes

CRM integrations plus connectors for channel marketing and data management.

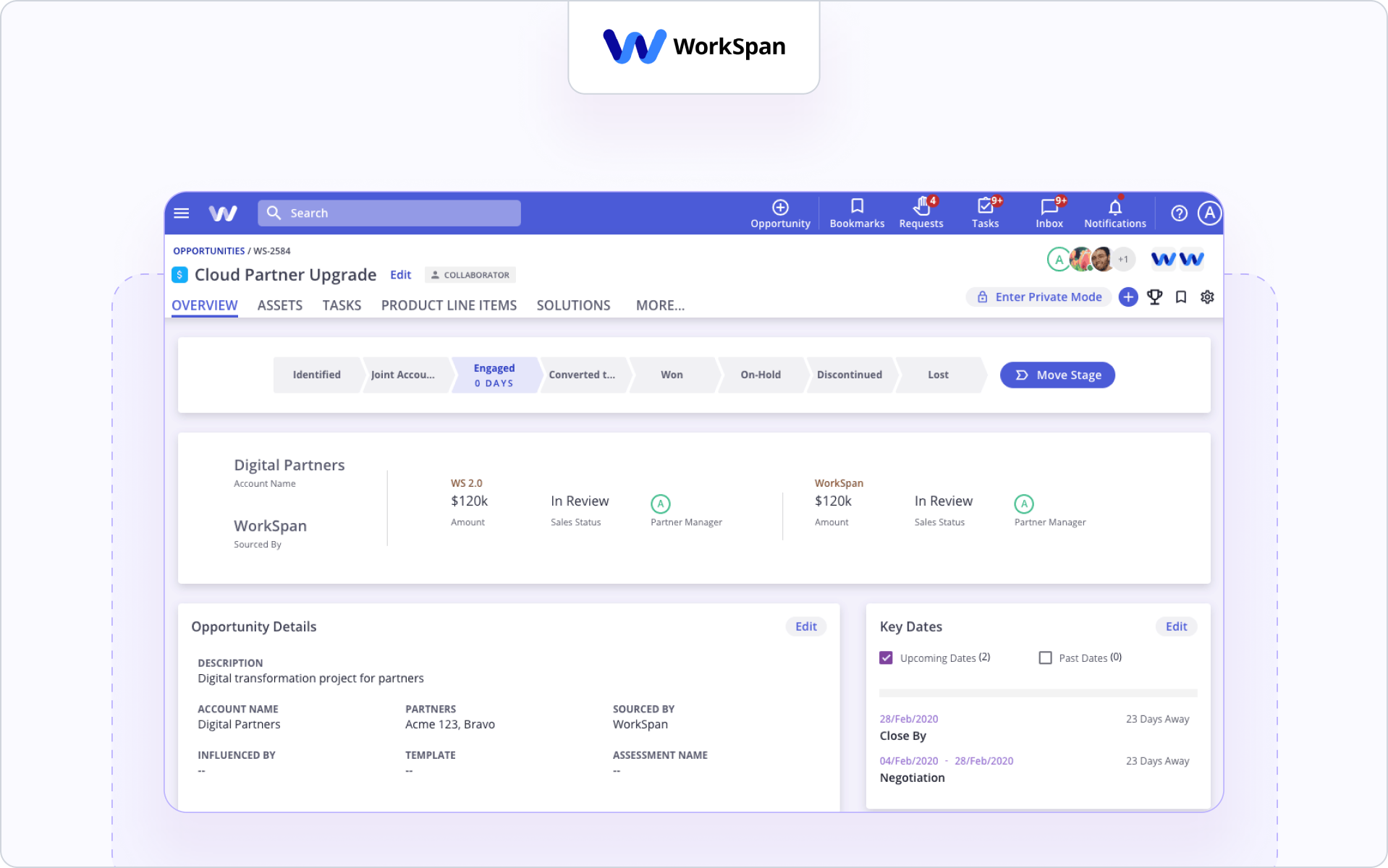

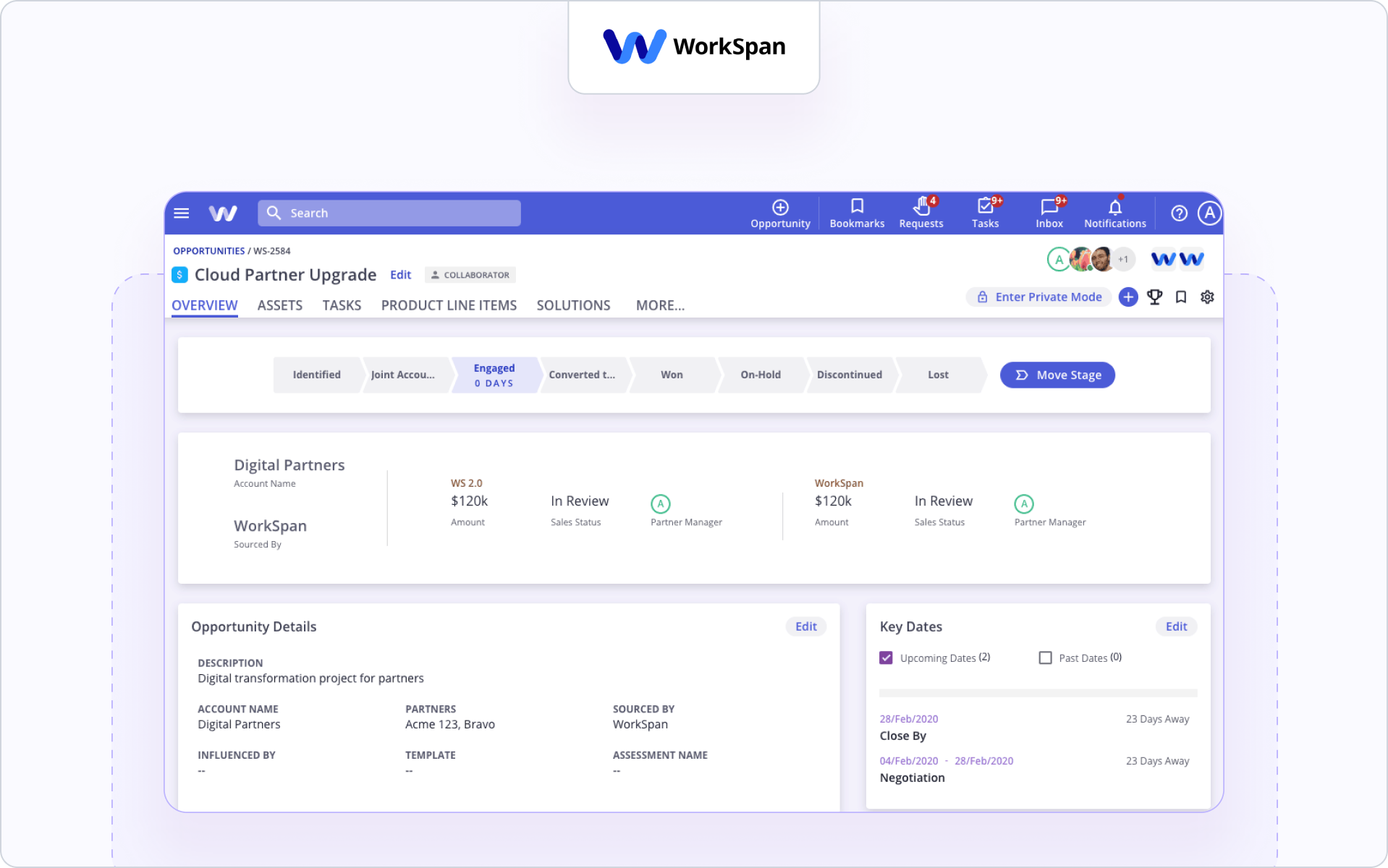

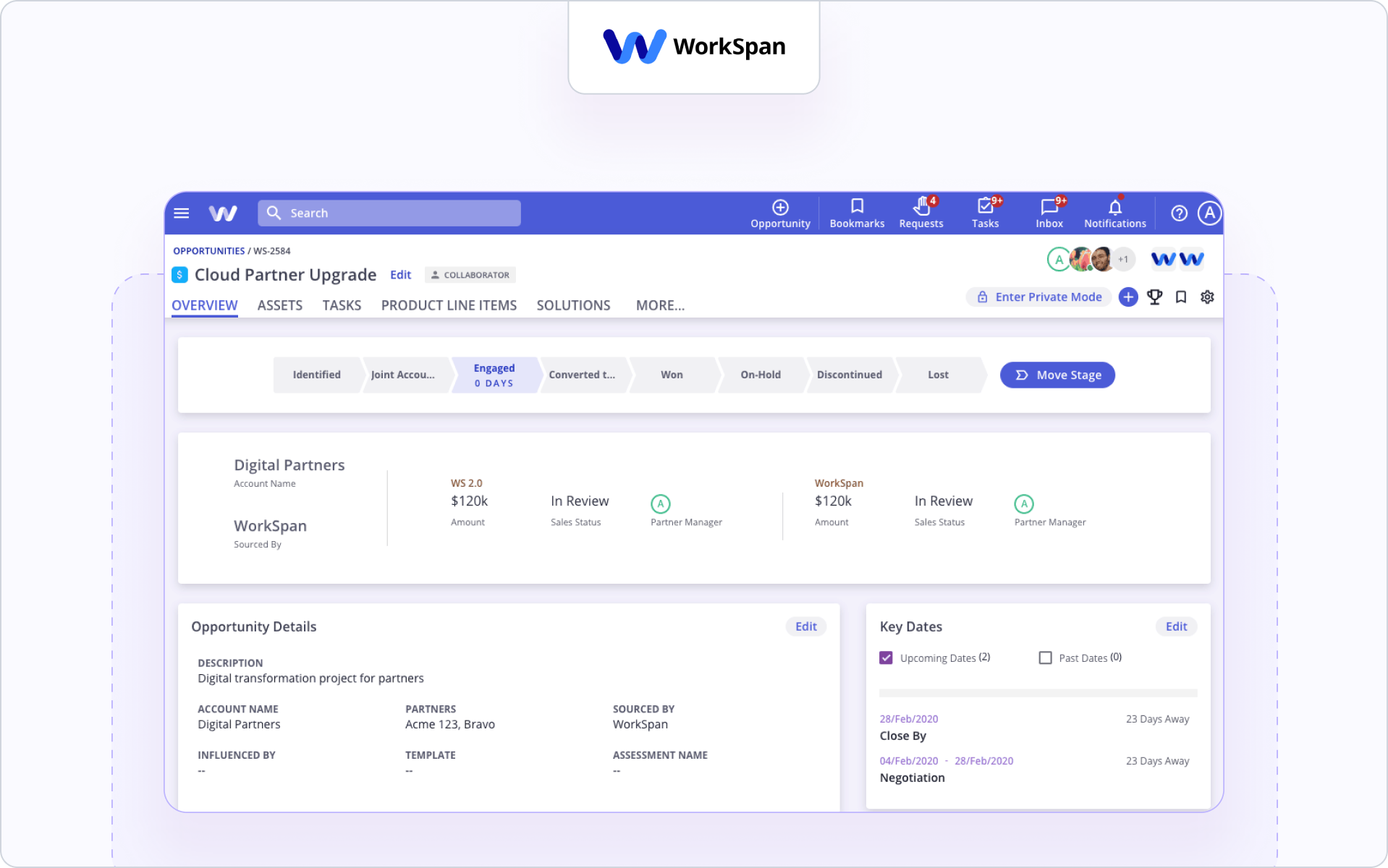

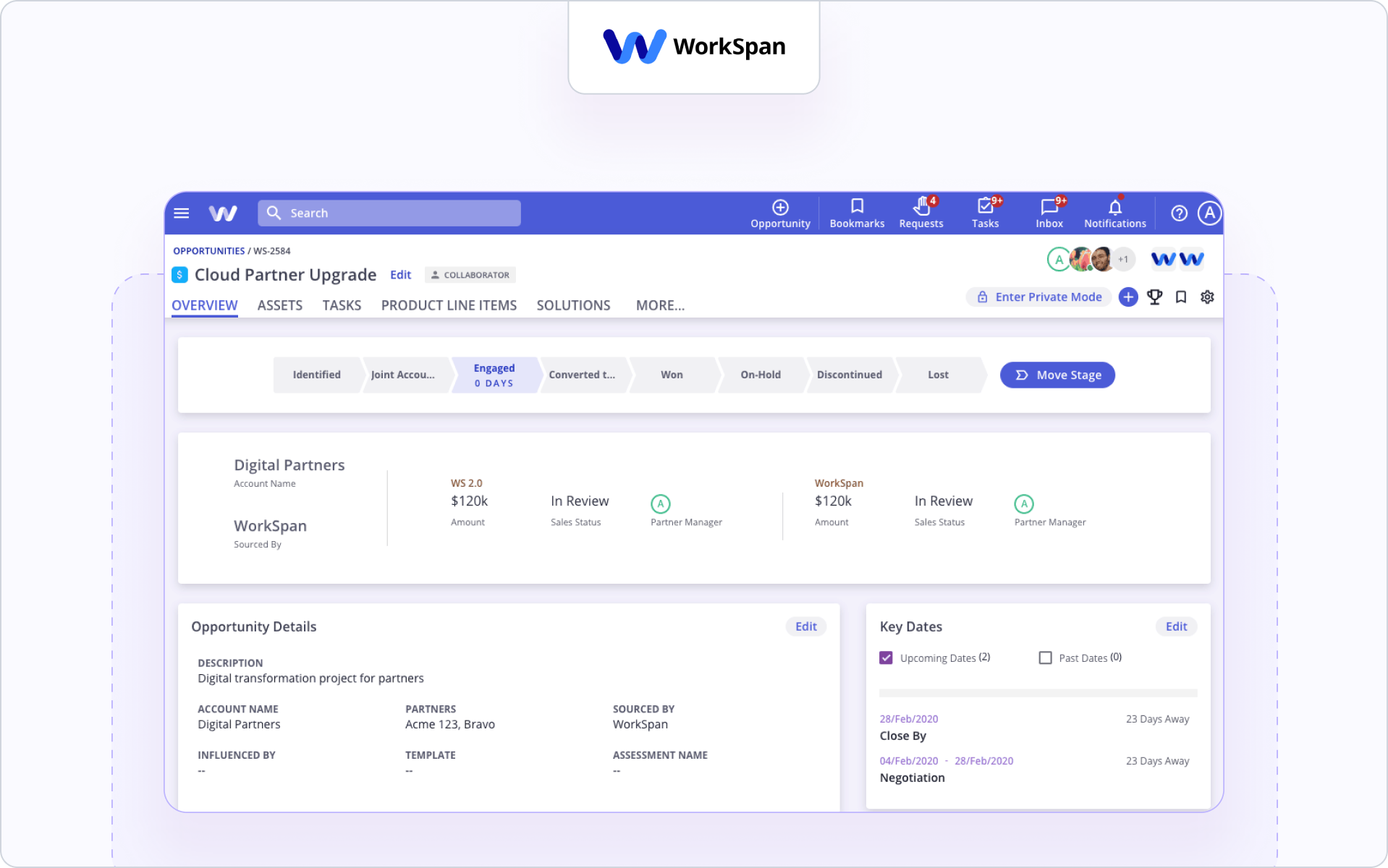

8. WorkSpan

WorkSpan specializes in co-selling and alliances rather than classic PRM workflows.

Who it’s for

Vendors working with hyperscalers or cloud marketplaces on joint opportunities.

Why choose it

Shared opportunity records make co-sell deal stages clear across both organizations.

Standout capabilities

Joint pipeline, ecosystem account mapping, and influenced-versus-sourced reporting.

Keep in mind

Not a traditional deal registration portal; often used alongside other partner tools.

Integrations/notes

Salesforce, Microsoft Dynamics, and cloud marketplace ecosystems.

9. Unifyr (formerly Zift Solutions)

Unifyr is an all-in-one partner management platform that includes deal registration, partner marketing, and enablement.

Who it’s for

Established channel programs managing many partners, regions, and partner segments.

Why choose it

Combines deal registration, training, and channel marketing in one partner portal.

Standout capabilities

Through-channel marketing, certification paths, deal lifecycle tracking, and channel revenue reporting.

Keep in mind

Broad feature set; define which modules matter most so partners are not overwhelmed.

Integrations/notes

Connectors for Salesforce, HubSpot, and major marketing systems.

10. Computer Market Research (CMR)

CMR provides deal registration and compliance automation for traditional channel programs.

Who it’s for

Vendors managing distributors, resellers, or partners with strict governance requirements.

Why choose it

Strong multi-step approval logic and audit records for channel conflict management.

Standout capabilities

Deal registration module, ERP/CRM connectors, and tier-based workflows.

Keep in mind

UX leans traditional; training may be needed for partner adoption.

Integrations/notes

Supports major CRMs and ERPs used in hardware and distribution channels.

11. PartnerStack

PartnerStack mixes affiliate, referral, and reseller programs with simple lead and deal registration.

Who it’s for

SaaS companies working with many small partners across different partner segments.

Why choose it

Partners get one portal to find campaigns, register deals, and track rewards.

Standout capabilities

Marketplace, payout automation, onboarding flows, and basic deal registration.

Keep in mind

Not CRM-native; syncing tight pipeline data may require extra setup.

Integrations/notes

Billing, payment, and referral tools, with optional CRM integrations.

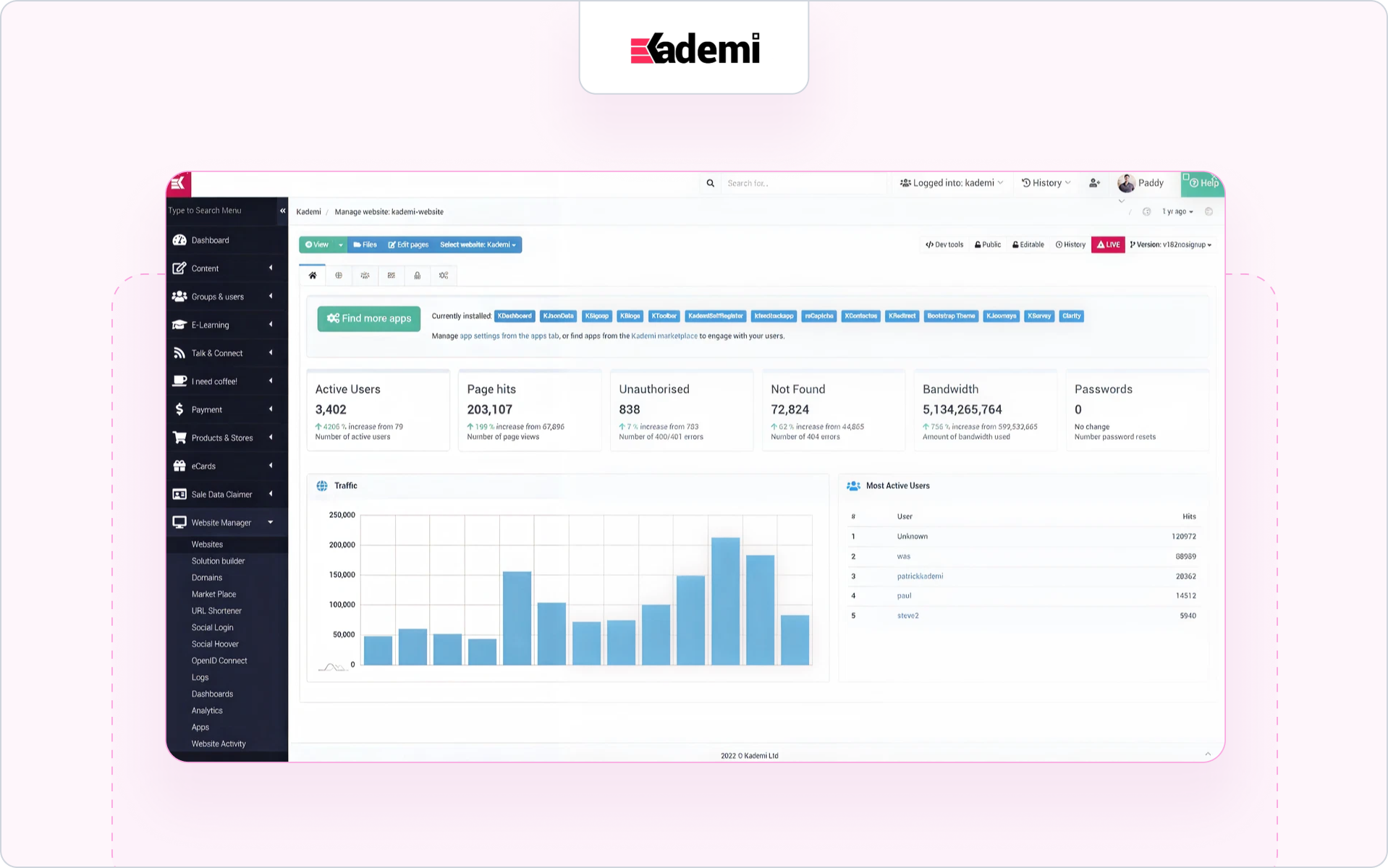

12. Kademi

Kademi focuses on partner enablement, incentives, and engagement, with deal registration included.

Who it’s for

Partner programs that rely heavily on motivation, gamification, and performance tracking.

Why choose it

Combines deal registration with incentives, certifications, and training.

Standout capabilities

Gamification, rewards, content libraries, and deal forms in one portal.

Keep in mind

Best suited for programs where partner loyalty is the main driver.

Integrations/notes

CRM and marketing tool integrations to support partner programs.

13. Partnerize

Partnerize supports partnership management across affiliates, influencers, and strategic partners.

Who it’s for

Enterprise brands with hybrid partner programs, including both performance and strategic partnerships.

Why choose it

Tracking, contracting, and attribution across many partner types, including deal-like flows.

Standout capabilities

Payments, performance reporting, partner discovery, and flexible contracting.

Keep in mind

Not built for classic B2B co-sell deal registration.

Integrations/notes

API-driven integrations for analytics, data warehouses, and performance platforms.

14. TUNE

TUNE is a customizable partner platform for app, mobile, and performance-driven programs.

Who it’s for

Mobile-focused vendors and performance teams that need flexible tracking.

Why choose it

Open APIs let teams design their own partner workflows, including light deal-style submissions.

Standout capabilities

Custom tracking, flexible partner types, and strong analytics.

Keep in mind

Not designed for B2B channel sales or structured deal registration.

Integrations/notes

API-first, integrates with mobile and ad-tech ecosystems.

15. Affise

Affise powers performance and affiliate programs with tracking, attribution, and partner management.

Who it’s for

Digital commerce vendors working with large performance networks.

Why choose it

High-scale partner tracking with optional lead or deal-style inputs.

Standout capabilities

Fraud protection, performance analytics, and flexible payout setups.

Keep in mind

Not a traditional channel sales platform; confirm fit for B2B deal registration needs.

Integrations/notes

Analytics, BI tools, and performance marketing platforms.

16. Salesforce PRM

Salesforce PRM extends Sales Cloud with partner portal and deal registration features.

Who it’s for

Companies standardized on Salesforce that want deal registration inside their CRM.

Why choose it

Partners register deals through a branded portal built on Experience Cloud with native Salesforce objects.

Standout capabilities

Partner portal, opportunity sharing, channel sales workflows, and training through Trailhead.

Keep in mind

Out-of-the-box UX is basic; usually needs admin support to fine-tune.

Integrations/notes

Deep Salesforce ecosystem integration, including Slack.

We know reviewing this many tools can feel overwhelming, but having a clear comparison helps you focus on what truly improves partner adoption and reduces friction.

The best way to narrow your list is to run a small, structured test.

So how do you compare platforms in a way that reflects real partner behavior?

Your 30-day deal registration software evaluation plan

A simple, structured test is the easiest way to see which deal registration software your partners will actually use.

In our experience, a short evaluation reveals far more than feature lists or demos. It shows how your channel partners register deals in real conditions, how clean your deal data stays, and which tool removes friction for your teams.

Week 1: shortlist and configure

Start with two or three options from your list. Set them up with the basics:

- Deal fields, partner segments, and approval rules

- Off-portal intake through email, Slack, or a lightweight form

- CRM sync for deal stages and ownership

This gives you a real view of how each deal registration tool fits your sales process.

Week 2: run a small partner pilot

Invite ten partners from different partner segments. Ask them to register deals the same way they usually would and watch what slows them down.

Measure:

- How fast partners register deals

- What questions they ask during the deal registration process

- How easily they stay informed as deal data updates in your CRM

This shows the difference between portal-heavy tools and software deal registration that partners enjoy using.

Week 3: evaluate performance

Focus on the signals that matter for channel programs:

- Submission time and approval speed

- Percent of accepted deals and clean deal stages

- Partner feedback on ease of use and partner satisfaction

These metrics show which platform improves partner pipeline visibility and reduces channel conflict across teams.

Week 4: choose your winner

Share your findings with sales leadership and internal channel managers. Here are the steps:

- Highlight what helped partners register deals faster,

- Look at where deal data stayed clean,

- and evaluate which deal registration software supported your channel partners without extra effort.

A fast path forward is to adopt the tool that reduces friction and improves forecasting.

Want to see how a CRM-first workflow feels in Salesforce or HubSpot? Request an Introw demo.

To understand how this plays out when partners register deals without hesitation, it helps to look at how Introw handles the entire flow.

Why SaaS teams pick Introw for deal registration

If you want partners to register deals consistently, keep deal data clean, and avoid channel conflict, the experience has to be simple.

Introw was built for that.

It meets partners where they already work, keeps your CRM as the single source of truth, and removes the manual work that slows teams down.

A quick look at how Introw compares

The results teams see with Introw

Introw is used in real partner programs that need reliable deal registration software. One example comes from SANDSIV, where moving away from spreadsheets to a CRM-first workflow created a measurable impact.

This lift came from reducing friction, improving partner satisfaction, and giving internal sales teams clear visibility into deal stages across different partner segments.

Your next steps

If you want your partner program to run with less friction and more consistency, here are three simple places to start:

- Audit your current deal registration process

Identify where partners get stuck, which steps require manual updates, and where deal data becomes unreliable in your CRM. - Test two or three tools with real partners

Even a small pilot shows which platform supports your channel partners and which ones create more work. - Compare CRM-native workflows

Look closely at how each tool handles deal stages, approvals, and pipeline visibility inside Salesforce or HubSpot.

Ready to see what a CRM-first, partner-friendly workflow looks like in practice? Schedule a short Introw session and request a demo today.

Partner Lead Registration: Capture Leads Without Logins in 2026

Great partner programs die on their first form. You want partners engaged, but the moment they hit a login wall, many stop. The good news: you can run partner lead registration without a portal login, keep data clean, and still resolve ownership fast. Below is a practical guide for teams that want more registered leads, fewer disputes, and a smoother sales process.

Why partner lead registration matters now

As your partner ecosystem grows, multiple partners find the same end customer, sales reps ask “who owns this account,” and leadership needs pipeline visibility. Lead registration (capturing a partner-sourced prospect early) protects the partner’s effort, reduces channel conflict, and lets you assign leads to the right team fast. It also creates a trail you can trust for commission payments and co-sell attribution.

When you make registration lightweight and fair, partners stay engaged, your sales team sees context, and operations keep a single source of truth for registered leads and registered deal records.

What “partner lead registration” is (and how it differs from deal registration)

Think of lead registration as the earliest claim: the partner flags a prospect with enough data for you to review and accept or decline. Deal registration comes later, once there’s a qualified opportunity with stage, amount, and next steps. Both fit inside modern partner programs, but they serve different moments:

- Lead registration: fast intake to assign leads, mark a cooling-off period, and prevent multiple partners from colliding on the same company.

- Deal registration: deeper validation to approve an existing deal with co-sell motions, attached resources, and clear SLAs.

Successful programs use both. Start with easy lead registration to capture more top-of-funnel, then elevate to deal reg when real pipeline appears.

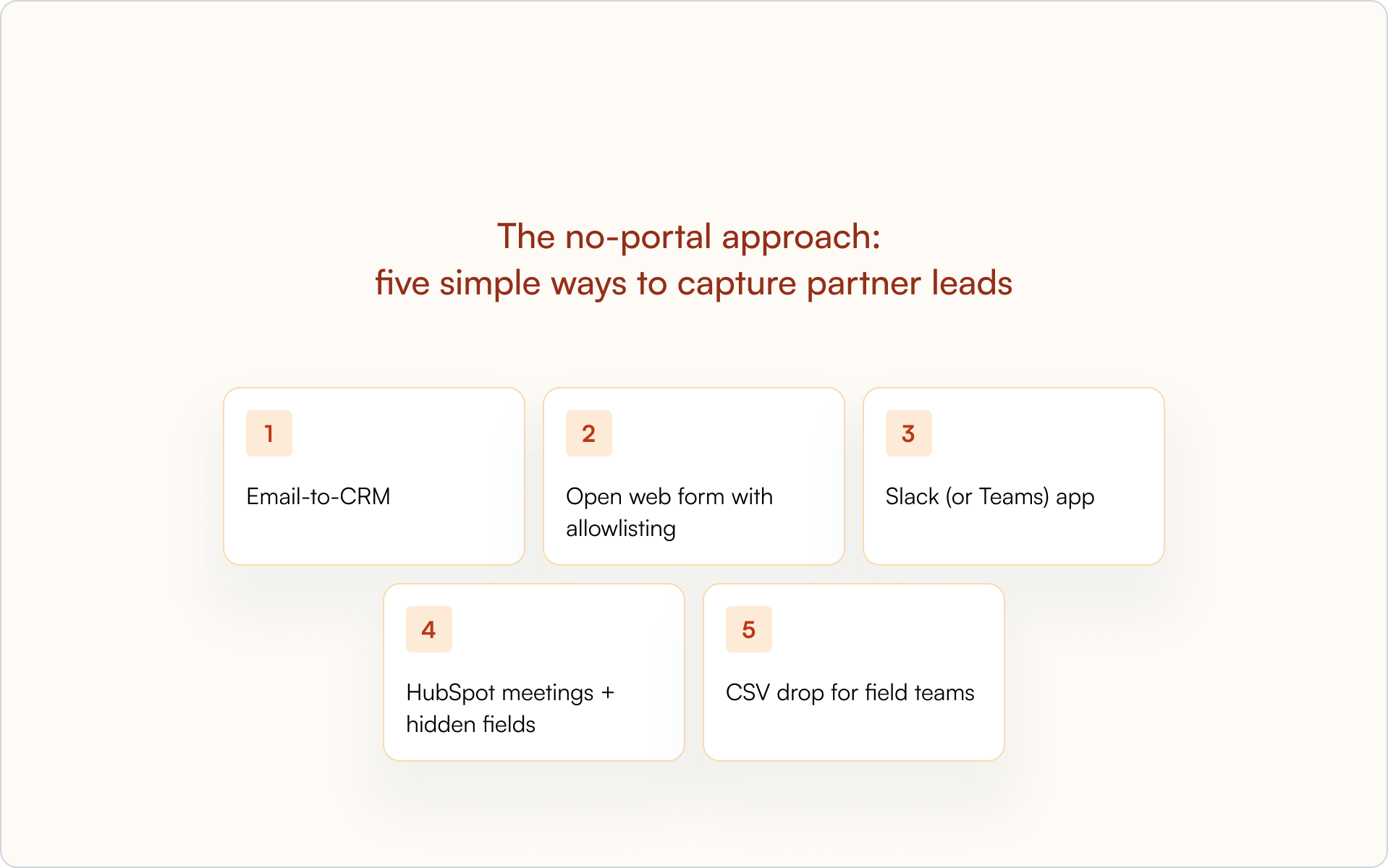

The no-portal approach: five simple ways to capture partner leads

Logins are the biggest drop-off point. You can capture leads without a portal login and still keep control.

- Email-to-CRM

Give partners a single address (for example, partners@yourcompany.com). When they send a short “registration form” by email (company name, contact, problem, consent), an automated flow parses the message, creates the record, and returns a case number and status.

- Open web form with allowlisting

Host a short registration form that’s public but gated by reCAPTCHA and a partner email domain check. Submissions create a lead and kick off validation, while approved third parties (your partners) get instant confirmation and a “pending” badge.

- Slack (or Teams) app

If you co-sell in shared channels, let partners use a “/register” slash command. The bot collects company, contact, use case, and creates the registered deal or lead in your system, then posts back the record link.

- HubSpot meetings + hidden fields

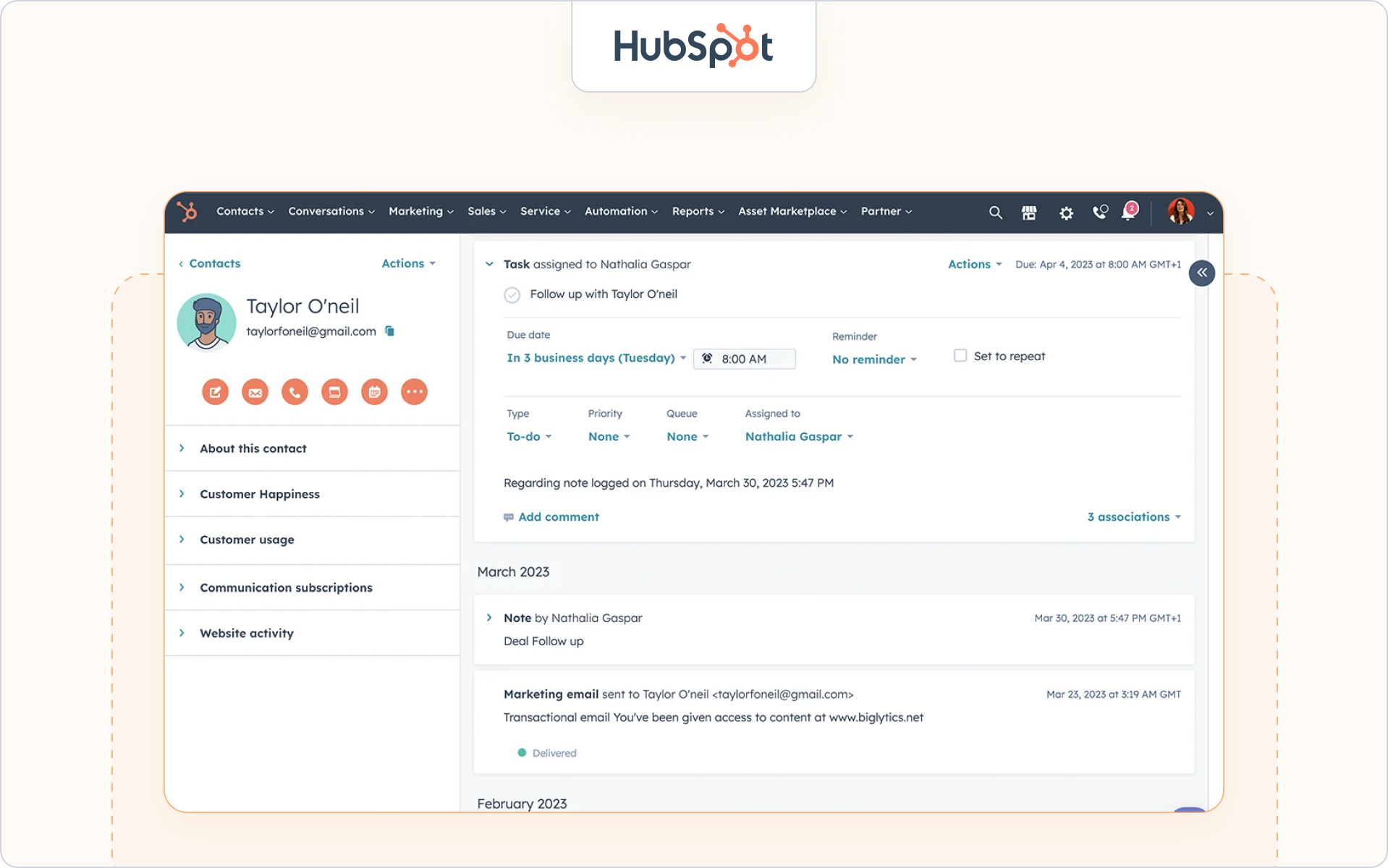

For HubSpot partner lead registration, use a short form attached to a partner-facing “Book a discovery” page. Hidden fields tag partner ID and program. When the form is submitted, HubSpot creates the contact, company, and a deal stub, and your workflow moves it to “Submitted for review.”

- CSV drop for field teams

Some service partners prefer bulk. A controlled CSV upload (fields validated on import) lets them register a new deal list weekly. Your system dedupes by domain and company name, flags conflicts, and returns approved/declined with reasons.

All five methods can feed the same backend rules, the same partner portal views, and the same commission plan. The difference is friction: partners can register from wherever they already work.

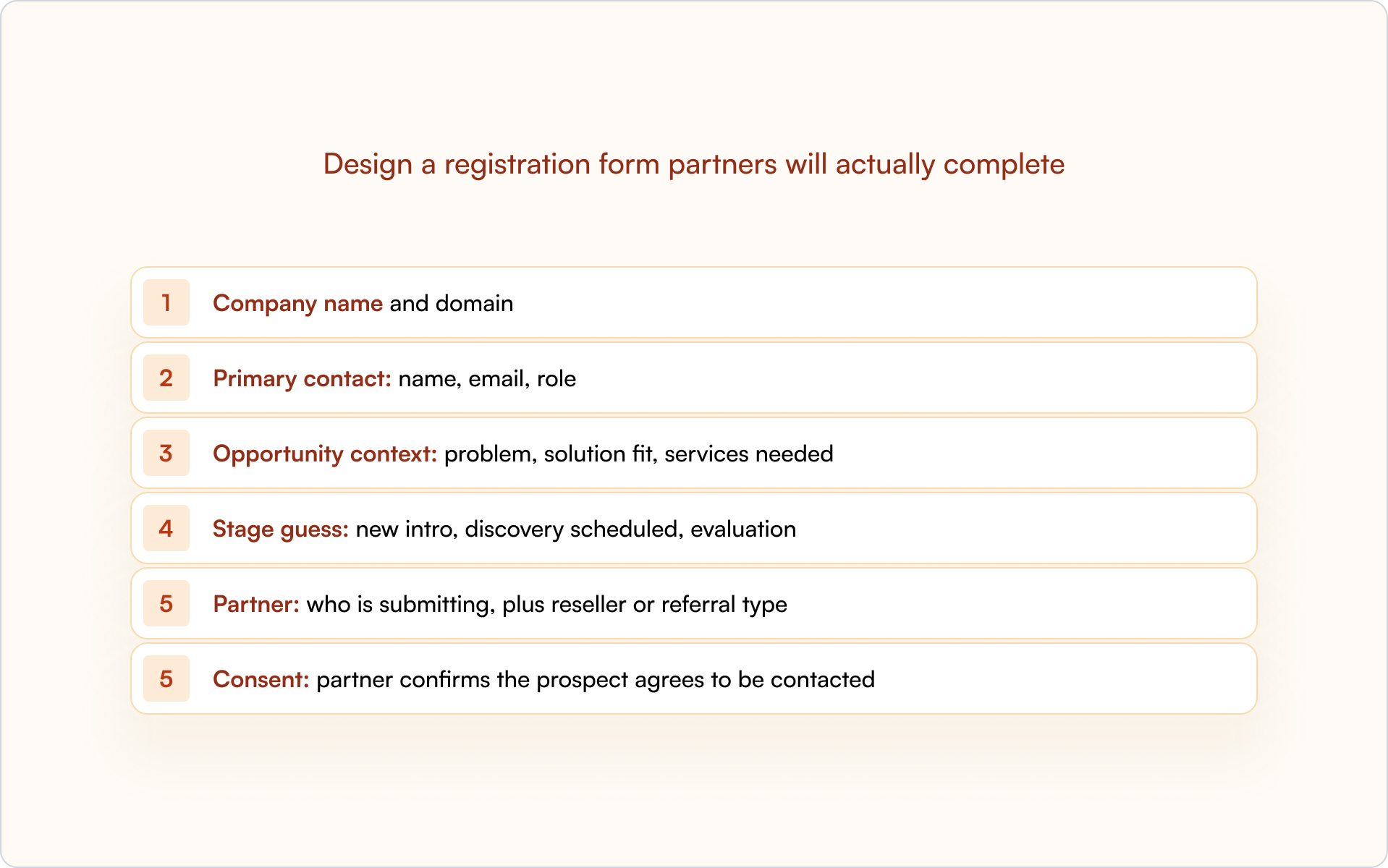

Design a registration form partners will actually complete

Keep it under a minute. These fields usually give you enough to decide:

- Company name and domain

- Primary contact: name, email, role

- Opportunity context: problem, solution fit, services needed

- Stage guess: new intro, discovery scheduled, evaluation

- Partner: who is submitting, plus reseller or referral type

- Consent: partner confirms the prospect agrees to be contacted

Optional, when needed: geography, target revenue, product interest, and competing vendors.

Make validation fair: from “submitted” to “approved” without drama

A good lead reg process balances speed and fairness. Publish the rules, enforce them consistently, and give partners a clean status they can see.

- SLA: respond inside two business days.

- Checks: duplicate by domain, existing deal check, territory rules, blocked accounts.

- Results: approved (with hold window), ask for more info, or declined (with reason).

- Hold window: 60–90 days of protection when partners complete the next step (for example, first meeting or intro email logged).

- Channel conflict: if two partners submit the same prospect, the one who got the first meeting within the window wins, or you split by segment/solution if that’s your policy.

Introw codifies these rules so operations doesn’t have to referee edge cases every week.

Map it to your CRM: HubSpot and Salesforce without side spreadsheets

Whether you run Salesforce or HubSpot, treat partner lead registration like any other intake you want to automate and audit.

- Objects: create a “Partner Registration” object or use a custom property set on Deals to track registration, status, partner, and window end date.

- De-dupe: auto-link to Company by domain; show “existing deal” if one is open.

- Workflows:

- Submitted → Validation queue → Approved/Declined

- Approved → Notify AE/partner → Start sales process tasks

- First meeting scheduled → Lock or extend hold window

- Dashboards: real time dashboards for operations and partner managers: pending, aging, approvals, meeting rates, win rates.

For HubSpot partner lead registration, keep your registration form in HubSpot, route through workflows, and surface status to partners via automated emails or a lightweight shared page. On Salesforce, mirror the same flow with Process Builder or Flow.

Incentives and SLAs that keep partners engaged (without overpaying)

You don’t need to pay for every submission. Reward progress, not spam.

- Tiered incentives: small flat fee when the first meeting is completed, larger percentage on new customers won, and accelerators for high margin products.

- Partner tier alignment: higher tiers may get faster response, priority support, or co-sell resources.

- SLAs: you respond within two days; the partner books a meeting within 14 days; your rep updates next steps after every call. Clear, mutual commitments build trust.

Seven metrics that prove the system works

Leaders care about outcomes. Measure what moves revenue and reduces friction.

- Registration-to-meeting rate within 14 days

- Approval rate by partner and segment

- Conflicts avoided vs. unresolved disputes

- Win rate and sales volume on approved registrations

- Time to first response and time to approval

- Active protection windows by region and product

- Commission payments accuracy and cycle time

When the numbers are visible, you can adjust commission structures, spot partner behavior trends, and focus enablement where it helps most.

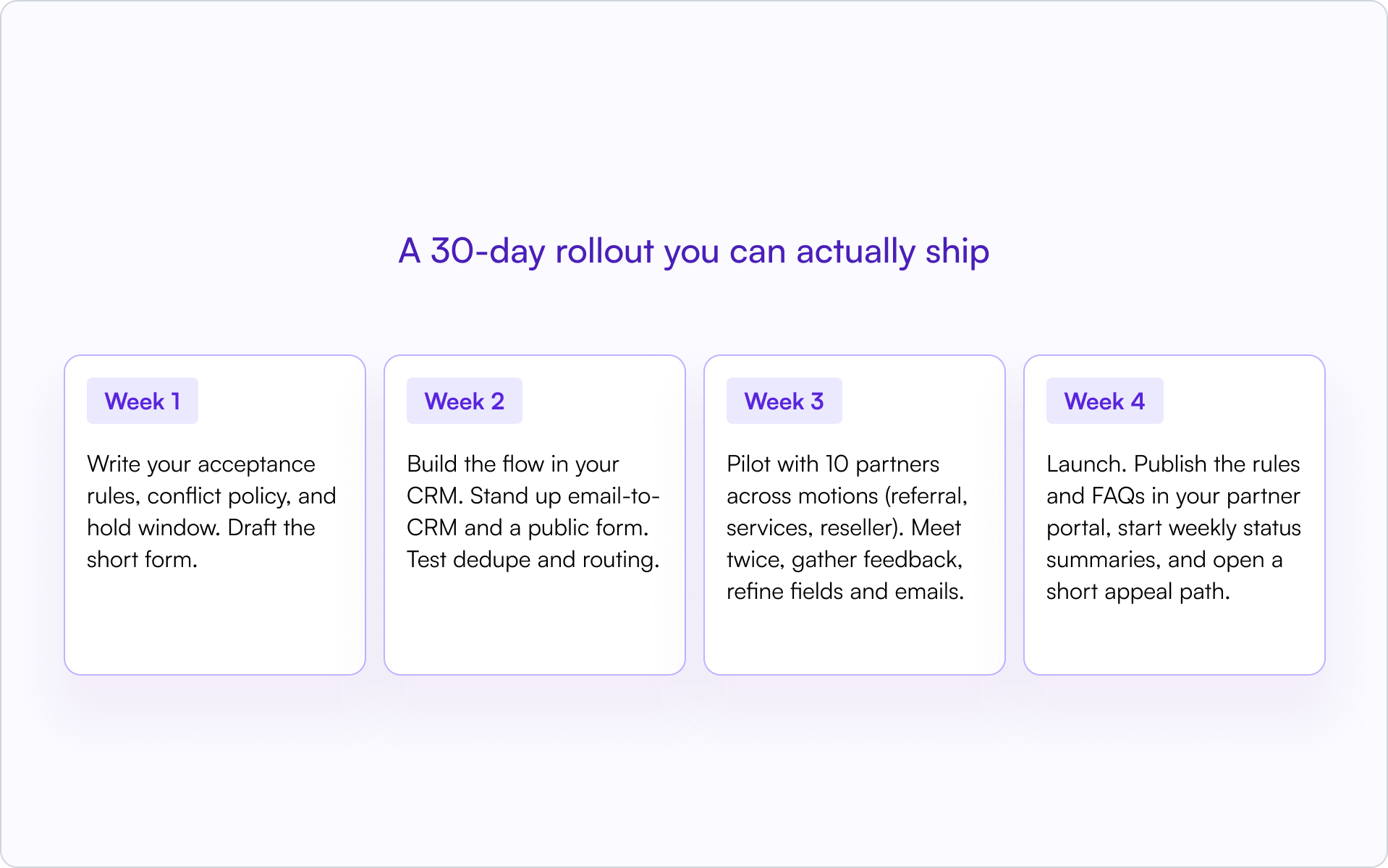

A 30-day rollout you can actually ship

You don’t need a massive project to modernize lead reg. Keep it tight and iterative.

- Week 1: Write your acceptance rules, conflict policy, and hold window. Draft the short form.

- Week 2: Build the flow in your CRM. Stand up email-to-CRM and a public form. Test dedupe and routing.

- Week 3: Pilot with 10 partners across motions (referral, services, reseller). Meet twice, gather feedback, refine fields and emails.

- Week 4: Launch. Publish the rules and FAQs in your partner portal, start weekly status summaries, and open a short appeal path.

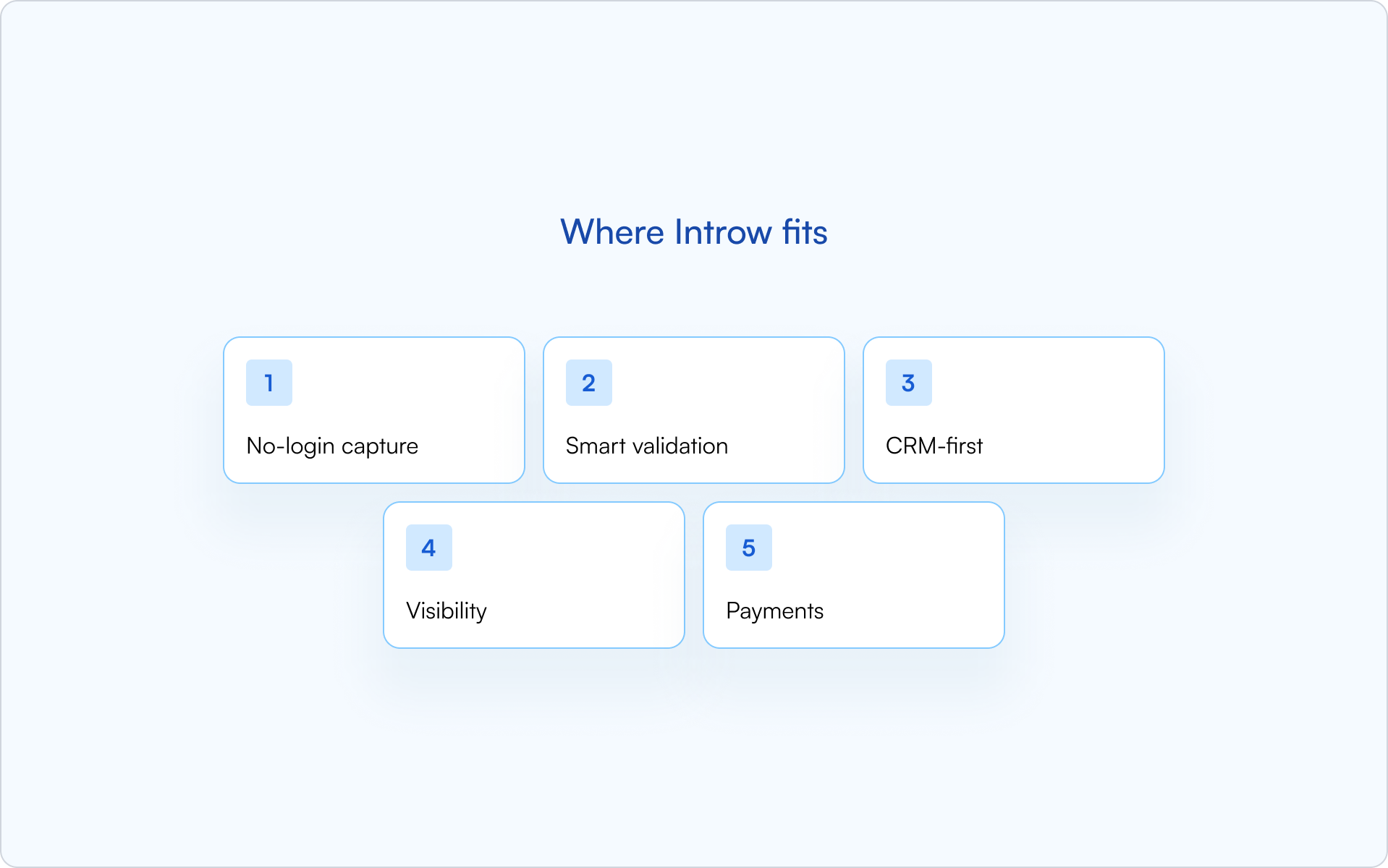

Where Introw fits

Introw is built to remove friction from partner lead registration and deal registration alike:

- No-login capture: partners register via email, a shared page, or Slack; Introw creates the record and sends status.

- Smart validation: automatic dedupe, account checks, and clear status transitions from submitted to approved to won.

- CRM-first: bi-directional sync with Salesforce or HubSpot, so ops and reps work in systems they already know.

- Visibility: partners see progress and next steps without asking you to “check the portal.”

- Payments: clean attribution makes commission management straightforward and commission payments timely.

If you’re ready to move beyond “please log in and fill this long form,” Introw gives you a lightweight, auditable path to more revenue and fewer headaches.

Ready to simplify partner lead registration?

If you want partners engaged, fewer conflicts, and clean data, make registration effortless and visible. Introw lets you capture leads without logins, validate fairly, and sync everything to your CRM so your sales team and partners can focus on winning. Request a demo and see how it works in your environment.

Partner Content Enablement Guide (That Actually Reaches Your Partners in 2026)

If you have ever asked what is content enablement, think of it as the connective tissue between creating content and closing deals. It is the discipline of organizing, delivering, and measuring sales enablement materials so sellers and partners can move prospective customers through the sales funnel with less friction. In a partner context, content enablement meaning widens: you are equipping external channel partners with up to date partner content and giving your internal sales team visibility into how it was used before a purchase order shows up.

Why is this urgent in 2026? Creation points keep multiplying. Marketing teams ship pages, playbooks, and videos. Sales reps record custom demos. Product managers publish technical specifications and security FAQs. Without a content enablement strategy, valuable content scatters across drives and chat threads. Partners guess which version is current, legal fees rise because brand risk slips through, and sales cycles drag while people hunt for the right slide. A thoughtful partner enablement strategy fixes this by aligning business content to buyer engagement and making it simple for partners to find, send, and track.

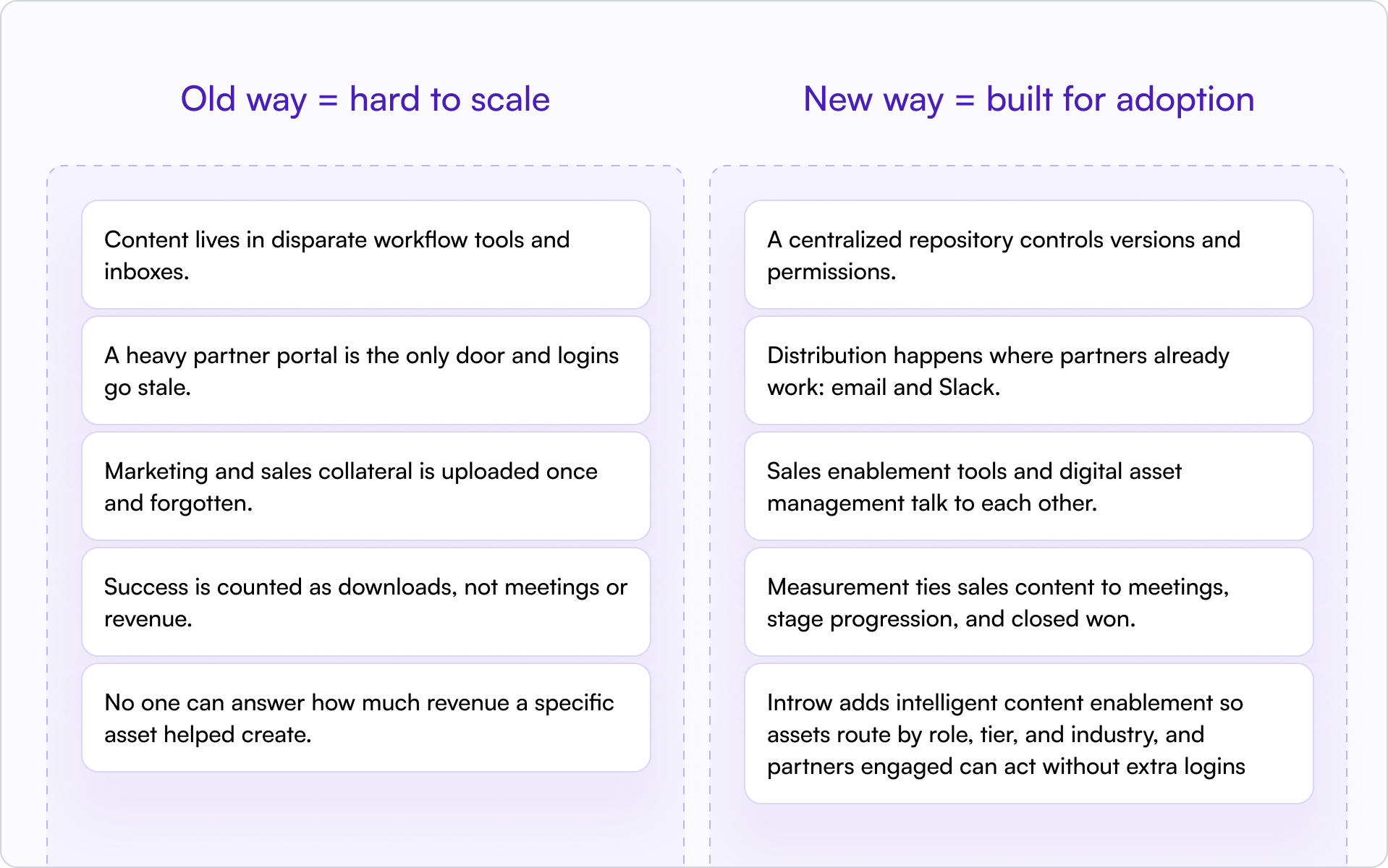

The old way versus the new way of enabling partners

It helps to name the shift so your partner program knows what will change and why.

Old way, hard to scale

- Content lives in disparate workflow tools and inboxes.

- A heavy partner portal is the only door and logins go stale.

- Marketing and sales collateral is uploaded once and forgotten.

- Success is counted as downloads, not meetings or revenue.

- No one can answer how much revenue a specific asset helped create.

New way, built for adoption

- A centralized repository controls versions and permissions.

- Distribution happens where partners already work: email and Slack.

- Sales enablement tools and digital asset management talk to each other.

- Measurement ties sales content to meetings, stage progression, and closed won.

- Introw adds intelligent content enablement so assets route by role, tier, and industry, and partners engaged can act without extra logins.

The new way respects how sales partners actually sell and how marketing teams want to manage brand consistency.

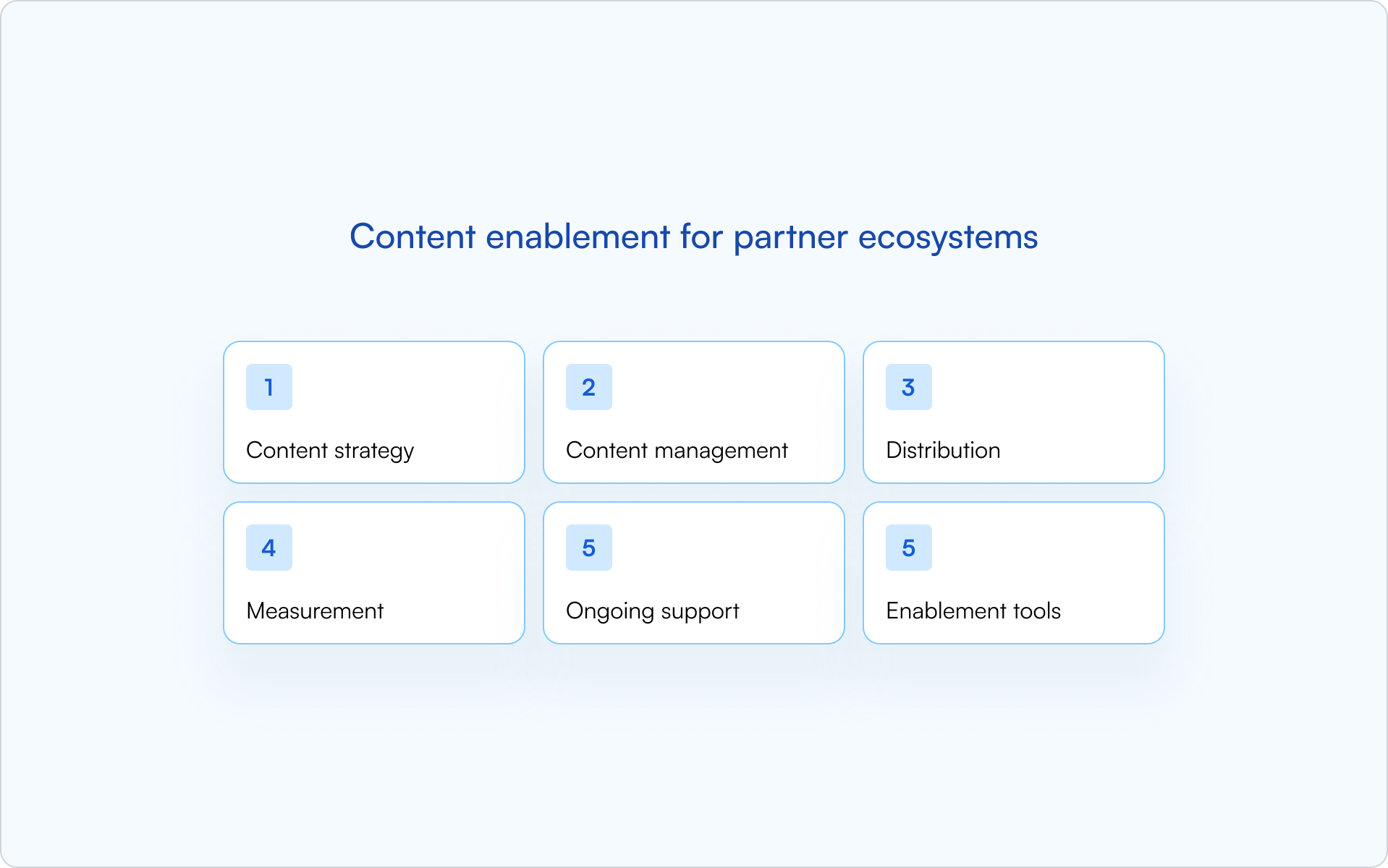

The expanded definition: content enablement for partner ecosystems

Let’s expand the definition so you can design an effective partner enablement strategy that fits a modern partner ecosystem.

- Content strategy maps formats to customer personas, objections, and stages. This is where value propositions are clarified and marketing materials are prioritized.

- Content management ensures managing content is safe and simple. Digital asset management, access controls, and data security keep everything current and compliant.

- Distribution puts partner enablement content into the flow of work. Think push delivery for urgency and a partner content hub for browsing and training.

- Measurement connects actions to outcomes. Key performance indicators live in your CRM and show what content actually shortens the sales cycle and improves sales performance.

- Ongoing support keeps partners engaged. Sales training, partner enablement training, and office hours help partners apply the message on real sales calls.

- Enablement tools automate the boring parts. Sales AI tools can flag stale claims, suggest next best content, apply AI powered spell checking to drafts, and even trigger document generation for localized one pagers.

This expanded definition turns a pile of files into a repeatable system.

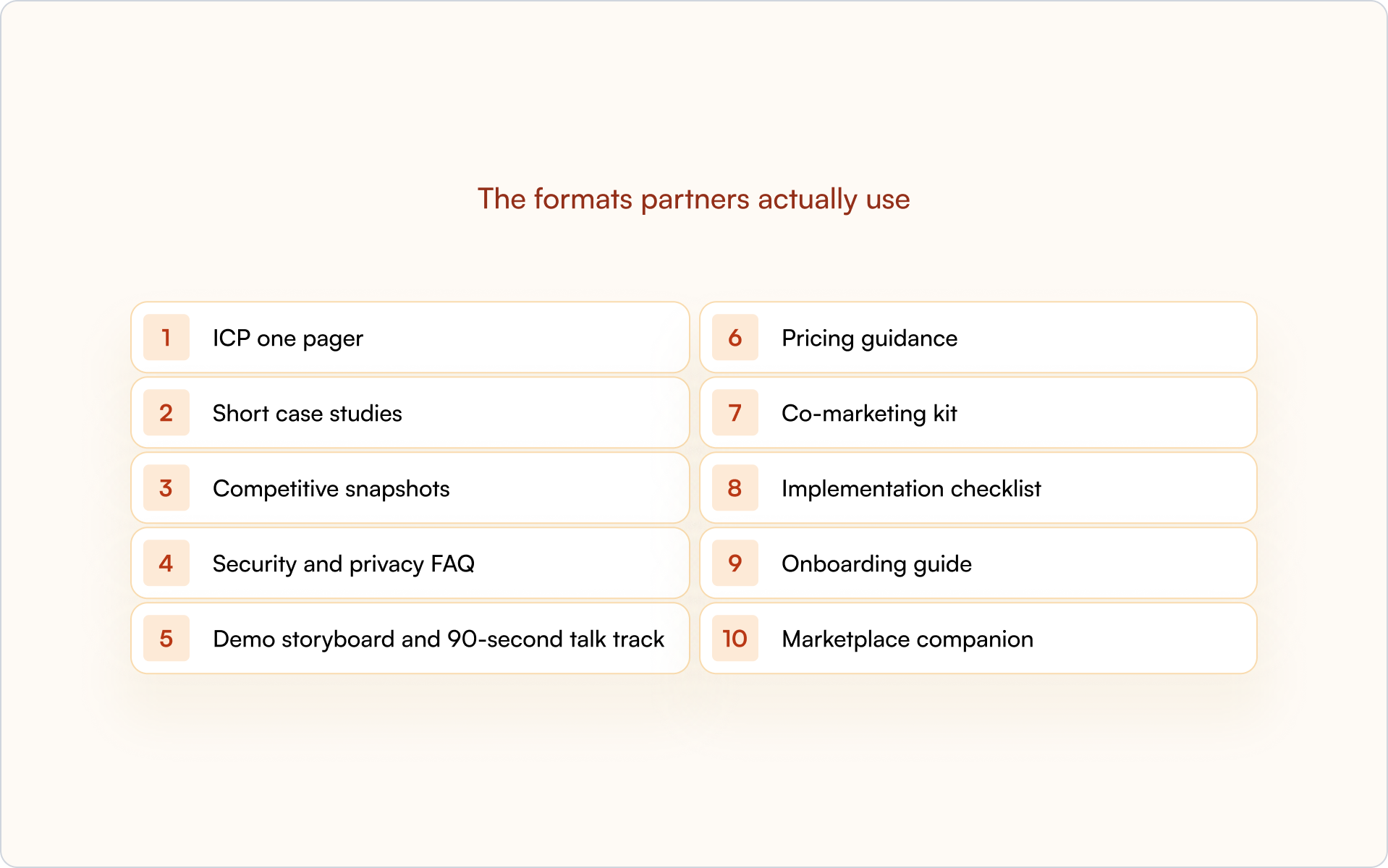

The formats partners actually use — and why they work

You do not need hundreds of assets to support channel partners. You need a tight core mapped to the buyer journey, plus a plan to keep it up to date. Here is a practical short list that consistently moves deals:

- ICP one pager that captures pains, triggers, and crisp value propositions for your target audience.

- Short case studies with outcomes, named roles, and a quote you can reuse.

- Competitive snapshots with three differentiators and traps to avoid.

- Security and privacy FAQ that answers procurement’s first questions and reduces back-and-forth.

- Demo storyboard and 90-second talk track that link features to jobs-to-be-done.

- Pricing guidance that explains models without revealing internal margins.

- Co-marketing kit with a landing page outline, two emails, and three social posts that partners can localize.

- Implementation checklist for services partners, including technical specifications and boundaries.

- Onboarding guide that sets expectations for handoff and adoption.

- Marketplace companion if you transact through AWS Marketplace or Google Cloud Marketplace.

Each item should show an owner, a version date, and a stage. That simple metadata is how sales and marketing teams keep confidence high.

Building your partner content engine in five steps

Every step here flows into the next, so avoid skipping ahead. You are building a system, not just uploading files.

Step 1. Align on audiences, motions, and use cases

Start with segmentation. Split your partner ecosystem by motion — resell, referral, ISV, and services. Within each motion, separate sellers and consultants, then overlay partner tier and region. This gives you the targeting you need so a consultant does not receive first-call decks, and a reseller AE is not reading deep implementation playbooks.

Outcome: clear audiences for content and reporting, fewer irrelevant pings, better partner satisfaction.

Step 2. Audit existing content with ruthless clarity

Map every asset to discovery, evaluation, selection, or onboarding. Identify duplicates and outdated claims. Keep winners, merge near-duplicates, and retire risky files. Capture gaps that stall deals, like an absent security FAQ or a weak competitive snapshot. This is where content related technologies help: a digital asset management tool will expose duplicates, and enablement tools will surface low-use files to replace.

Outcome: a trimmed library that your internal team trusts and partners will actually reuse.

Step 3. Create the minimum viable set and standardize quality

Create marketing and sales collateral with a shared checklist: audience, use case, stage, owner, review cadence, legal status. Use standardized templates to speed document generation and maintain brand consistency. Where possible, add short narration guidance so sales reps know when and how to use the asset during sales calls.

Outcome: fewer, sharper pieces that are easier to keep up to date and safer to send.

Step 4. Distribute in the flow of work, not just the portal

A partner portal is useful, but it should not be the only door. Push content by email and Slack when timing matters. Let partners browse a partner content hub for training and self-serve discovery. Surface the next best asset inside your CRM when a sales rep opens an opportunity. Distribution should feel like today’s digital HQ, not a scavenger hunt.

Outcome: higher adoption, faster response, and less time spent hunting links.

Step 5. Measure what leaders care about and iterate quarterly

Replace vanity metrics with outcome metrics. Track first meetings within 14 days of send, stage progression on opportunities that received specific assets, influenced pipeline, and win rate deltas where content was used. Add operational KPIs like training completion and asset freshness. Review quarterly with partners and your internal sales team, then tune your content enablement strategy.

Outcome: proof that content moves revenue, not just downloads.

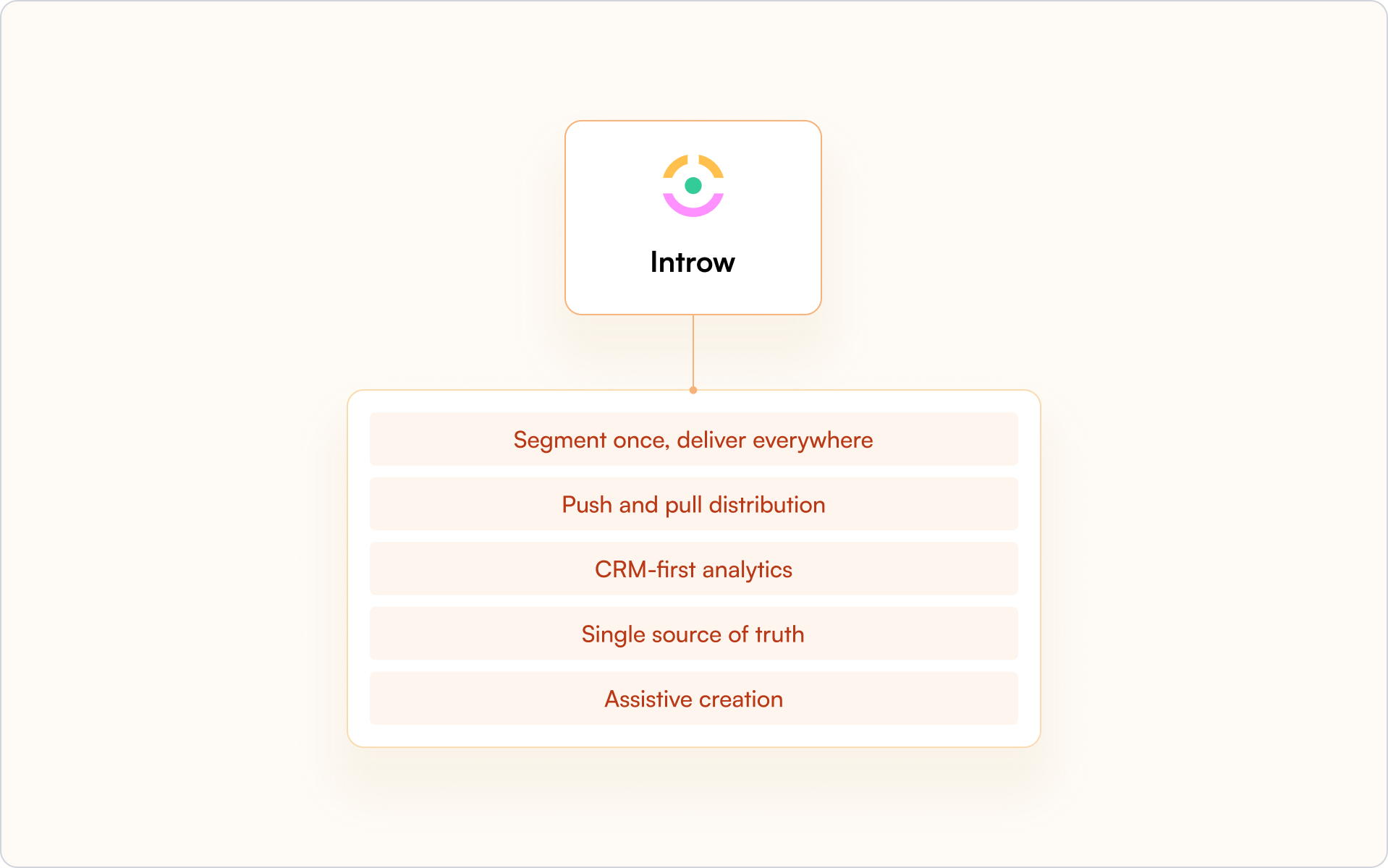

Where Introw fits — intelligent content enablement that partners adopt

Introw is built to make partner content reach the field and show up in your numbers.

- Segment once, deliver everywhere. Target by motion, tier, role, industry, certification status, or region. A reseller AE gets first-call assets and a co-marketing kit. A services architect sees implementation plays and product training.

- Push and pull distribution. Send content by email and Slack for urgency, while a lightweight partner content hub supports discovery and training. Partners do not need to learn a heavy system to stay current.

- CRM-first analytics. Engagement rolls up next to account and opportunity records so leaders can see which assets improve first-meeting rate, stage progression, and close won.

- Single source of truth. A centralized repository handles managing content, permissions, and data security. Owners and review cadences keep everything up to date.

- Assistive creation. Sales AI tools inside the workflow suggest next best content, flag stale messages, apply AI powered spell checking, and trigger document generation for localized one pagers.

This is partner content marketing that respects how partners sell and how marketing and sales teams want to measure.

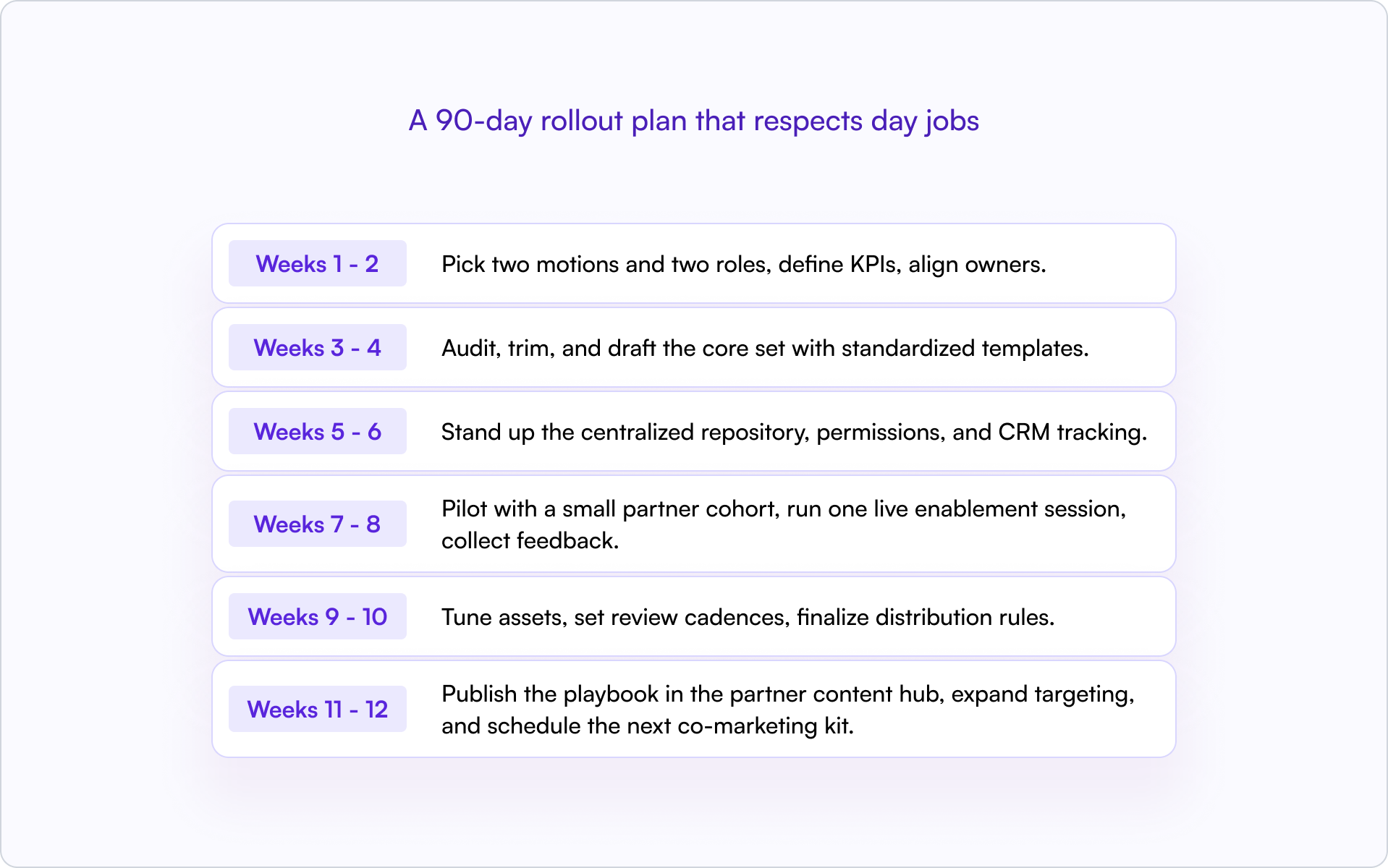

A 90-day rollout plan that respects day jobs

Long rollouts lose momentum. This plan gets you live fast and gives you space to improve.

Weeks 1–2 — pick two motions and two roles, define KPIs, align owners.

Weeks 3–4 — audit, trim, and draft the core set with standardized templates.

Weeks 5–6 — stand up the centralized repository, permissions, and CRM tracking.

Weeks 7–8 — pilot with a small partner cohort, run one live enablement session, collect feedback.

Weeks 9–10 — tune assets, set review cadences, finalize distribution rules.

Weeks 11–12 — publish the playbook in the partner content hub, expand targeting, and schedule the next co-marketing kit.

Because Introw connects segmentation, delivery, and analytics to your CRM, most of the wiring is configuration rather than custom work.

Bringing it all together

Great partner enablement is not about more files. It is about delivering relevant marketing content to the right people at the right time and proving it helped close business. When sales and marketing teams share a centralized repository, when content management is tight, and when distribution meets partners where they already work, buyer engagement improves and closing deals gets easier.

Introw adds the missing glue by combining segmentation, a partner content hub, push delivery, and CRM analytics so your channel partner enablement program turns content into revenue. If you want an effective partner enablement strategy that partners adopt and leaders can measure, Introw is ready to help.

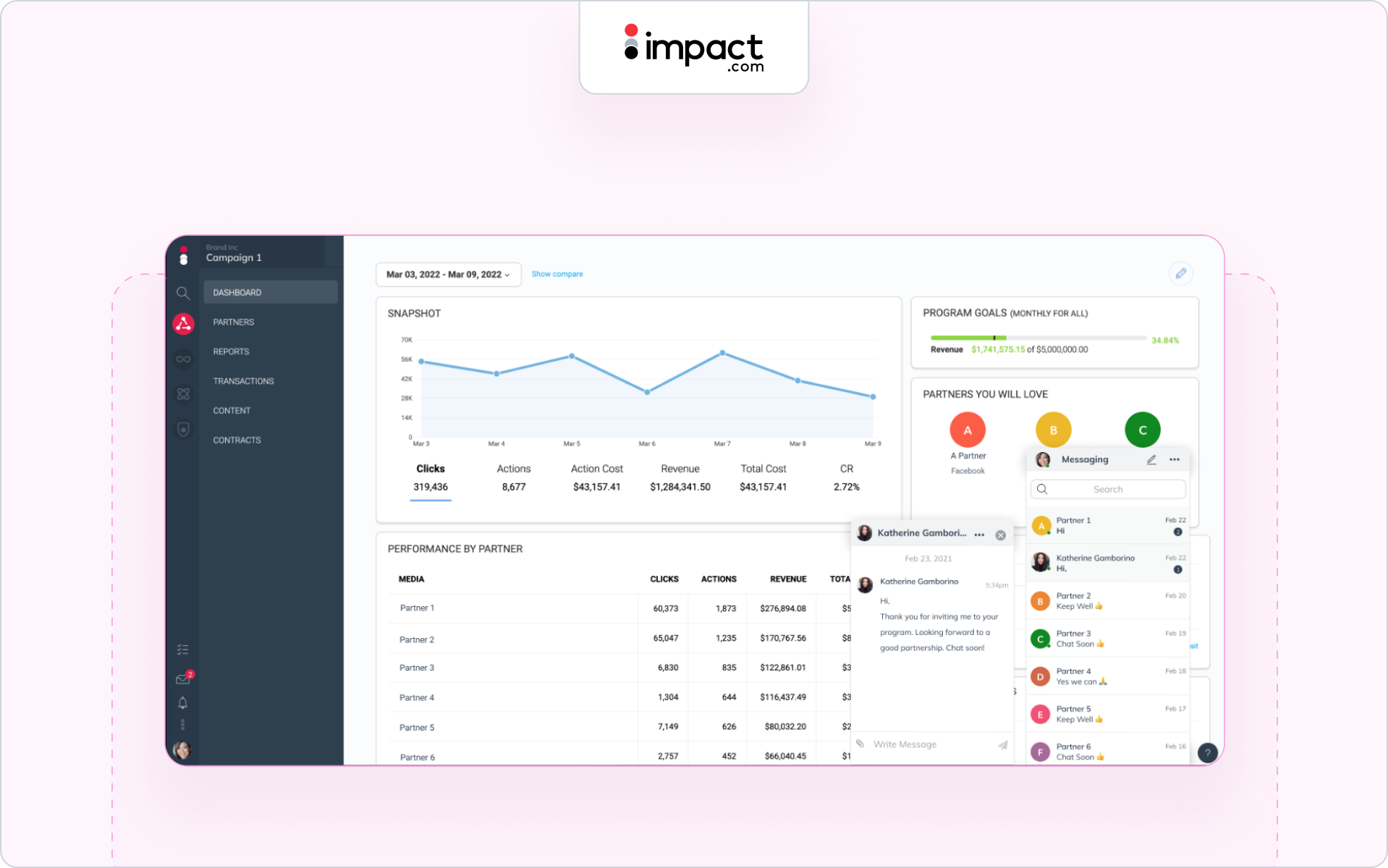

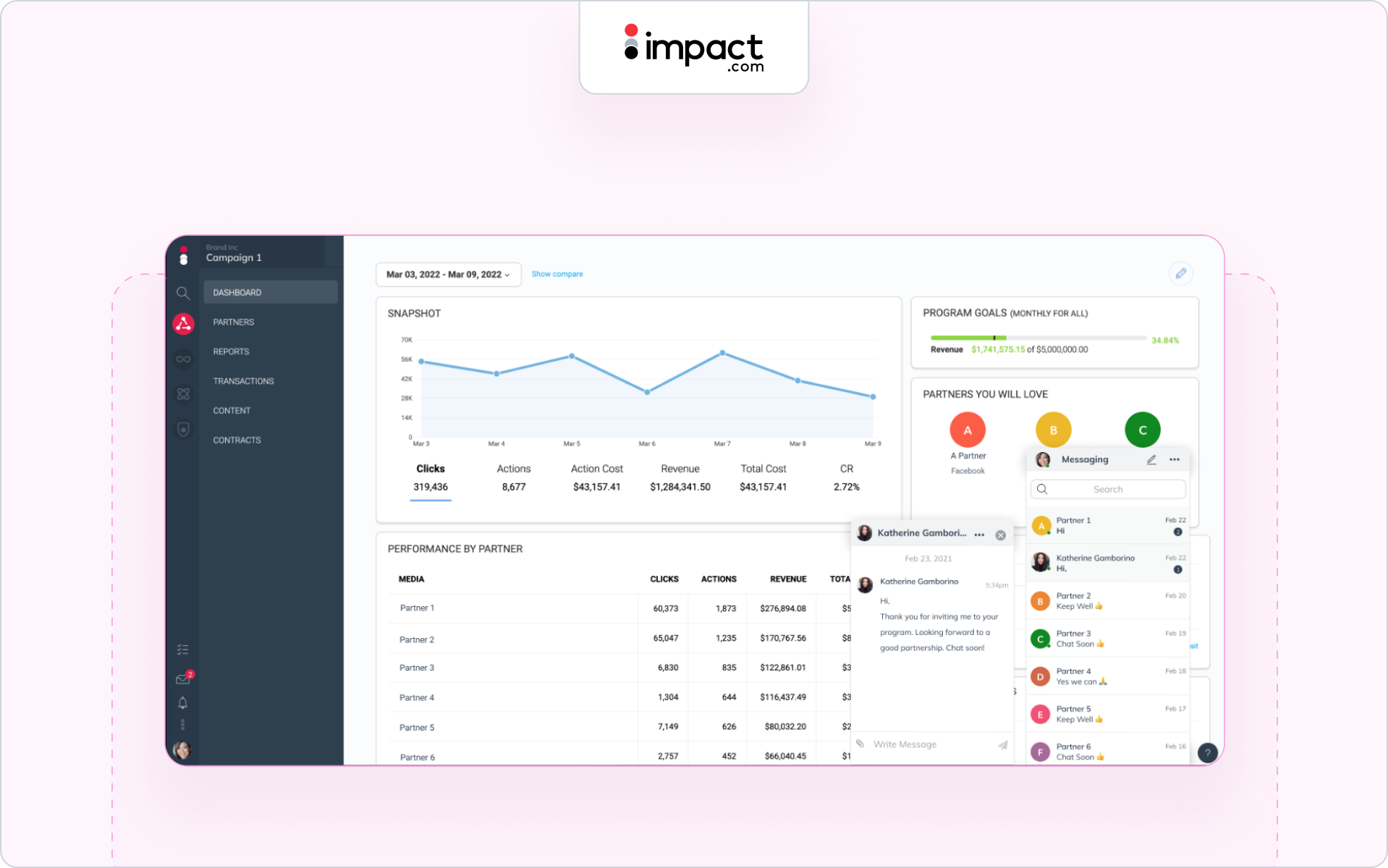

Top 15 Impact Alternatives for Effective Partner Management in 2026

Impact is a partnership management platform designed primarily for affiliate, influencer, and performance marketing programs.

It can be a handy tool if your business relies heavily on affiliates and influencers to generate sales.

However, if your partner program is broader in scope – perhaps your strategy is more channel-focused, for example – you’ll benefit from a more comprehensive partner relationship management (PRM) platform.

Ready to kick your partner management up a gear this year? Read on for our 15 top Impact.com alternatives in 2026.

Why Consider an Impact Alternative in 2026?

An end-to-end performance marketing tool, Impact excels at affiliate and influencer programs because that’s what it’s designed for.

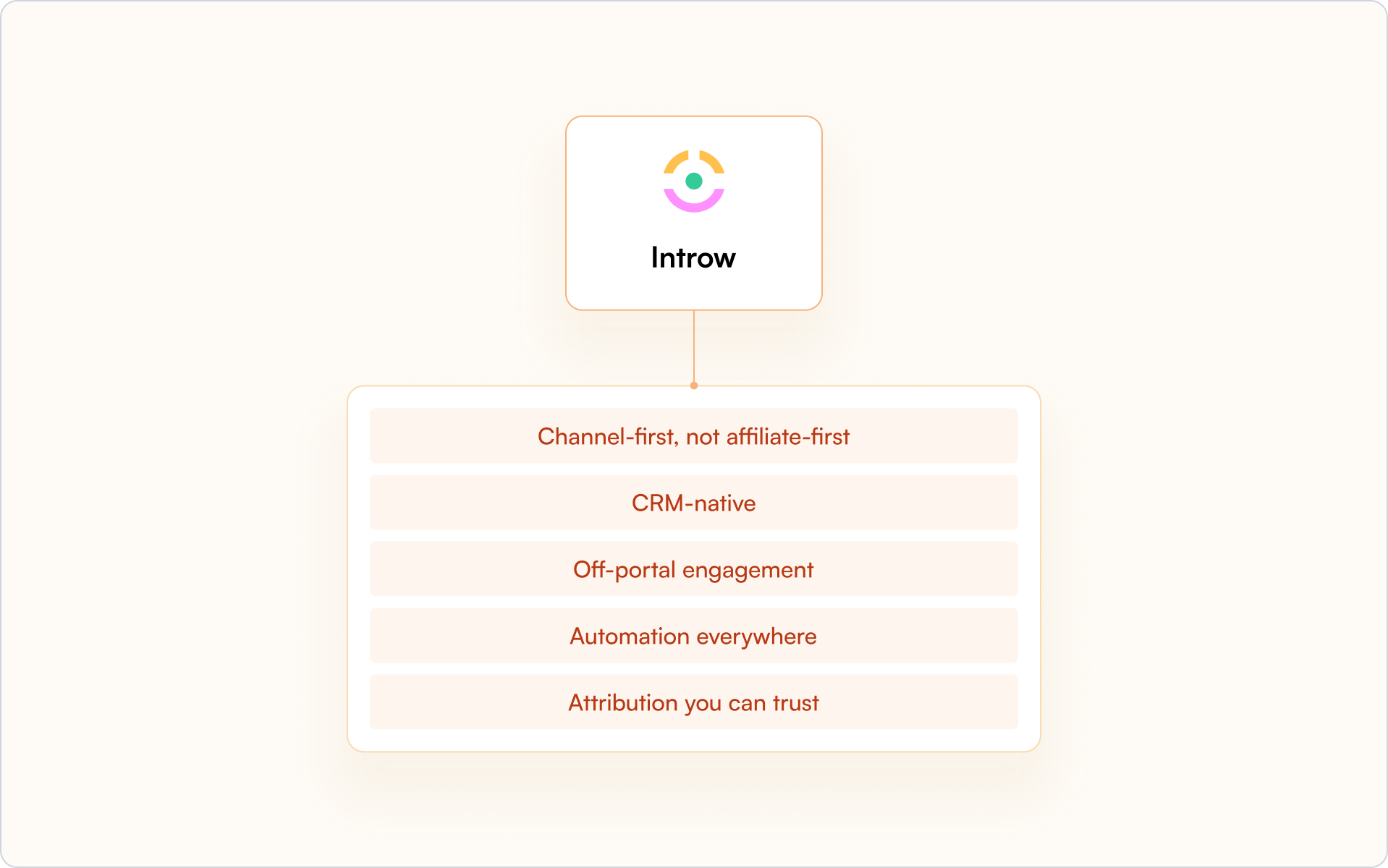

However, there are four major areas in which SaaS outstrips this online platform.

1. Limited CRM-Native Channel Workflows

Modern SaaS platforms like Introw work on top of your CRM, enabling seamless logging, tracking, and reporting directly inside Salesforce or HubSpot.

This deep embedding provides sales teams and all their partners with real-time visibility, eliminating the need to switch platforms.

However, Impact is browser and app-based, and requires teams and their partners to operate largely outside the CRM, which can create friction in channel workflows.

2. Deal Registration & Co-sell Motions Vs Affiliate Tracking

While Impact is certainly strong on affiliate tracking and commission management, it doesn’t fully support deal registration and co-sell motions.

Affiliate link tracking is primarily focused on click attribution, but SaaS functionality goes deeper, enabling joint selling motions, more meaningful collaboration, and improved pipeline visibility.

Indeed, try out a modern SaaS platform and you’ll generally find a structured deal registration pipeline, where partners can submit opportunities, collaborate with sales teams, and track progress through the funnel.

3. Off-portal engagement

Impact relies heavily on its portal for communication with partners.

In contrast, modern SaaS solutions meet partners where they already work – for example, email, Slack, or other collaboration tools.

What’s more, in 2026, this off-portal engagement is mostly automated, delivering updates surrounding deal stages, approvals, or payments into partners’ daily workflows.

And when it comes to saving time and boosting engagement, you can't beat automated outreach.

4. Attribution & Forecasting

Impact will track conversions and clicks, but SaaS platforms will typically offer more robust attribution and forecasting capabilities than this.

Indeed, SaaS tools directly tie partner activities to pipeline metrics, making it clear how each partner impacts revenue.

This makes strategic planning and forecasting much easier.

➡️ This is why, if your B2B partnerships include referral, reseller, or co-sell, it’s worth considering a CRM-first alternative to Impact. Learn more about Introw here, or read on for more information on shopping for the best alternative.

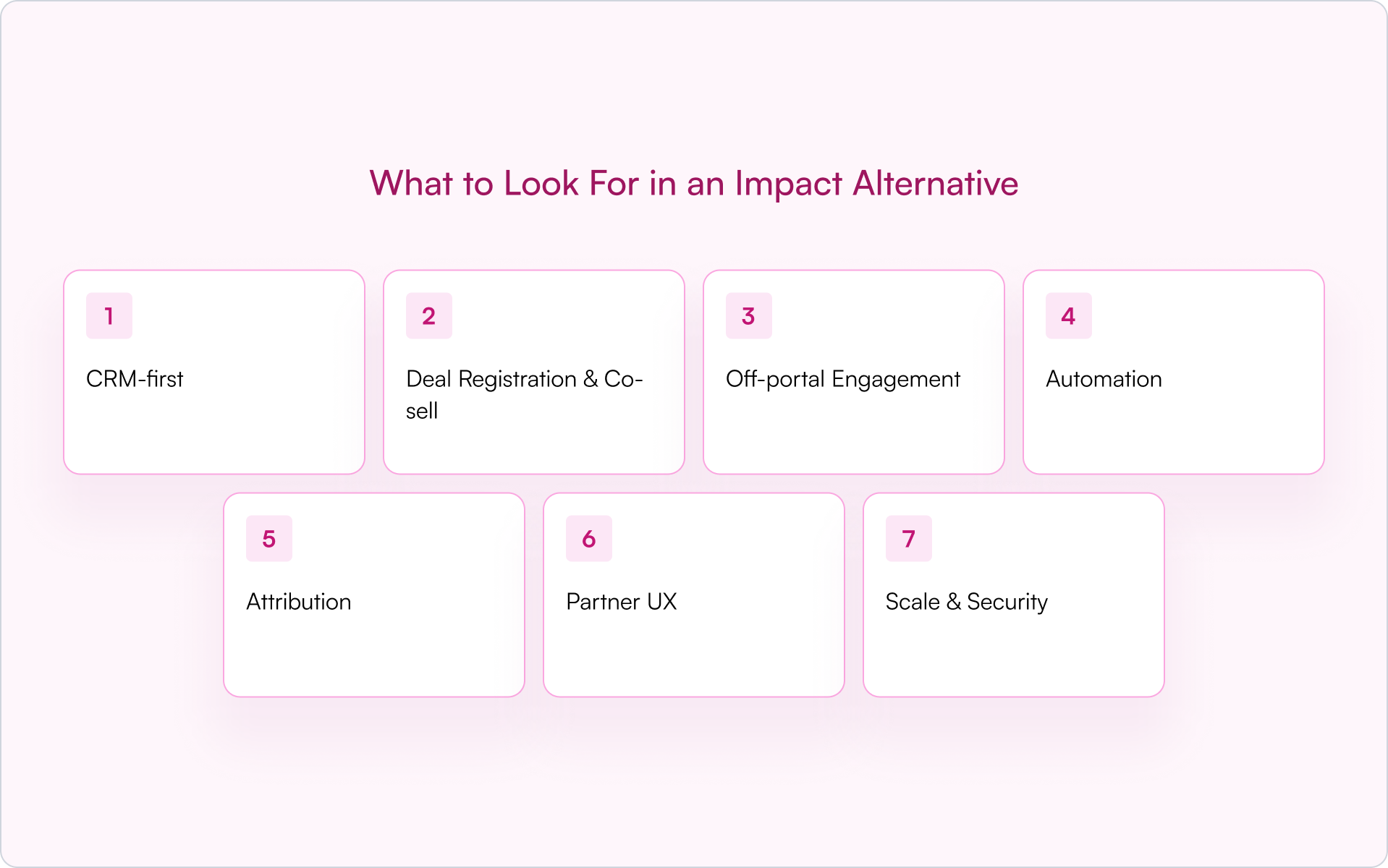

What to Look For in an Impact Alternative in 2026

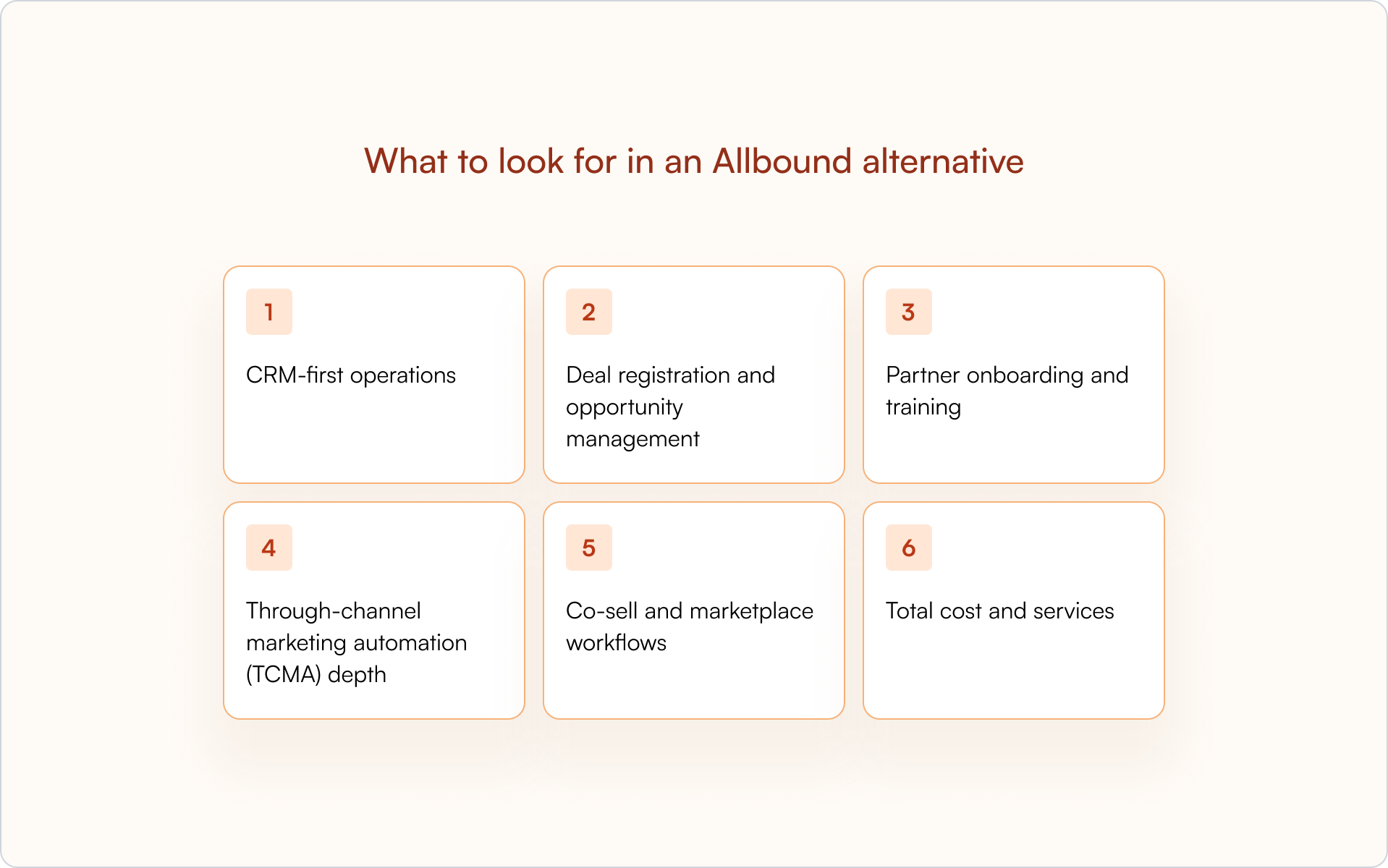

Considering swapping Impact for a modern PRM?

Here’s what you should be looking for when it comes to choosing your next PRM.

- CRM-first: Look for a PRM that integrates directly with your CRM, so partner records, fields, and reporting live natively in Salesforce or HubSpot.

- Deal Registration & Co-sell: Your new PRM should support seamless deal registration and co-selling by enabling a shared pipeline, mutual action plans, and conflict prevention.

- Off-portal Engagement: Forcing partners to log into a portal every time they need a quick update will put you on a fast track to disengagement. Instead, prioritize a PRM that delivers automated updates and alerts in channels they already use, such as email or Slack.

- Automation: Automation is a must-have in 2026. These tools help you launch and optimize campaigns, onboard partners, engage partners, send activity reminders and prepare for QBRs much more quickly, and with much less manual labour, than in the past.

- Attribution: Make sure your new platform provides clear attribution, from partner engagement through to pipeline and revenue impact.

- Partner UX: Your PRM must deliver a frictionless experience, making the user journey as easy as possible for your partners. Look out for features like a simple submission process, easy access to branded assets, and self-serve tools.

- Scale & Security: As your partnership program grows, you’ll need to be able to easily manage different partner tiers, regions, and types. Choose a PRM with strong security and role-based access controls.

The 15 Best Impact Alternatives for SaaS Partner Programs (2026)

If you’ve been using Impact, but are keen to see what other alternatives could offer you, you’re in the right place.

Here’s our pick of the 15 best Impact alternatives on the market in 2026.

1) Introw

A CRM-first PRM designed for SaaS, Introw is perfect for teams that already use Salesforce or HubSpot, and are running referral, reseller, and/or co-sell programs at scale.

So, why should you choose Introw over Impact?

Introw is purpose-built for channel partnerships — with CRM-native, partner-first workflows that streamline co-selling and co-marketing across your ecosystem.

It embeds deal registration, co-sell updates, and engagement tracking directly inside your CRM, while off-portal updates via email and Slack keep partners engaged without forcing them to log into another tool.

Key capabilities:

- Campaign management features

- Partner engagement analytics (visits, content usage, opens/clicks)

- Outreach automation including automated deal updates

- White-labeled experiences

- Role-based dashboards

- Integrates with Salesforce, HubSpot, Slack

- Responsive customer support

🚀Ready to take your partner program to the next level? Request an Introw demo here.

2) PartnerStack

Looking to combine affiliate programs, referral marketing, and reseller partners while gaining marketplace reach?

Take a look at PartnerStack.

Unlike Impact, which is primarily affiliate-focused, PartnerStack is built with SaaS go-to-market strategies in mind and extends well beyond affiliate-only use cases.

Please note that PartnerStack is not CRM-native, so advanced co-sell programs may require additional tools.

Key capabilities:

- Partner marketplace

- Payouts

- Referrals/reseller workflows

💡Looking for some great PartnerStack alternatives? Here are some of the best.

3) Kiflo

Kiflo is a PRM that works well for small to mid-market SaaS companies just starting their formal channel or partner programs.

This platform offers a lighter-weight PRM approach compared to Impact, making it easier for companies to launch and manage reseller or referral programs.

However, bear in mind that it has limited enterprise-grade analytics and deep CRM workflows, so it’s much better suited to smaller businesses looking for a simpler solution.

Key capabilities:

- Deal registration

- Incentives

- Enablement basics

➡️ You can see our top Kiflo alternatives here.

4) Channelscaler

Channelscaler offers a full PRM and partner automation stack for companies running channel or partner programs.

It’s perfect for companies looking for modular solutions, but if you’re planning to run a simple program, be careful you don’t end up implementing more modules than you actually need.

How does it compare to Impact? Channelscaler delivers a channel-centric platform with a wider scope, while Impact is an affiliate-first tool.

Key capabilities:

- Deal registration

- Incentive and rebate management

- Content & enablement

- Partner journey automation

- Performance tracking dashboards

5) Impartner

Partner marketing automation platform Impartner caters to enterprises with complex, global channel operations.

Consider this platform if you need a system robust enough to handle multiple regions, tiers, and partner types.

If you’re considering switching from Impact to Impartner, you’ll notice a huge difference: namely, that this solution provides a full-stack PRM built for deep governance and enterprise-grade scale, while Impact has a more narrow focus.

Of course, Impartner’s more complex system comes with a heavier implementation and administrative lift, so it’s vital to ensure your business has the resources to manage it effectively.

Key capabilities:

- Tiering

- MDF

- Workflows

- Robust analytics

6) Unifyr

Unifyr is an all-in-one, AI-enabled PRM and channel growth platform.

It is designed for organizations managing partner ecosystems and aiming to centralize and streamline their operations, particularly in dealing with maturing or enterprise-scale channel programs.

This SaaS platform offers a wider variety of features than Impact, which focuses on performance marketing.

However, this does mean there can be a learning curve and it can be a little heavy for smaller brands, with some advanced features more applicable to mid-size or large companies.

Key capabilities:

- Partner onboarding & activation

- Deal registration & lead management

- Supplier/multi-vendor support

- AI-enabled features

7) Magentrix

Magentrix is made for Salesforce-centric teams that need deeply integrated custom portals.